U-Haul 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Fleet Loans

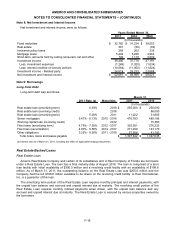

Rental Truck Amortizing Loans

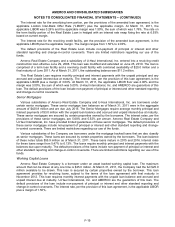

U-Haul International, Inc. and several of its subsidiaries are borrowers under amortizing term loans. The

balance of the loans as of March 31, 2011 was $240.6 million with the final maturities between April 2012 and

July 2017.

The Amortizing Loans require monthly principal and interest payments, with the unpaid loan balance and

accrued and unpaid interest due at maturity. These loans were used to purchase new trucks. The interest rates,

per the provision of the Loan Agreements, are the applicable LIBOR plus a margin between 0.90% and 2.63%.

At March 31, 2011, the applicable LIBOR was 0.26% and applicable margins were between 1.13% and 2.63%.

The interest rates are hedged with interest rate swaps fixing the rates between 4.78% and 7.32% based on

current margins. Additionally, $18.7 million of these loans are carried at a fixed rate of 7.95%.

AMERCO and U-Haul International, Inc. are guarantors of these loans. The default provisions of these loans

include non-payment of principal or interest and other standard reporting and change-in-control covenants.

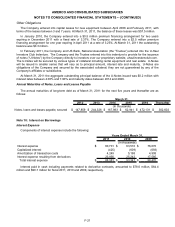

On December 31, 2009 a subsidiary of U-Haul International, Inc. entered into an $85.0 million term note that

will be used to fund cargo van and pickup acquisitions for the next two years. This term note has a final maturity

of December 2012. The agreement contains options to extend the maturity through September 2013. The note

is secured by the purchased equipment and the corresponding operating cash flows associated with their

operation. At March 31, 2011, the applicable LIBOR was 0.31% and the applicable margin was 4.50%, the sum

of which was 4.81%. At March 31, 2011 the Company had drawn the full $85.0 million on this loan.

Rental Truck Securitizations

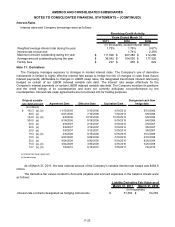

U-Haul S Fleet and its subsidiaries (collectively, “USF”) issued a $217.0 million asset-backed note (“2007

Box Truck Note”) on June 1, 2007. USF is a bankruptcy-remote special purpose entity wholly-owned by U-Haul

International, Inc. The net proceeds from the securitized transaction were used to finance new box truck

purchases throughout fiscal 2008. U.S. Bank, NA acts as the trustee for this securitization.

The 2007 Box Truck Note has a fixed interest rate of 5.56% with an estimated final maturity of February

2014. At March 31, 2011, the outstanding balance was $120.2 million. The note is secured by the box trucks

that were purchased and the corresponding operating cash flows associated with their operation.

The 2007 Box Truck Note has the benefit of a financial guaranty insurance policy which guarantees the

timely payment of interest on and the ultimate payment of the principal of this note.

2010 U-Haul S Fleet and its subsidiaries (collectively, “2010 USF”) issued a $155.0 million asset-backed

note (“2010 Box Truck Note”) on October 28, 2010. 2010 USF is a bankruptcy-remote special purpose entity

wholly-owned by U-Haul International, Inc. The net proceeds from the securitized transaction will be used to

finance new box truck purchases. U.S. Bank, NA acts as the trustee for this securitization.

The 2010 Box Truck Note has a fixed interest rate of 4.90% with an estimated final maturity of October 2017.

At March 31, 2011, the outstanding balance was $151.1 million. The note is securitized by the box trucks being

purchased and the corresponding operating cash flows associated with their operation. The unused portion of

this facility has been recorded as Other assets on our balance sheet.

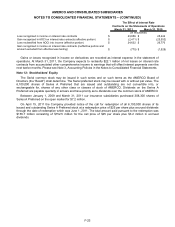

The 2007 Box Truck Note and 2010 Box Truck Note are subject to certain covenants with respect to liens,

additional indebtedness of the special purpose entities, the disposition of assets and other customary covenants

of bankruptcy-remote special purpose entities. The default provisions of these notes include non-payment of

principal or interest and other standard reporting and change-in-control covenants.

F-20