U-Haul 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

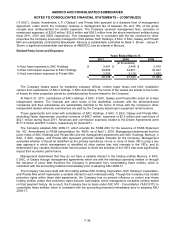

Other Obligations

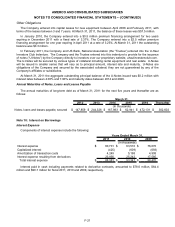

(In thousands)

Balance at March 31, 2010 $ -

Issuance of U-Haul Investors Club Securities 174

Balance at March 31, 2011 $ 174

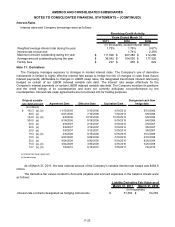

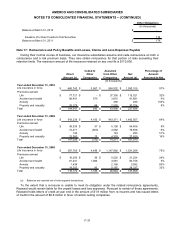

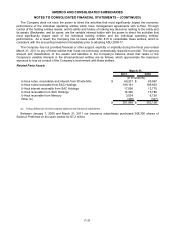

Note 17: Reinsurance and Policy Benefits and Losses, Claims and Loss Expenses Payable

During their normal course of business, our insurance subsidiaries assume and cede reinsurance on both a

coinsurance and a risk premium basis. They also obtain reinsurance for that portion of risks exceeding their

retention limits. The maximum amount of life insurance retained on any one life is $110,000.

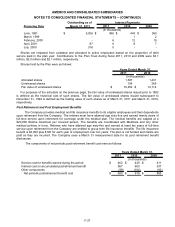

Direct

Amount (a)

Ceded to

Other

Companies

Assumed

from Other

Companies

Net

Amount (a)

Percentage of

Amount

Assumed to Net

Year ended December 31, 2010

Life insurance in force $ 668,740 $ 3,567 $ 884,932 $ 1,550,105 57%

Premiums earned:

Life $ 77,721 $ - $ 37,300 $ 115,021 32%

Accident and health 88,441 575 3,815 91,681 4%

Annuity - - 290 290 100%

Property and casualty 28,179 68 2,593 30,704 8%

Total $ 194,341 $ 643 $ 43,998 $ 237,696

Year ended December 31, 2009

Life insurance in force $ 543,236 $ 4,100 $ 943,371 $ 1,482,507 64%

Premiums earned:

Life $ 49,335 $ 37 $ 5,108 $ 54,406 9%

Accident and health 74,271 (803) 4,582 79,656 6%

Annuity 140 - 143 283 51%

Property and casualty 23,260 13 4,378 27,625 16%

Total $ 147,006 $ (753) $ 14,211 $ 161,970

Year ended December 31, 2008

Life insurance in force $ 387,783 $ 4,499 $ 1,147,982 $ 1,531,266 75%

Premiums earned:

Life $ 16,240 $ 36 $ 5,020 $ 21,224 24%

Accident and health 81,241 1,066 4,581 84,756 5%

Annuity 1,436 - 2,156 3,592 60%

Property and casualty 19,253 83 9,167 28,337 32%

Total $ 118,170 $ 1,185 $ 20,924 $ 137,909

(In thousands)

(a) Balances are reported net of inter-segment transactions.

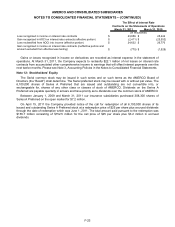

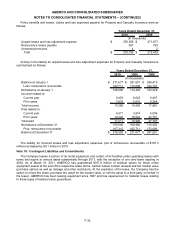

To the extent that a re-insurer is unable to meet its obligation under the related reinsurance agreements,

Repwest would remain liable for the unpaid losses and loss expenses. Pursuant to certain of these agreements,

Repwest holds letters of credit at year end in the amount of $1.9 million from re-insurers and has issued letters

of credit in the amount of $8.8 million in favor of certain ceding companies.

F-31