U-Haul 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

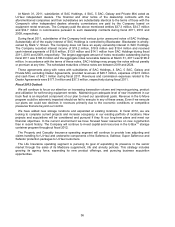

Interest Rate Risk

The exposure to market risk for changes in interest rates relates primarily to our variable rate debt

obligations. We have used interest rate swap agreements and forward swaps to reduce our exposure to

changes in interest rates. The Company enters into these arrangements with counterparties that are

significant financial institutions with whom we generally have other financial arrangements. We are

exposed to credit risk should these counterparties not be able to perform on their obligations.

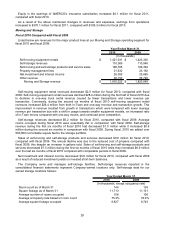

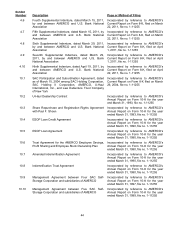

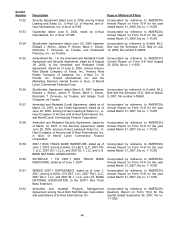

Notional Amount Fair Value Effective Date Expiration Date Fixed Rate Floating Rate

58,014$ (a), (b) (2,209)$ 5/10/2006 4/10/2012 5.06% 1 Month LIBOR

58,859 (a), (b) (4,088) 10/10/2006 10/10/2012 5.57% 1 Month LIBOR

20,324 (a) (1,834) 7/10/2006 7/10/2013 5.67% 1 Month LIBOR

254,167 (a) (37,541) 8/18/2006 8/10/2018 5.43% 1 Month LIBOR

13,075 (a) (1,244) 2/12/2007 2/10/2014 5.24% 1 Month LIBOR

8,794 (a) (799) 3/12/2007 3/10/2014 4.99% 1 Month LIBOR

8,800 (a) (799) 3/12/2007 3/10/2014 4.99% 1 Month LIBOR

10,750 (a), (b) (585) 8/15/2008 6/15/2015 3.62% 1 Month LIBOR

11,638 (a) (762) 8/29/2008 7/10/2015 4.04% 1 Month LIBOR

17,238 (a) (1,226) 9/30/2008 9/10/2015 4.16% 1 Month LIBOR

9,938 (a), (b) (47) 3/30/2009 4/15/2016 2.24% 1 Month LIBOR

13,001 (a), (b) 82 8/15/2010 7/15/2017 2.15% 1 Month LIBOR

(a) interest rate swap agreement

(b) forward swap

(In thousands)

As of March 31, 2011, the Company had approximately $571.9 million of variable rate debt obligations.

If the London Inter-Bank Offer Rate were to increase 100 basis points, the increase in interest expense

on the variable rate debt would decrease future earnings and cash flows by approximately $0.9 million

annually (after consideration of the effect of the above derivative contracts).

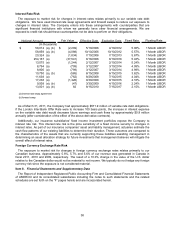

Additionally, our insurance subsidiaries’ fixed income investment portfolios expose the Company to

interest rate risk. This interest rate risk is the price sensitivity of a fixed income security to changes in

interest rates. As part of our insurance companies’ asset and liability management, actuaries estimate the

cash flow patterns of our existing liabilities to determine their duration. These outcomes are compared to

the characteristics of the assets that are currently supporting these liabilities assisting management in

determining an asset allocation strategy for future investments that management believes will mitigate the

overall effect of interest rates.

Foreign Currency Exchange Rate Risk

The exposure to market risk for changes in foreign currency exchange rates relates primarily to our

Canadian business. Approximately 5.8%, 5.7% and 5.6% of our revenue was generated in Canada in

fiscal 2011, 2010 and 2009, respectively. The result of a 10.0% change in the value of the U.S. dollar

relative to the Canadian dollar would not be material to net income. We typically do not hedge any foreign

currency risk since the exposure is not considered material.

Item 8. Financial Statements and Supplementary Data

The Report of Independent Registered Public Accounting Firm and Consolidated Financial Statements

of AMERCO and its consolidated subsidiaries including the notes to such statements and the related

schedules are set forth on the “F” pages hereto and are incorporated herein.

38