U-Haul 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

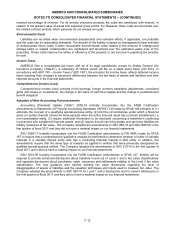

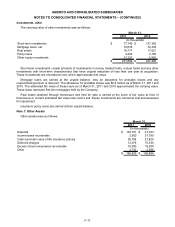

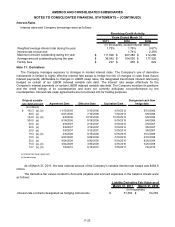

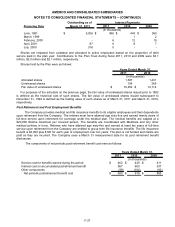

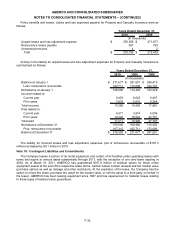

March 31, 2011 March 31, 2010

Loss recognized in income on interest rate contracts $ 23,856 $ 25,242

Gain recognized in AOCI on interest rate contracts (effective portion) $ (2,411) $ (23,352)

Loss reclassified from AOCI into income (effective portion) $ 24,632 $ 26,770

Gain recognized in income on interest rate contracts (ineffective portion and

amount excluded from effectiveness testing) $ (775) $ (1,528)

(In thousands)

The Effect of Interest Rate

Contracts on the Statements of Operations

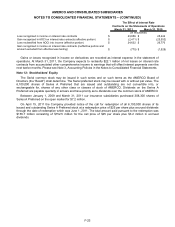

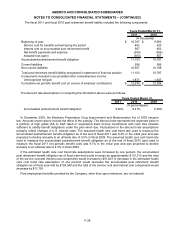

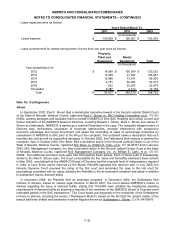

Gains or losses recognized in income on derivatives are recorded as interest expense in the statement of

operations. At March 31, 2011, the Company expects to reclassify $22.1 million of net losses on interest rate

contracts from accumulated other comprehensive income to earnings that will offset interest payments over the

next twelve months. Please see Note 3, Accounting Policies in the Notes to Consolidated Financial Statements.

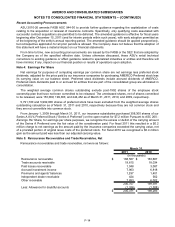

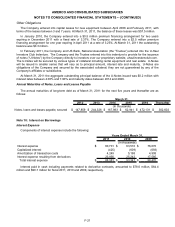

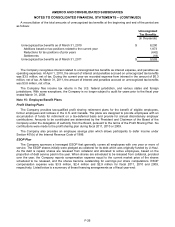

Note 12: Stockholders’ Equity

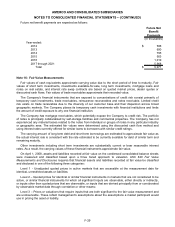

The Serial common stock may be issued in such series and on such terms as the AMERCO Board of

Directors (the “Board”) shall determine. The Serial preferred stock may be issued with or without par value. The

6,100,000 shares of Series A Preferred that are issued and outstanding are not convertible into, or

exchangeable for, shares of any other class or classes of stock of AMERCO. Dividends on the Series A

Preferred are payable quarterly in arrears and have priority as to dividends over the common stock of AMERCO.

Between January 1, 2009 and March 31, 2011 our insurance subsidiaries purchased 308,300 shares of

Series A Preferred on the open market for $7.2 million.

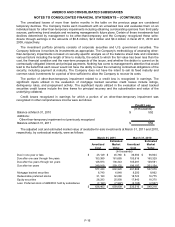

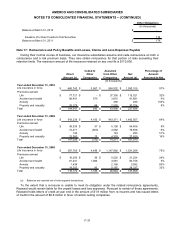

On April 15, 2011 the Company provided notice of the call for redemption of all 6,100,000 shares of its

issued and outstanding Series A Preferred stock at a redemption price of $25 per share plus accrued dividends

through the date of redemption which was June 1, 2011. The total amount paid pursuant to the redemption was

$155.7 million consisting of $152.5 million for the call price of $25 per share plus $3.2 million in accrued

dividends.

F-23