U-Haul 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Other Obligations

The Company entered into capital leases for new equipment between April 2008 and February 2011, with

terms of the leases between 3 and 7 years. At March 31, 2011, the balance of these leases was $57.5 million.

In January 2010, the Company entered into a $0.5 million premium financing arrangement for two years

expiring in December 2011 with a fixed rate of 3.37%. The Company entered into a $2.5 million premium

financing arrangement for one year expiring in April 2011 at a rate of 3.25%. At March 31, 2011 the outstanding

balance was $0.3 million.

In February 2011, the Company and US Bank, National Association (the “Trustee”) entered into the U-Haul

Investors Club Indenture. The Company and the Trustee entered into this indenture to provide for the issuance

of notes (“U-Notes”) by the Company directly to investors over our proprietary website, uhaulinvestorsclub.com.

The U-Notes will be secured by various types of collateral including rental equipment and real estate. U-Notes

will be issued in smaller series that will vary as to principal amount, interest rate and maturity. U-Notes are

obligations of the Company and secured by the associated collateral; they are not guaranteed by any of the

Company’s affiliates or subsidiaries.

At March 31, 2011 the aggregate outstanding principal balance of the U-Notes issued was $0.2 million with

interest rates between 4.00% and 7.90% and maturity dates between 2014 and 2026.

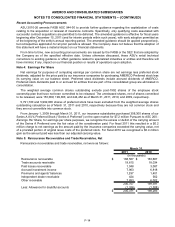

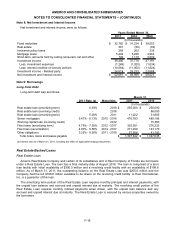

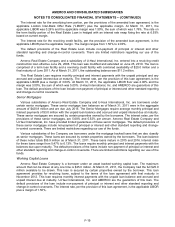

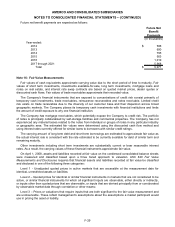

Annual Maturities of Notes, Loans and Leases Payable

The annual maturities of long-term debt as of March 31, 2011 for the next five years and thereafter are as

follows:

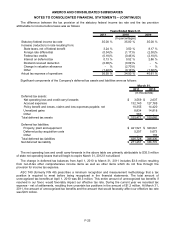

2012 2013 2014 2015 2016 Thereafter

Notes, loans and leases payable, secured $ 147,859 $ 244,326 $ 167,983 $ 62,941 $ 472,131 $ 302,602

March 31,

(In thousands)

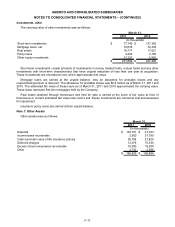

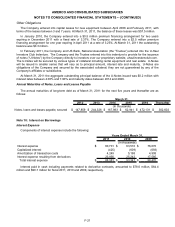

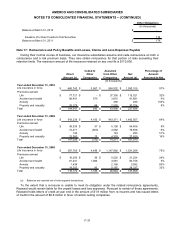

Note 10: Interest on Borrowings

Interest Expense

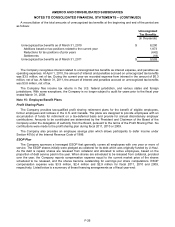

Components of interest expense include the following:

2011 2010 2009

Interest expense $ 60,701 $ 63,516 $ 76,670

Capitalized interest (425) (609) (693)

Amortization of transaction costs 4,249 5,198 4,908

Interest expense resulting from derivatives 23,856 25,242 17,585

Total interest expense $ 88,381 $ 93,347 $ 98,470

Years Ended March 31,

(In thousands)

Interest paid in cash including payments related to derivative contracts, amounted to $78.6 million, $64.4

million and $90.7 million for fiscal 2011, 2010 and 2009, respectively.

F-21