U-Haul 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

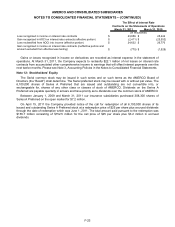

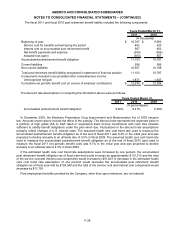

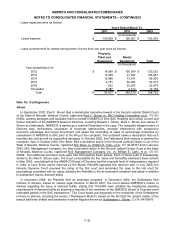

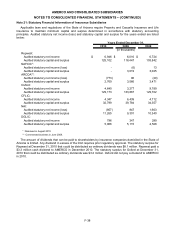

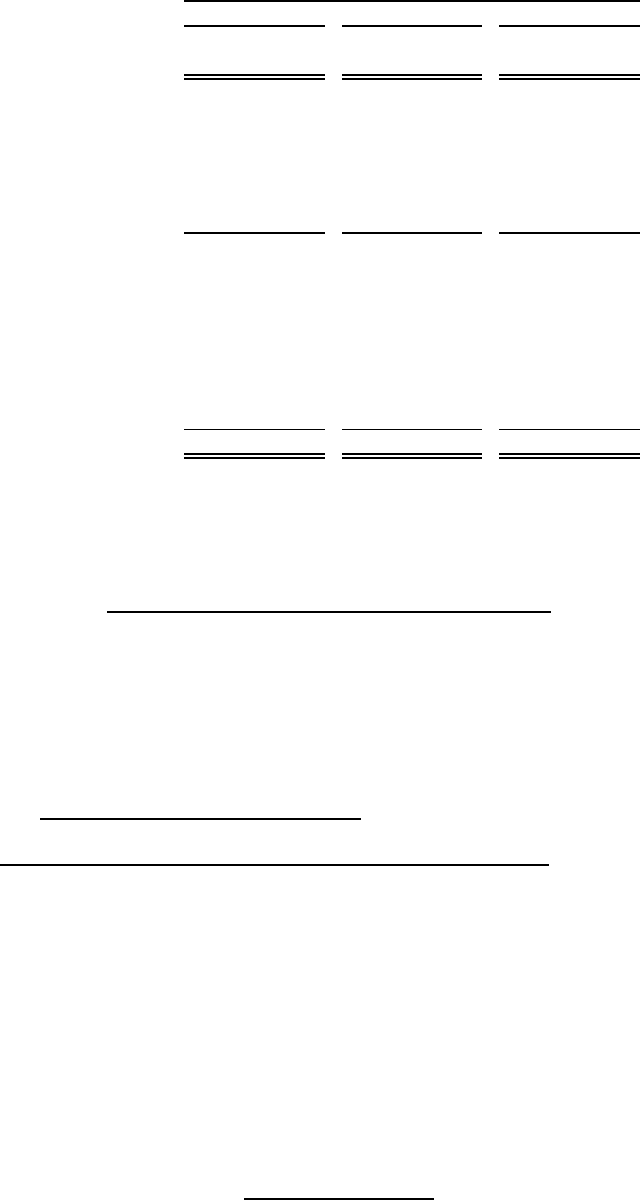

Lease expenses were as follows:

2011 2010 2009

Lease expense $ 150,809 $ 156,951 $ 152,424

Years Ended March 31,

(In thousands)

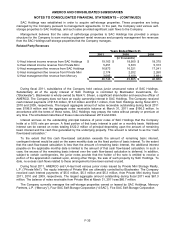

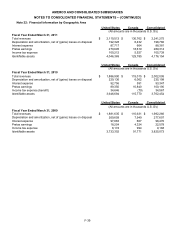

Lease commitments for leases having terms of more than one year were as follows:

Property,

Plant and

Equipment

Rental

Equipment Total

(In thousands)

Year-ended March 31:

2012 $ 14,859 $ 105,364 $ 120,223

2013 13,959 91,722 105,681

2014 12,889 73,914 86,803

2015 2,761 50,252 53,013

2016 622 22,254 22,876

Thereafter 5,387 4,772 10,159

Total $ 50,477 $ 348,278 $ 398,755

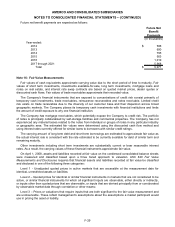

Note 19: Contingencies

Shoen

In September 2002, Paul F. Shoen filed a shareholder derivative lawsuit in the Second Judicial District Court

of the State of Nevada, Washoe County, captioned Paul F. Shoen vs. SAC Holding Corporation et al., CV 02-

05602, seeking damages and equitable relief on behalf of AMERCO from SAC Holdings and certain current and

former members of the AMERCO Board of Directors, including Edward J. Shoen, Mark V. Shoen and James P.

Shoen as Defendants. AMERCO is named as a nominal Defendant in the case. The complaint alleges breach of

fiduciary duty, self-dealing, usurpation of corporate opportunities, wrongful interference with prospective

economic advantage and unjust enrichment and seeks the unwinding of sales of self-storage properties by

subsidiaries of AMERCO to SAC prior to the filing of the complaint. The complaint seeks a declaration that such

transfers are void as well as unspecified damages. In October 2002, the Defendants filed motions to dismiss the

complaint. Also in October 2002, Ron Belec filed a derivative action in the Second Judicial District Court of the

State of Nevada, Washoe County, captioned Ron Belec vs. William E. Carty, et al., CV 02-06331 and in January

2003, M.S. Management Company, Inc. filed a derivative action in the Second Judicial District Court of the State

of Nevada, Washoe County, captioned M.S. Management Company, Inc. vs. William E. Carty, et al., CV 03-

00386. Two additional derivative suits were also filed against these parties. Each of these suits is substantially

similar to the Paul F. Shoen case. The Court consolidated the five cases and thereafter dismissed these actions

in May 2003, concluding that the AMERCO Board of Directors had the requisite level of independence required

in order to have these claims resolved by the Board. Plaintiffs appealed this decision and, in July 2006, the

Nevada Supreme Court reversed the ruling of the trial court and remanded the case to the trial court for

proceedings consistent with its ruling, allowing the Plaintiffs to file an amended complaint and plead in addition

to substantive claims, demand futility.

In November 2006, the Plaintiffs filed an amended complaint. In December 2006, the Defendants filed

motions to dismiss, based on various legal theories. In March 2007, the Court denied AMERCO’s motion to

dismiss regarding the issue of demand futility, stating that “Plaintiffs have satisfied the heightened pleading

requirements of demand futility by showing a majority of the members of the AMERCO Board of Directors were

interested parties in the SAC transactions.” The Court heard oral argument on the remainder of the Defendants’

motions to dismiss, including the motion (“Goldwasser Motion”) based on the fact that the subject matter of the

lawsuit had been settled and dismissed in earlier litigation known as Goldwasser v. Shoen, C.V.N.-94-00810-

F-33