U-Haul 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 6

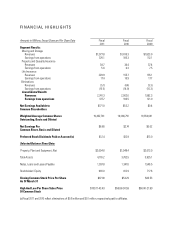

Net revenue from our Life Insurance operating segment was approximately 10.2%, 7.8% and 6.8% of

consolidated net revenue in fiscal 2011, 2010 and 2009, respectively.

Employees

As of March 31, 2011, we employed approximately 16,600 people throughout North America with

approximately 98% of these employees working within our Moving and Storage operating segment.

Approximately 55% of these employees work on a part-time basis.

Sales and Marketing

We promote U-Haul brand awareness through direct and co-marketing arrangements. Our direct

marketing activities consist of yellow pages, print and web based advertising as well as trade events,

movie cameos of our rental fleet and boxes, and industry and consumer communications. Our rental

equipment is our best form of advertisement. We support our independent U-Haul dealers through

advertising of U-Haul moving and self-storage rentals, products and services.

Our marketing plan focuses on maintaining our leadership position in the “do-it-yourself” moving and

storage industry by continually improving the ease of use and efficiency of our rental equipment, by

providing added convenience to our retail centers through independent U-Haul dealers, and by expanding

the capabilities of our eMove® web sites.

A significant driver of U-Haul’s rental transaction volume is our utilization of an online reservation and

sales system, through uhaul.com, eMove.com and our 24-hour 1-800-GO-U-HAUL telephone

reservations system. These points of contact are prominently featured and are a major driver of customer

lead sources.

Competition

Moving and Storage Operating Segment

The truck rental industry is highly competitive and includes a number of significant national, regional

and local competitors. Generally speaking, we consider there to be two distinct users of rental trucks:

commercial and “do-it-yourself” residential users. We primarily focus on the “do-it-yourself” residential

user. Within this segment, we believe the principal competitive factors are convenience of rental

locations, availability of quality rental moving equipment, breadth of essential products and services, and

total cost to the user. Our major national competitors in both the In-Town and one-way moving equipment

rental market are Avis Budget Group, Inc. and Penske Truck Leasing. Additionally, we have numerous

small local competitors throughout North America who compete with us in the In-Town market.

The self-storage market is large and very fragmented. We believe the principal competitive factors in

this industry are convenience of storage rental locations, cleanliness, security and price. Our largest

competitors in the self-storage market are Public Storage Inc., Extra Space Storage, Inc., and Sovran

Self-Storage Inc.

Insurance Operating Segments

The insurance industry is highly competitive. In addition, the marketplace includes financial services

firms offering both insurance and financial products. Some of the insurance companies are owned by

stockholders and others are owned by policyholders. Many competitors have been in business for a

longer period of time or possess substantially greater financial resources and broader product portfolios

than our insurance companies. We compete in the insurance business based upon price, product design,

and services rendered to agents and policyholders.

Recent Developments

Preferred Stock

On April 15, 2011 the Company provided notice of the call for redemption of all 6,100,000 shares of its

issued and outstanding Series A 8½% Preferred Stock (“Series A Preferred”) at a redemption price of $25

per share plus accrued dividends through the date of redemption which was June 1, 2011. The total

amount paid pursuant to the redemption was $155.7 million consisting of $152.5 million for the call price

of $25 per share plus $3.2 million in accrued dividends.