U-Haul 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

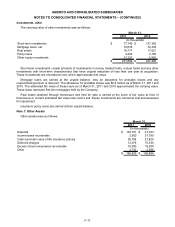

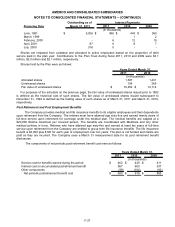

Investments, other

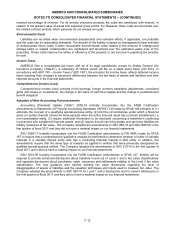

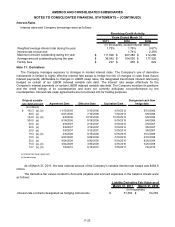

The carrying value of other investments was as follows:

2011 2010

Short-term investments $ 77,745 $ 127,385

Mortgage loans, net 79,635 72,438

Real estate 18,777 17,621

Policy loans 4,404 4,190

Other equity investments 21,307 5,852

$ 201,868 $ 227,486

March 31,

(In thousands)

Short-term investments consist primarily of investments in money market funds, mutual funds and any other

investments with short-term characteristics that have original maturities of less than one year at acquisition.

These investments are recorded at cost, which approximates fair value.

Mortgage loans are carried at the unpaid balance, less an allowance for probable losses and any

unamortized premium or discount. The allowance for probable losses was $0.4 million as of March 31, 2011 and

2010. The estimated fair value of these loans as of March 31, 2011 and 2010 approximated the carrying value.

These loans represent first lien mortgages held by the Company.

Real estate obtained through foreclosure and held for sale is carried at the lower of fair value at time of

foreclosure or current estimated fair value less cost to sell. Equity investments are carried at cost and assessed

for impairment.

Insurance policy loans are carried at their unpaid balance.

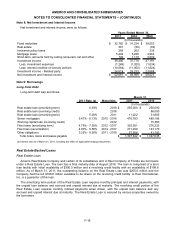

Note 7: Other Assets

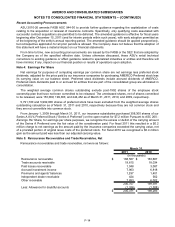

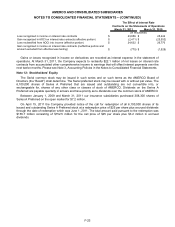

Other assets were as follows:

2011 2010

Deposits $ 103,191 $ 47,323

Income taxes recoverable 2,850 37,790

Cash surrender value of life insurance policies 28,784 27,825

Deferred charges 13,076 15,330

Excess of loss reinsurance recoverable 15,000 15,000

Other 3,732 2,596

$ 166,633 $ 145,864

March 31,

(In thousands)

F-17