U-Haul 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Policy Benefits and Losses, Claims and Loss Expenses Payable

Life Insurance’s liabilities for life insurance and certain annuity and health policies are established to meet

the estimated future obligations of policies in force, and are based on mortality, morbidity and withdrawal

assumptions from recognized actuarial tables which contain margins for adverse deviation. Liabilities for health,

disability and other policies include estimates of payments to be made on insurance claims for reported losses

and estimates of losses incurred, but not yet reported. Oxford’s liabilities for deferred annuity contracts consist

of contract account balances that accrue to the benefit of the policyholders.

Repwest’s liability for reported and unreported losses is based on Repwest’s historical data along with

industry averages. The liability for unpaid loss adjustment expenses is based on historical ratios of loss

adjustment expenses paid to losses paid. Amounts recoverable from re-insurers on unpaid losses are estimated

in a manner consistent with the claim liability associated with the re-insured policy. Adjustments to the liability for

unpaid losses and loss expenses as well as amounts recoverable from re-insurers on unpaid losses are

charged or credited to expense in the periods in which they are made.

Self-Insurance Reserves

U-Haul retains the risk for certain public liability and property damage programs related to the rental

equipment. The consolidated balance sheets include $397.4 million and $385.5 million of liabilities related to

these programs as of March 31, 2011 and 2010, respectively. These liabilities are recorded in Policy benefits

and losses payable. Management takes into account losses incurred based upon actuarial estimates, past

experience, current claim trends, as well as social and economic conditions. This liability is subject to change in

the future based upon changes in the underlying assumptions including claims experience, frequency of

incidents, and severity of incidents. Based upon additional claims information obtained through the passage of

time, the Company reduced its self-insurance reserve balance associated with prior accident years by $15.0

million in both fiscal 2011 and fiscal 2010.

Additionally, as of March 31, 2011 and 2010, the consolidated balance sheets include liabilities of $6.9

million and $7.7 million, respectively, related to Company provided medical plan benefits for eligible employees.

The Company estimates this liability based on actual claims outstanding as of the balance sheet date as well as

an actuarial estimate of claims incurred but not reported. This liability is reported net of estimated recoveries

from excess loss reinsurance policies with unaffiliated insurers of $0.3 million in both fiscal 2011 and 2010,

respectively. These amounts are recorded in Accounts payable and accrued expenses on the consolidated

balance sheets.

Revenue Recognition

Self-moving rentals are recognized for the period that trucks and moving equipment are rented. Self-storage

revenues, based upon the number of paid storage contract days, are recognized as earned during the period.

Sales of self-moving and self-storage related products are recognized at the time that title passes and the

customer accepts delivery. Property and casualty, traditional life and Medicare supplement insurance premiums

are recognized as revenue over the policy periods. For products where premiums are due over a significantly

shorter duration than the period over which benefits are provided, such as our single premium whole life

product, premiums are recognized when received and excess profits are deferred and recognized in relation to

the insurance in force. Interest and investment income are recognized as earned.

Amounts collected from customers for sales tax are recorded on a net basis.

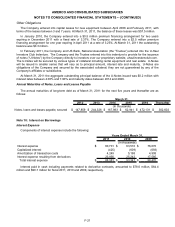

Advertising

All advertising costs are expensed as incurred. Advertising expense was $14.9 million, $20.2 million and

$24.7 million in fiscal 2011, 2010 and 2009, respectively.

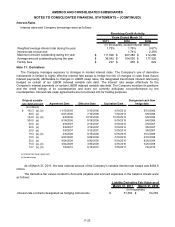

Deferred Policy Acquisition Costs

Commissions and other costs that fluctuate with and are primarily related to the acquisition or renewal of

certain insurance premiums are deferred. For the Life Insurance operating segment’s life and health insurance

products, these costs are amortized, with interest, in relation to revenue such that costs are realized as a

F-12