U-Haul 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

(“5 SAC”), Galaxy Investments, L.P. (“Galaxy”) and Private Mini pursuant to a standard form of management

agreement, under which the Company receives a management fee of between 4% and 10% of the gross

receipts plus reimbursement for certain expenses. The Company received management fees, exclusive of

reimbursed expenses, of $22.0 million, $22.6 million and $24.3 million from the above mentioned entities during

fiscal 2011, 2010 and 2009, respectively. This management fee is consistent with the fee received for other

properties the Company previously managed for third parties. SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private

Mini are substantially controlled by Blackwater. Mercury is substantially controlled by Mark V. Shoen. James P.

Shoen, a significant shareholder and director of AMERCO, has an interest in Mercury.

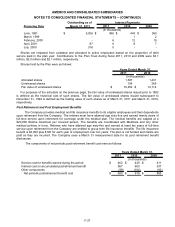

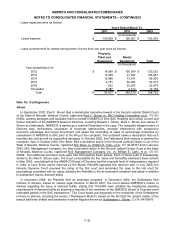

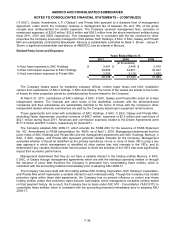

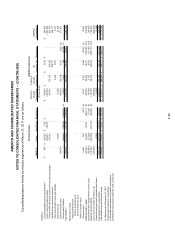

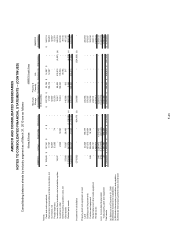

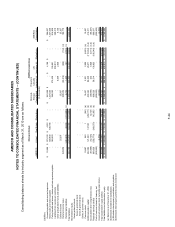

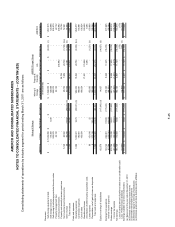

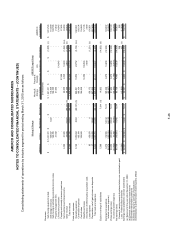

Related Party Costs and Expenses

2011 2010 2009

U-Haul lease expenses to SAC Holdings $ 2,491 $ 2,446 $ 2,418

U-Haul commission expenses to SAC Holdings 34,858 32,621 32,837

U-Haul commission expenses to Private Mini 2,399 2,116 1,825

$ 39,748 $ 37,183 $ 37,080

(In thousands)

Years Ended March 31,

The Company leases space for marketing company offices, vehicle repair shops and hitch installation

centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. The terms of the leases are similar to the terms

of leases for other properties owned by unrelated parties that are leased to the Company.

At March 31, 2011, subsidiaries of SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private Mini acted as U-Haul

independent dealers. The financial and other terms of the dealership contracts with the aforementioned

companies and their subsidiaries are substantially identical to the terms of those with the Company’s other

independent dealers whereby commissions are paid by the Company based upon equipment rental revenue.

These agreements and notes with subsidiaries of SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private Mini,

excluding Dealer Agreements, provided revenues of $46.7 million, expenses of $2.5 million and cash flows of

$42.1 million during fiscal 2011. Revenues and commission expenses related to the Dealer Agreements were

$177.0 million and $37.3 million, respectively for fiscal 2011.

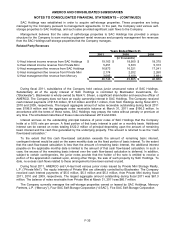

The Company adopted ASU 2009-17, which amends the FASB ASC for the issuance of FASB Statement

No. 167, Amendments to FASB Interpretation No. 46(R), as of April 1, 2010. Management determined that the

junior notes of SAC Holdings and Private Mini and the management agreements with SAC Holdings, Mercury, 4

SAC, 5 SAC, Galaxy, and Private Mini represent potential variable interests for the Company. Management

evaluated whether it should be identified as the primary beneficiary of one or more of these VIE’s using a two

step approach in which management a) identified all other parties that hold interests in the VIE’s, and b)

determined if any variable interest holder has the power to direct the activities of the VIE’s that most significantly

impact their economic performance.

Management determined that they do not have a variable interest in the holding entities Mercury, 4 SAC,

5 SAC, or Galaxy through management agreements which are with the individual operating entities or through

the issuance of junior debt therefore the Company is precluded from consolidating these entities, which is

consistent with the accounting treatment immediately prior to adopting ASU 2009-17.

The Company has junior debt with the holding entities SAC Holding Corporation, SAC Holding II Corporation,

and Private Mini which represents a variable interest in each individual entity. Though the Company has certain

protective rights within these debt agreements, the Company has no present influence or control over these

holding entities unless their protective rights become exercisable, which management considers unlikely based

on their payment history. As a result, the Company has no basis under ASC 810 - Consolidation (“ASC 810”) to

consolidate these entities, which is consistent with the accounting treatment immediately prior to adopting ASU

2009-17.

F-36