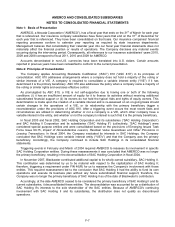

U-Haul 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

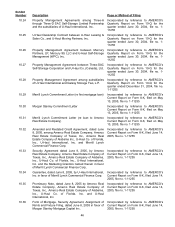

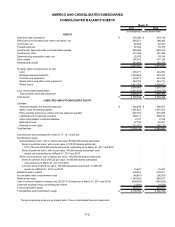

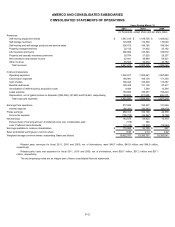

F-4

Description

Common

Stock, $0.25

Par Value

A

dditional Paid

-

In Capital

A

ccumulated Other

Comprehensive

Income

(

Loss

)

Retained

Earnin

g

s

Less:

Treasury

Stock

Less: Unearned

Employee Stock

Ownership Plan

Shares

Total

Stockhol

Equi

ders'

t

y

Balance as of ,431

Increase in ma 2,448

Foreign currency 030)

Unrealized los 914)

Fair market val 833)

Adjustment to post retirem 56

Net earnings ,410

Preferred stock 963)

Treasury stock 976)

Net activity 802)

Balance as of ,629

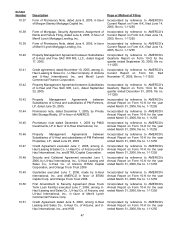

Increase in ma 2,447

Foreign currency ,471

Unrealized gai ,254

Fair market val ,478

Adjustment to post retirem 410)

Net earnings ,623

Excess of carr 388

Preferred stock 856)

Contribution to 113)

Net activity ,282

Balance as of ,911

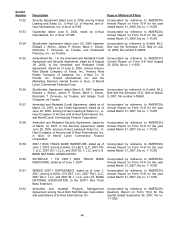

Increase in ma 4,210

Foreign currency ,114

Unrealized gai ,930

Fair market val ,495

Adjustment to post retirem 201

Net earnings ,575

Loss of carrying am 178)

Preferred stock 412)

Contribution to 826)

Net activity ,109

Balance as of ,020

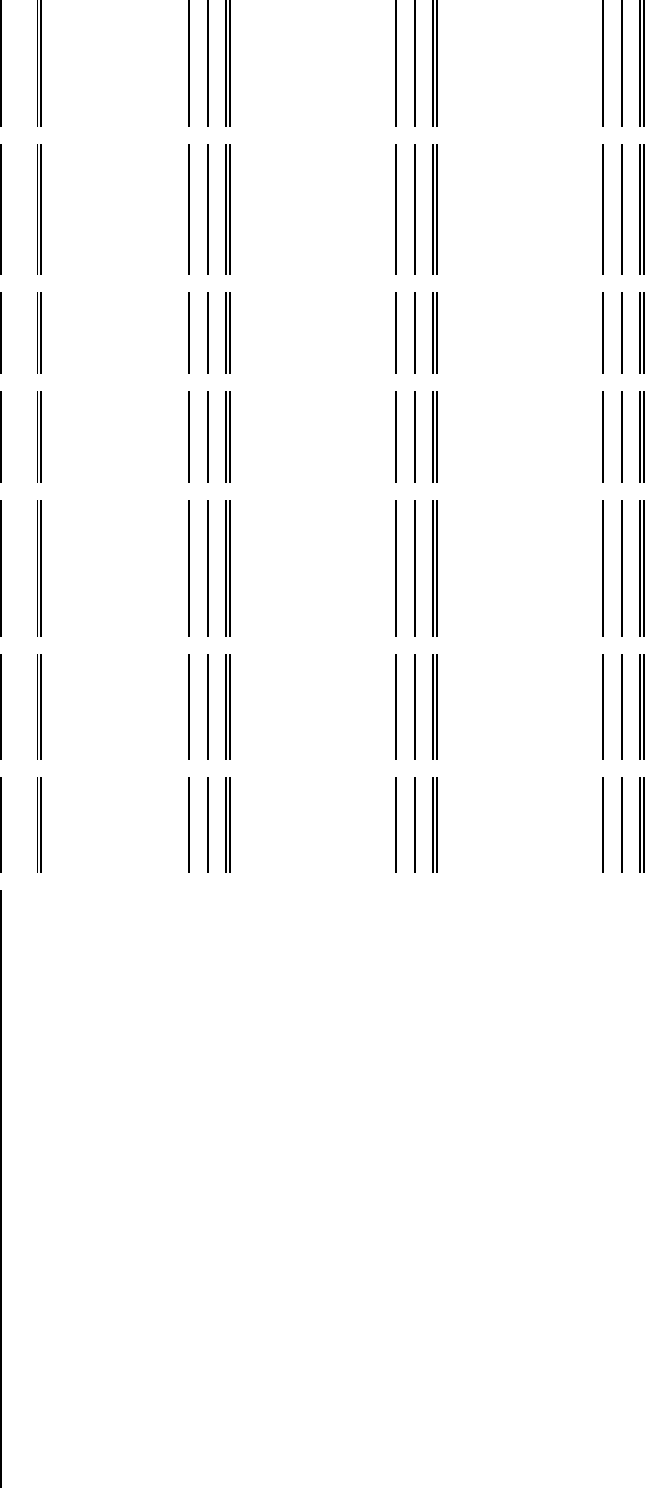

March 31, 2008 $ 10,497 $ 419,370 $ (55,279) $ 915,415 $ (524,677) $ (6,895) $ 758

rket value of released ESOP shares and release of unearned ESOP shares - 1,218 - - - 1,230

translation - - (16,030) - - - (16,

s on investments, net of tax - - (8,914) - - - (8,

ue of cash flow hedges, net of tax - - (17,833) - - - (17,

ent benefit obligation - - 56 - - -

- - - 13,410 - - 13

dividends: Series A ($2.13 per share for fiscal 2009) - - - (12,963) - - (12,

- - - - (976) - (

- 1,218 (42,721) 447 (976) 1,230 (40,

March 31, 2009 $ 10,497 $ 420,588 $ (98,000) $ 915,862 $ (525,653) $ (5,665) $ 717

rket value of released ESOP shares and release of unearned ESOP shares - 1,336 - - - 1,111

translation - - 14,471 - - - 14

n on investments, net of tax - - 13,254 - - - 13

ue of cash flow hedges, net of tax - - 14,478 - - - 14

ent benefit obligation - - (410) - - - (

- - - 65,623 - - 65

ying amount of preferred stock over consideration paid - - - 388 - -

dividends: Series A ($2.13 per share for fiscal 2010) - - - (12,856) - - (12,

related party - (2,113) - - - - (2,

- (777) 41,793 53,155 - 1,111 95

March 31, 2010 $ 10,497 $ 419,811 $ (56,207) $ 969,017 $ (525,653) $ (4,554) $ 812

rket value of released ESOP shares and release of unearned ESOP shares - 3,038 - - - 1,172

translation - - 3,114 - - - 3

n on investments, net of tax - - 4,930 - - - 4

ue of cash flow hedges, net of tax - - 1,495 - - - 1

ent benefit obligation - - 201 - - -

- - - 183,575 - - 183

ount of preferred stock over consideration paid - - - (178) - - (

dividends: Series A ($2.13 per share for fiscal 2011) - - - (12,412) - - (12,

related party - (4,826) - - - - (4,

- (1,788) 9,740 170,985 - 1,172 180

March 31, 2011 $ 10,497 $ 418,023 $ (46,467) $ 1,140,002 $ (525,653) $ (3,382) $ 993

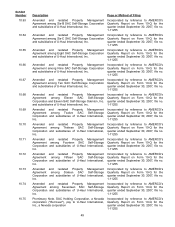

(In thousands)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

AMERCO AND CONSOLIDATED SUBSIDIARIES

The accompanying notes are an integral part of these consolidated financial statements.