U-Haul 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 30

Life Insurance

2010 Compared with 2009

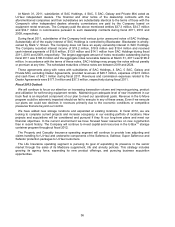

Net premiums were $207.0 million and $134.3 million for the years ended December 31, 2010 and

2009, respectively. Of the increase, $30.8 million resulted from the coinsurance agreement entered into

on September 30, 2010 to reinsure a block of final expense life insurance policies. As part of the

transaction, assets were transferred to us and classified as premium upon such transfer. Medicare

supplement premiums increased by $13.6 million primarily due to the acquisition of a Medicare

supplement block of business and rate increases on existing policies, offset by policy lapses and

terminations. Sales of the company’s single premium whole life product accounted for an increase of

$22.1 million.

Net investment income was $20.7 million and $18.5 million for the years ended December 31, 2010 and

2009, respectively. The improvement was due to an increased asset base and from gains on sale of

securities.

Net operating expenses were $29.8 million and $24.8 million for the years ended December 31, 2010

and 2009, respectively. The growth was a result of commissions paid on increased sales of the single

premium life product plus commissions on the Medicare supplement block of business purchased in

September 2010.

Benefits and losses incurred were $173.2 million and $106.5 million for the years ended December 31,

2010 and 2009, respectively. Life insurance benefits increased $59.1 million, of which $19.7 million was

due to expanded sales of the single premium life product, $6.6 million from increased sales of final

expense life insurance, and $30.8 million from reserves that were transferred under the new coinsurance

agreement. Medicare supplement increased by a net of $8.9 million, of which $14.9 million was due to

the acquisition of a Medicare supplement block of business offset by policy lapses and terminations.

Amortization of deferred acquisition costs (“DAC”) and the value of business acquired (“VOBA”) was

$9.5 million and $7.6 million for the years ended December 31, 2010 and 2009, respectively.

As a result of the above mentioned changes in revenues and expenses, pretax earnings from

operations were $17.4 million and $16.9 million for the years ended December 31, 2010 and 2009,

respectively.

Life Insurance

2009 Compared with 2008

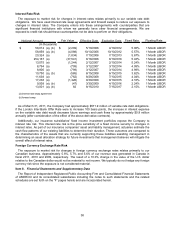

Net premiums were $134.3 million and $109.6 million for the years ended December 31, 2009 and

2008, respectively. The increase was primarily driven by expanded distribution resulting in an increase in

life insurance premiums of $33.5 million. This was somewhat offset by a decrease in Medicare

supplement premiums of $6.3 million.

Net investment income was $18.5 million and $20.4 million for the years ended December 31, 2009 and

2008, respectively. The decrease was due to lower short term investment yields and a lower average

investment portfolio compared with the prior year.

Other income was $2.9 million and $5.1 million for the years ended December 31, 2009 and 2008,

respectively. The decrease was due to the settlement of an arbitration in 2008 related to the acquisition of

DGLIC.

Net operating expenses were $24.8 million and $21.3 million for the years ended December 31, 2009

and 2008, respectively. The increase was primarily attributable to commissions, premium taxes, licenses,

and fees associated with the increase in premiums.

Benefits and losses incurred were $106.5 million and $83.6 million, for the years ended December 31,

2009 and 2008, respectively. The significant increase was the result of higher life insurance benefits of

$27.8 million due to the increase in reserves from expanded sales and additional claims on a larger

volume of inforce business which was offset by a net decrease of $4.9 million in the other business lines.

Amortization of DAC and VOBA was $7.6 million and $12.4 million for the years ended December 31,

2009 and 2008, respectively. Most of this was from a decrease of $4.0 million in the annuity block due to

a refinement in the maximum amortization periods in 2008.