U-Haul 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

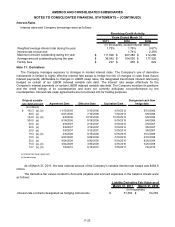

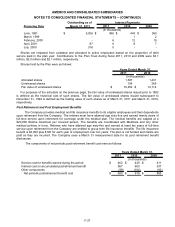

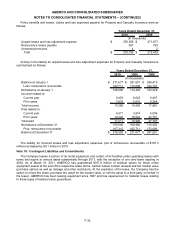

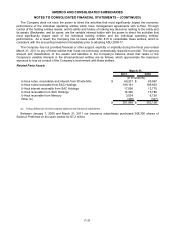

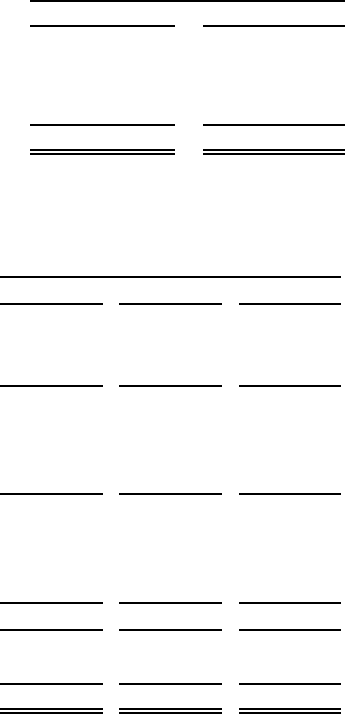

Policy benefits and losses, claims and loss expenses payable for Property and Casualty Insurance were as

follows:

2010 2009

Unpaid losses and loss adjustment expense $ 276,355 $ 271,677

Reinsurance losses payable 367 759

Unearned premiums 4 2

Total $ 276,726 $ 272,438

Years Ended December 31,

(In thousands)

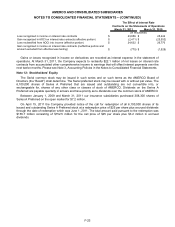

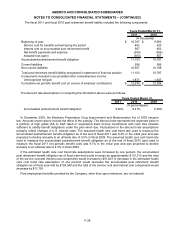

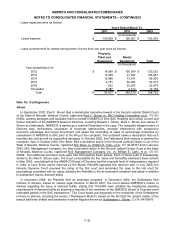

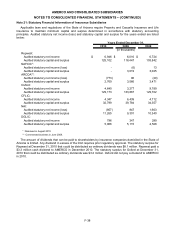

Activity in the liability for unpaid losses and loss adjustment expenses for Property and Casualty Insurance is

summarized as follows:

2010 2009 2008

Balance at January 1 $ 271,677 $ 287,501 $ 288,410

Less: reinsurance recoverable 162,711 173,098 164,181

Net balance at January 1 108,966 114,403 124,229

Incurred related to:

Current year 9,453 8,043 8,497

Prior years 7,832 6,516 9,384

Total incurred 17,285 14,559 17,881

Paid related to:

Current year 4,971 3,974 5,006

Prior years 12,240 16,022 22,701

Total paid 17,211 19,996 27,707

Net balance at December 31 109,040 108,966 114,403

Plus: reinsurance recoverable 167,315 162,711 173,098

Balance at December 31 $ 276,355 $ 271,677 $ 287,501

(In thousands)

Years Ended December 31,

The liability for incurred losses and loss adjustment expenses (net of reinsurance recoverable of $167.3

million) increased by $0.1 million in 2010.

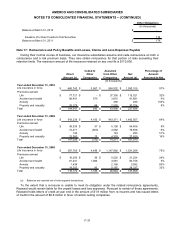

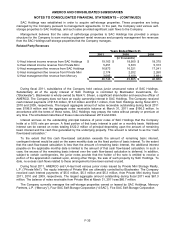

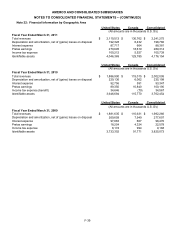

Note 18: Contingent Liabilities and Commitments

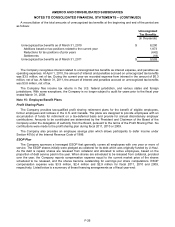

The Company leases a portion of its rental equipment and certain of its facilities under operating leases with

terms that expire at various dates substantially through 2017, with the exception of one land lease expiring in

2034. As of March 31, 2011, AMERCO has guaranteed $167.6 million of residual values for these rental

equipment assets at the end of the respective lease terms. Certain leases contain renewal and fair market value

purchase options as well as mileage and other restrictions. At the expiration of the lease, the Company has the

option to renew the lease, purchase the asset for fair market value, or sell the asset to a third party on behalf of

the lessor. AMERCO has been leasing equipment since 1987 and has experienced no material losses relating

to these types of residual value guarantees.

F-32