U-Haul 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

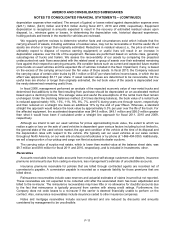

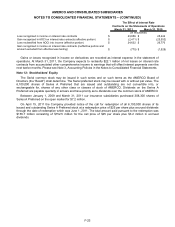

The unrealized losses of more than twelve months in the table on the previous page are considered

temporary declines. The Company tracks each investment with an unrealized loss and evaluates them on an

individual basis for other-than-temporary impairments including obtaining corroborating opinions from third party

sources, performing trend analysis and reviewing management’s future plans. Certain of these investments had

declines determined by management to be other-than-temporary and the Company recognized these write-

downs through earnings in the amounts of $0.8 million, $2.2 million and $0.4 million in fiscal 2011, 2010 and

2009, respectively.

The investment portfolio primarily consists of corporate securities and U.S. government securities. The

Company believes it monitors its investments as appropriate. The Company’s methodology of assessing other-

than-temporary impairments is based on security-specific analysis as of the balance sheet date and considers

various factors including the length of time to maturity, the extent to which the fair value has been less than the

cost, the financial condition and the near-term prospects of the issuer, and whether the debtor is current on its

contractually obligated interest and principal payments. Nothing has come to management’s attention that would

lead to the belief that each issuer would not have the ability to meet the remaining contractual obligations of the

security, including payment at maturity. The Company does not have the intent to sell its fixed maturity and

common stock investments for a period of time sufficient to allow the Company to recover its costs.

The portion of other-than-temporary impairment related to a credit loss is recognized in earnings. The

significant inputs utilized in the evaluation of mortgage backed securities credit losses include ratings,

delinquency rates, and prepayment activity. The significant inputs utilized in the evaluation of asset backed

securities credit losses include the time frame for principal recovery and the subordination and value of the

underlying collateral.

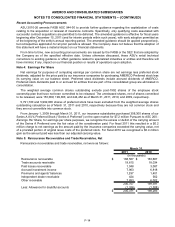

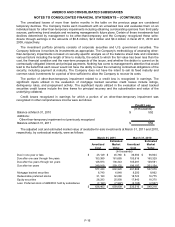

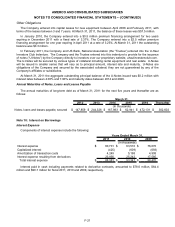

Credit losses recognized in earnings for which a portion of an other-than-temporary impairment was

recognized in other comprehensive income were as follows:

Credit Loss

(In thousands)

Balance at March 31, 2010 $ 552

Additions:

Other-than-temporary impairment not previously recognized -

Balance at March 31, 2011 $ 552

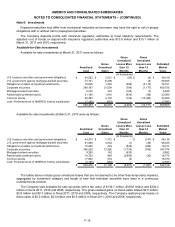

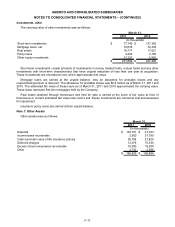

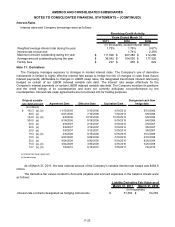

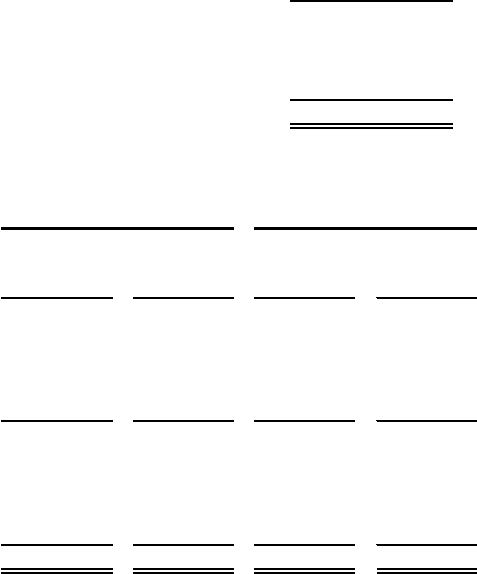

The adjusted cost and estimated market value of available-for-sale investments at March 31, 2011 and 2010,

respectively, by contractual maturity, were as follows:

Amortized

Cost

Estimated

Market

Value

Amortized

Cost

Estimated

Market

Value

Due in one year or less $ 45,149 $ 45,760 $ 36,384 $ 36,804

Due after one year through five years 153,389 161,685 153,816 160,329

Due after five years through ten years 128,973 136,343 105,491 109,591

Due after ten years 249,919 259,132 196,197 201,154

577,430 602,920 491,888 507,878

Mortgage backed securities 6,740 6,848 9,250 8,862

Redeemable preferred stocks 31,190 32,080 18,723 16,775

Equity securities 28,293 25,958 17,840 18,370

Less: Preferred stock of AMERCO held by subsidiaries (7,190) (7,997) (2,185) (2,567)

$ 636,463 $ 659,809 $ 535,516 $ 549,318

March 31, 2011 March 31, 2010

(In thousands)

F-16