U-Haul 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

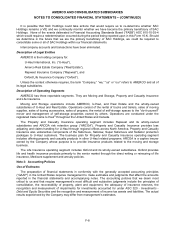

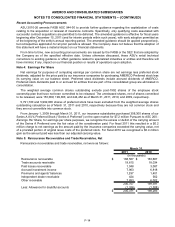

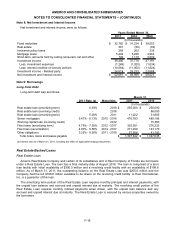

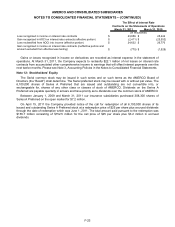

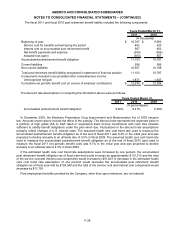

Note 8: Net Investment and Interest Income

Net investment and interest income, were as follows:

2011 2010 2009

Fixed maturities $ 32,782 $ 31,234 $ 38,553

Real estate 361 (56) (99)

Insurance policy loans 259 262 236

Mortgage loans 5,249 5,226 4,962

Short-term, amounts held by ceding reinsurers, net and other 749 1,110 3,539

Investment income 39,400 37,776 47,191

Less: investment expenses (1,269) (1,020) (1,034)

Less: interest credited on annuity policies (10,084) (11,000) (11,824)

Investment income - Related party 24,614 24,233 23,688

Net investment and interest income $ 52,661 $ 49,989 $ 58,021

Years Ended March 31,

(In thousands)

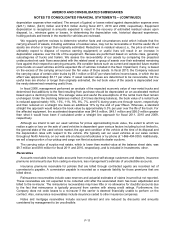

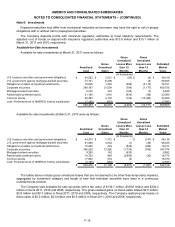

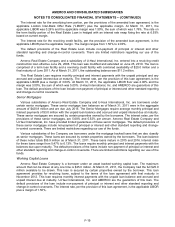

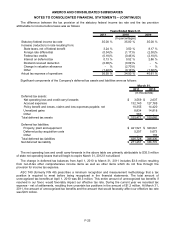

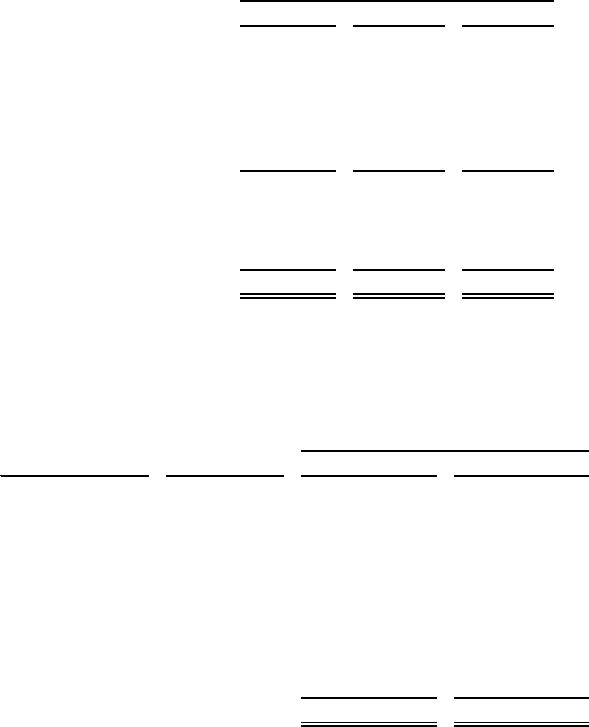

Note 9: Borrowings

Long-Term Debt

Long-term debt was as follows:

2011 Rate (a) Maturities 2011 2010

Real estate loan (amortizing term) 6.93% 2018 $ 255,000 $ 265,000

Real estate loan (revolving credit) - 2018 - 86,000

Real estate loan (amortizing term) 5.00% 2011 11,222 31,865

Senior mortgages 5.47% - 6.13% 2015 - 2016 476,783 489,186

Working capital loan (revolving credit) - 2012 - 15,000

Fleet loans (amortizing term) 4.78% - 7.95% 2012 - 2017 325,591 276,222

Fleet loan (securitization) 4.90% - 5.56% 2014 - 2017 271,290 143,170

Other obligations 3.25% - 9.50% 2011 - 2018 57,956 41,192

Total notes, loans and leases payable $ 1,397,842 $ 1,347,635

(a) Interest rate as of March 31, 2011, including the effect of applicable hedging instruments

(In thousands)

March 31,

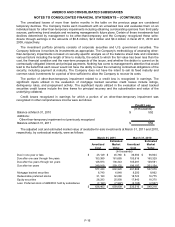

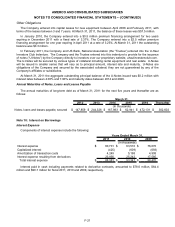

Real Estate Backed Loans

Real Estate Loan

Amerco Real Estate Company and certain of its subsidiaries and U-Haul Company of Florida are borrowers

under a Real Estate Loan. The loan has a final maturity date of August 2018. The loan is comprised of a term

loan facility with initial availability of $300.0 million and a revolving credit facility with an availability of $198.8

million. As of March 31, 2011, the outstanding balance on the Real Estate Loan was $255.0 million and the

Company had the full $198.8 million available to be drawn on the revolving credit facility. U-Haul International,

Inc. is a guarantor of this loan.

The amortizing term portion of the Real Estate Loan requires monthly principal and interest payments, with

the unpaid loan balance and accrued and unpaid interest due at maturity. The revolving credit portion of the

Real Estate Loan requires monthly interest payments when drawn, with the unpaid loan balance and any

accrued and unpaid interest due at maturity. The Real Estate Loan is secured by various properties owned by

the borrowers.

F-18