U-Haul 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

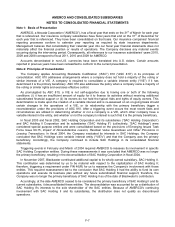

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Derivative Financial Instruments

The Company’s objective for holding derivative financial instruments is to manage interest rate risk exposure

primarily through entering interest rate swap agreements. An interest rate swap is a contractual exchange of

interest payments between two parties. A standard interest rate swap involves the payment of a fixed rate times

a notional amount by one party in exchange for a floating rate times the same notional amount from another

party. As interest rates change, the difference to be paid or received is accrued and recognized as interest

expense or income over the life of the agreement. The Company does not enter into these instruments for

trading purposes. Counterparties to the Company’s interest rate swap agreements are major financial

institutions. In accordance with ASC 815 - Derivatives and Hedging, the Company recognizes interest rate swap

agreements on the balance sheet at fair value, which is classified as prepaid expenses (asset) or accrued

expenses (liability). Derivatives that are not designated as cash flow hedges for accounting purposes must be

adjusted to fair value through income. If the derivative qualifies and is designated as a cash flow hedge,

changes in its fair value will either be offset against the change in fair value of the hedged item through earnings

or recognized in other comprehensive income (loss) until the hedged item is recognized in earnings. See Note

11, Derivatives of the Notes to Consolidated Financial Statements.

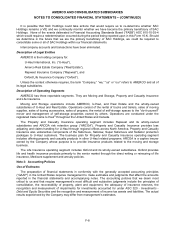

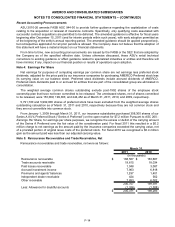

Inventories, net

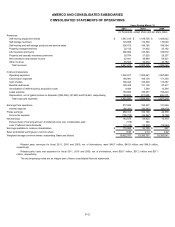

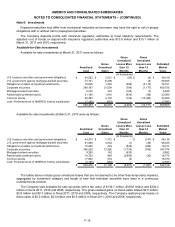

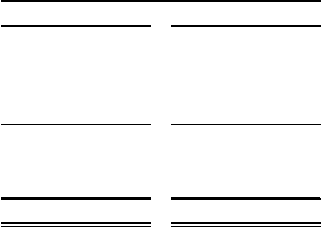

Inventories, net were as follows:

2011 2010

Truck and trailer parts and accessories (a) $ 53,212

$

46,304

Hitches and towing components (b) 12,797 13,644

Moving supplies and propane (b) 7,822 7,452

Subtotal 73,831 67,400

Less: LIFO reserves (13,294) (11,963)

Less: excess and obsolete reserves (595) (2,600)

Total $ 59,942 $ 52,837

(a) Primarily held for internal usage, including equipment manufacturing and repair

(b) Primarily held for retail sales

(In thousands)

March 31,

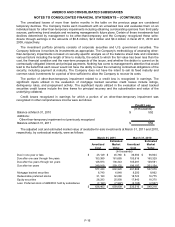

Inventories consist primarily of truck and trailer parts and accessories used to manufacture and repair rental

equipment as well as products and accessories available for retail sale. Inventory is held at Company owned

locations; our independent dealers do not hold any of the Company’s inventory.

Inventory cost is primarily determined using the last-in first-out method (“LIFO”). Inventories valued using

LIFO consisted of approximately 95% of the total inventories for both March 31, 2011 and 2010, respectively.

Had the Company utilized the first-in first-out method (“FIFO”), stated inventory balances would have been

$13.3 million and $12.0 million higher at March 31, 2011 and 2010, respectively. In fiscal 2011, the positive

effect on income due to liquidation of a portion of the LIFO inventory was $0.7 million.

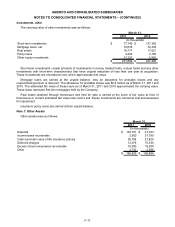

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Interest expense incurred during the initial construction of

buildings and rental equipment is considered part of cost. Depreciation is computed for financial reporting

purposes using the straight line or an accelerated method based on a declining balance formula over the

following estimated useful lives: rental equipment 2-20 years and buildings and non-rental equipment 3-55

years. The Company follows the deferral method of accounting based on ASC 908 - Airlines for major overhauls

in which engine overhauls are capitalized and amortized over five years and transmission overhauls are

capitalized and amortized over three years. Routine maintenance costs are charged to operating expense as

they are incurred. Gains and losses on dispositions of property, plant and equipment are netted against

F-10