U-Haul 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

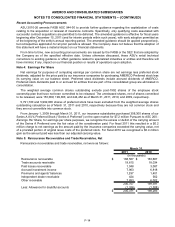

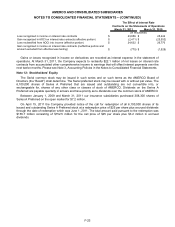

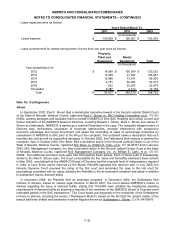

Note 13: Comprehensive Income (Loss)

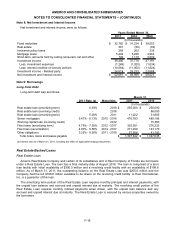

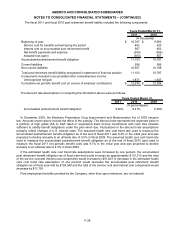

A summary of accumulated other comprehensive income (loss) components, net of taxes, were as follows:

Foreign

Currency

Translation

Unrealized

Gain (Loss)

on

Investments

Fair Market

Value of

Cash Flow

Hedge

Postretirement

Benefit Obligation

Gain (Loss)

A

ccumulated

Other

Comprehensive

Income (Loss)

Balance at March 31, 2008 $ (27,583) $ 1,591 $ (30,578) $ 1,291 $ (55,279)

Foreign currency translation (16,030) - - - (16,030)

Unrealized loss on investments - (8,914) - - (8,914)

Change in fair value of cash flow hedge - - (17,833) - (17,833)

Change in postretirement benefit obligation - - - 56 56

Balance at March 31, 2009 (43,613) (7,323) (48,411) 1,347 (98,000)

Foreign currency translation 14,471 - - - 14,471

Unrealized gain on investments - 13,254 - - 13,254

Change in fair value of cash flow hedge - - 14,478 - 14,478

Change in postretirement benefit obligation - - - (410) (410)

Balance at March 31, 2010 (29,142) 5,931 (33,933) 937 (56,207)

Foreign currency translation 3,114 - - - 3,114

Unrealized gain on investments - 4,930 - - 4,930

Change in fair value of cash flow hedge - - 1,495 - 1,495

Change in postretirement benefit obligation - - - 201 201

Balance at March 31, 2011 $ (26,028) $ 10,861 $ (32,438) $ 1,138 $ (46,467)

(In thousands)

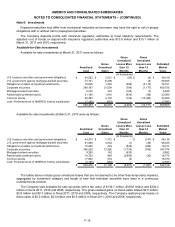

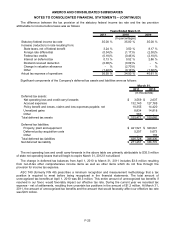

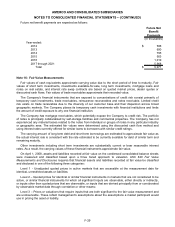

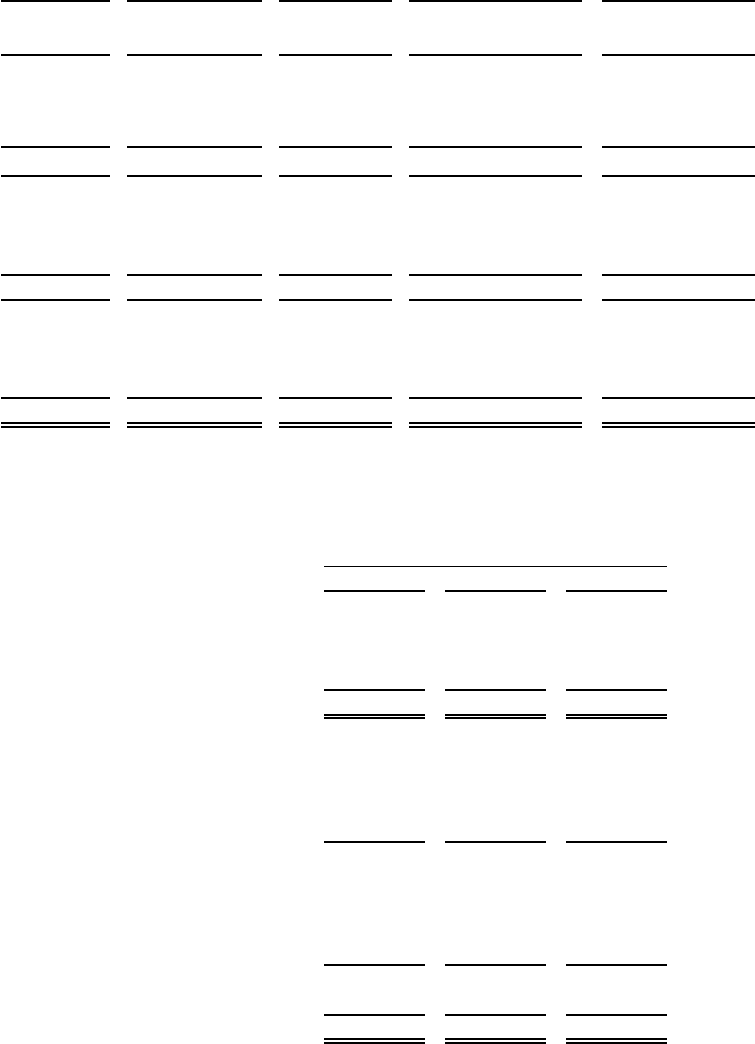

Note 14: Provision for Taxes

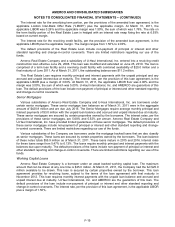

Earnings before taxes and the provision for taxes consisted of the following:

2011 2010 2009

Pretax earnings:

U.S. $ 270,695 $ 89,350 $ 18,254

Non-U.S. 18,619 10,840 4,324

Total pretax earnings $ 289,314 $ 100,190 $ 22,578

Current provision (benefit)

Federal $ 14,784 $ (23,965) $ 5,202

State 7,475 1,965 1,436

Non-U.S. 3,861 34 (31)

26,120 (21,966) 6,607

Deferred provision (benefit)

Federal 70,653 53,174 149

State 7,300 3,472 1,387

Non-U.S. 1,666 (113) 1,025

79,619 56,533 2,561

Provision for income tax expense $ 105,739 $ 34,567 $ 9,168

Income taxes paid (net of income tax refunds received) $ 14,265 $ 1,558 $ 2,037

Years Ended March 31,

(In thousands)

F-24