U-Haul 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

constant percentage of revenue. For its annuity insurance products the costs are amortized, with interest, in

relation to the present value of actual and expected gross profits. For Repwest, these costs are amortized over

the related contract periods, which generally do not exceed one year.

Environmental Costs

Liabilities are recorded when environmental assessments and remedial efforts, if applicable, are probable

and the costs can be reasonably estimated. The amount of the liability is based on management’s best estimate

of undiscounted future costs. Certain recoverable environmental costs related to the removal of underground

storage tanks or related contamination are capitalized and amortized over the estimated useful lives of the

properties. These costs improve the safety or efficiency of the property or are incurred in preparing the property

for sale.

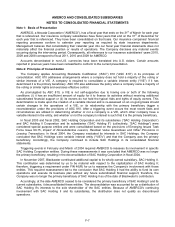

Income Taxes

AMERCO files a consolidated tax return with all of its legal subsidiaries, except for Dallas General Life

Insurance Company (“DGLIC”), a subsidiary of Oxford, which will file on a stand alone basis until 2012. In

accordance with ASC 740 - Income Taxes (“ASC 740”), the provision for income taxes reflects deferred income

taxes resulting from changes in temporary differences between the tax basis of assets and liabilities and their

reported amounts in the financial statements.

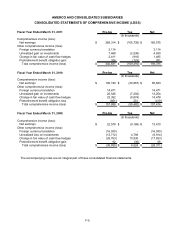

Comprehensive Income (Loss)

Comprehensive income (loss) consists of net earnings, foreign currency translation adjustments, unrealized

gains and losses on investments, the change in fair value of cash flow hedges and the change in postretirement

benefit obligation.

Adoption of New Accounting Pronouncements

Accounting Standards Update (“ASU”) 2009-16 formally incorporates into the FASB Codification

amendments to Statements of Financial Accounting Standards (“SFAS”) 140 made by SFAS 166 primarily to (1)

eliminate the concept of a qualifying special-purpose entity, (2) limit the circumstances under which a financial

asset (or portion thereof) should be derecognized when the entire financial asset has not been transferred to a

non-consolidated entity, (3) require additional information to be disclosed concerning a transferor's continuing

involvement with transferred financial assets, and (4) require that all servicing assets and servicing liabilities be

initially measured at fair value. The Company adopted the amendments to ASC 860-10 and ASC 860-50 in the

first quarter of fiscal 2011 and they did not have a material impact on our financial statements.

ASU 2009-17 formally incorporates into the FASB Codification amendments to FIN 46(R) made by SFAS

167 to require that a comprehensive qualitative analysis be performed to determine whether a holder of variable

interests in a variable interest entity also has a controlling financial interest in that entity. In addition, the

amendments require that the same type of analysis be applied to entities that were previously designated as

qualified special-purpose entities. The Company adopted the amendments to ASC 810-10 in the first quarter of

fiscal 2011 and it did not have a material impact on our financial statements.

ASU 2010-06 formally incorporates into the FASB Codification amendments to SFAS 157. Entities will be

required to provide enhanced disclosures about transfers in and out of Level 1 and 2 fair value classifications

and separate disclosures about purchases, sales, issuances and settlements relating to the Level 3 fair value

classification. The new guidance also clarifies existing fair value disclosures regarding the level of

disaggregation of assets or liabilities and the valuation techniques and inputs used to measure fair value. The

Company adopted the amendments to ASC 820-10 for Level 1 and 2 disclosures and for Level 3 disclosures in

the first quarter of fiscal 2011 and they did not have a material impact on our financial statements.

F-13