U-Haul 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

96

71

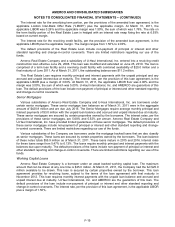

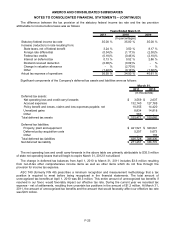

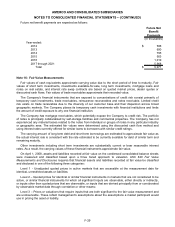

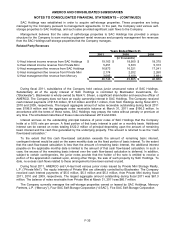

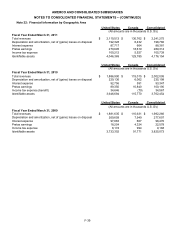

Future net benefit payments are expected as follows:

Future Net

Benefit

Payments

(In thousands)

Year-ended:

2012 $5

2013 690

2014 795

2015 903

2016 1,019

2017 through 2021 5,968

Total $9,9

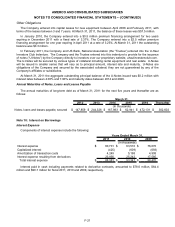

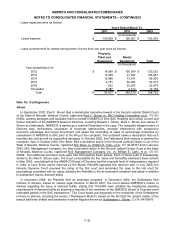

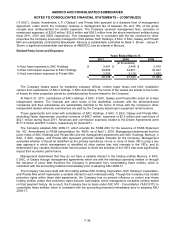

Note 16: Fair Value Measurements

Fair values of cash equivalents approximate carrying value due to the short period of time to maturity. Fair

values of short term investments, investments available-for-sale, long term investments, mortgage loans and

notes on real estate, and interest rate swap contracts are based on quoted market prices, dealer quotes or

discounted cash flows. Fair values of trade receivables approximate their recorded value.

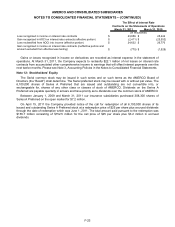

The Company’s financial instruments that are exposed to concentrations of credit risk consist primarily of

temporary cash investments, trade receivables, reinsurance recoverables and notes receivable. Limited credit

risk exists on trade receivables due to the diversity of our customer base and their dispersion across broad

geographic markets. The Company places its temporary cash investments with financial institutions and limits

the amount of credit exposure to any one financial institution.

The Company has mortgage receivables, which potentially expose the Company to credit risk. The portfolio

of notes is principally collateralized by self-storage facilities and commercial properties. The Company has not

experienced any material losses related to the notes from individual or groups of notes in any particular industry

or geographic area. The estimated fair values were determined using the discounted cash flow method and

using interest rates currently offered for similar loans to borrowers with similar credit ratings.

The carrying amount of long term debt and short term borrowings are estimated to approximate fair value as

the actual interest rate is consistent with the rate estimated to be currently available for debt of similar term and

remaining maturity.

Other investments including short term investments are substantially current or bear reasonable interest

rates. As a result, the carrying values of these financial instruments approximate fair value.

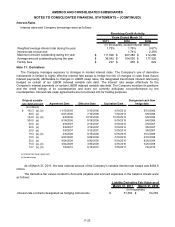

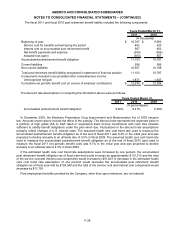

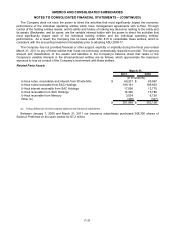

On April 1, 2008, assets and liabilities recorded at fair value on the condensed consolidated balance sheets

were measured and classified based upon a three tiered approach to valuation. ASC 820 Fair Value

Measurements and Disclosures requires that financial assets and liabilities recorded at fair value be classified

and disclosed in one of the following three categories:

Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for

identical, unrestricted assets or liabilities;

Level 2 – Quoted prices for identical or similar financial instruments in markets that are not considered to be

active, or similar financial instruments for which all significant inputs are observable, either directly or indirectly,

or inputs other than quoted prices that are observable, or inputs that are derived principally from or corroborated

by observable market data through correlation or other means;

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and

are unobservable. These reflect management’s assumptions about the assumptions a market participant would

use in pricing the asset or liability.

F-29