U-Haul 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

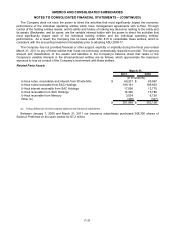

The Company does not have the power to direct the activities that most significantly impact the economic

performance of the individual operating entities which have management agreements with U-Haul. Through

control of the holding entities assets, and its ability and history of making key decisions relating to the entity and

its assets, Blackwater, and its owner, are the variable interest holder with the power to direct the activities that

most significantly impact each of the individual holding entities and the individual operating entities’

performance. As a result, the Company has no basis under ASC 810 to consolidate these entities, which is

consistent with the accounting treatment immediately prior to adopting ASU 2009-17.

The Company has not provided financial or other support explicitly or implicitly during the fiscal year ended

March 31, 2011 to any of these entities that it was not previously contractually required to provide. The carrying

amount and classification of the assets and liabilities in the Company’s balance sheet that relate to the

Company’s variable interests in the aforementioned entities are as follows, which approximate the maximum

exposure to loss as a result of the Company’s involvement with these entities:

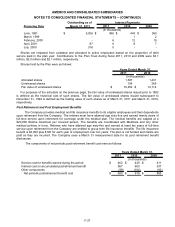

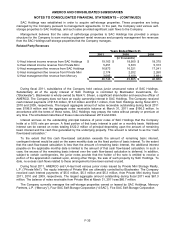

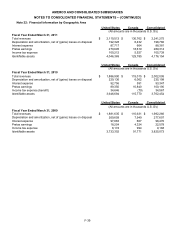

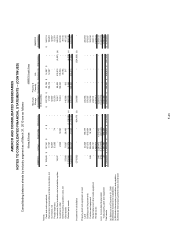

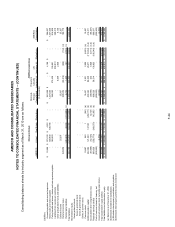

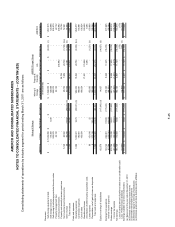

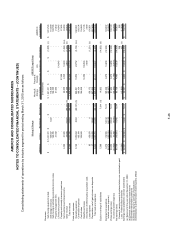

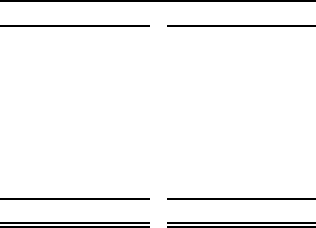

Related Party Assets

2011 2010

U-Haul notes, receivables and interest from Private Mini $ 69,201 $ 69,867

U-Haul notes receivable from SAC Holdings 196,191 196,903

U-Haul interest receivable from SAC Holdings 17,096 13,775

U-Haul receivable from SAC Holdings 16,346 15,780

U-Haul receivable from Mercury 3,534 6,138

Other (a) (400) (337)

$ 301,968 $ 302,126

March 31,

(In thousands)

(a) Timing differences for intercompany balances with insurance subsidiaries.

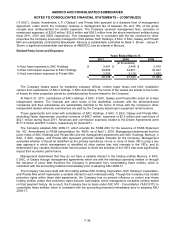

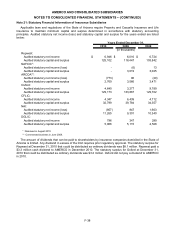

Between January 1, 2009 and March 31, 2011 our insurance subsidiaries purchased 308,300 shares of

Series A Preferred on the open market for $7.2 million.

F-37