U-Haul 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 15

From January 1, 2009 through March 31, 2011, our insurance subsidiaries purchased 308,300 shares

of Series A Preferred on the open market for $7.2 million. Pursuant to Financial Accounting Standards

Board (“FASB”) Accounting Standards Codification (“ASC”) 260 - Earnings Per Share (“ASC 260”), for

earnings per share purposes, we recognize the excess or deficit of the carrying amount of the Series A

Preferred over the fair value of the consideration paid. For fiscal 2011 this resulted in a $0.2 million

charge to net earnings as the amount paid by the insurance companies exceeded the carrying value, net

of a prorated portion of original issue costs of the preferred stock. For fiscal 2010 we recognized a $0.4

million gain as the amount paid was less than our adjusted carrying value.

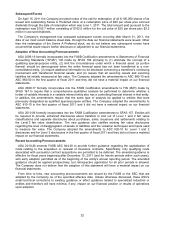

On April 15, 2011 the Company provided notice of the call for redemption of all 6,100,000 shares of its

issued and outstanding Series A Preferred stock at a redemption price of $25 per share plus accrued

dividends through the date of redemption which was June 1, 2011. The total amount paid pursuant to the

redemption was $155.7 million consisting of $152.5 million for the call price of $25 per share plus $3.2

million in accrued dividends.