U-Haul 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-60

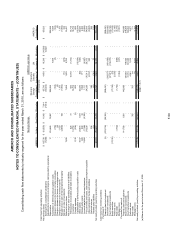

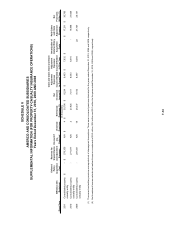

Fiscal Year

Affiliation with

Re

g

istrant

Deferred

Policy

Acquisition

Cost

Reserves for

Unpaid Claims

and Adjustment

Expenses

Discount if

any,

Deducted

Unearned

Premiums

Net Earned

Premiums

(

1

)

Net

Investment

Income

(

2

)

Claim and Claim

Adjustment

Expenses

Incurred Related

to Current Yea

r

Claim and Claim

Adjustment

Expenses

Incurred Related

to Prior Yea

r

Amortization of

Deferred Policy

Acquisition

Costs

Paid Claims

and Claim

Adjustment

Expense

Net

Premiums

Written

(

1

)

2011 Consolidated property

casualty entity

-$ 276,355$ N/A 4$ 30,704$ 8,234$ 9,453$ 7,832$ -$ 17,211$ 30,706$

2010 Consolidated property

casualty entity

- 271,677 N/A 2 27,625 7,411 8,043 6,516 - 19,996 27,608

2009 Consolidated property

casualty entity

- 287,501 N/A 19 28,337 9,192 8,497 9,384 22 27,707 28,157

(In thousands)

(1) The earned and written premiums are reported net of intersegment transactions. There were no earned premiums eliminated for the years ended December 31, 2010, 2009 and 2008, respectively.

(2) Net Investment Income excludes net realized losses on investments of $0.3 million, $0.6 million and $0.1 million for the years ended December 31, 2010, 2009 and 2008, respectively.

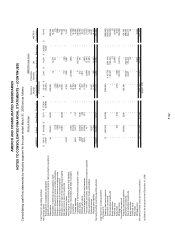

AMERCO AND CONSOLIDATED SUBSIDIARIES

SUPPLEMENTAL INFORMATION (FOR PROPERTY-CASUALTY INSURANCE OPERATIONS)

Years Ended December 31, 2010, 2009 AND 2008

SCHEDULE V