U-Haul 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 22

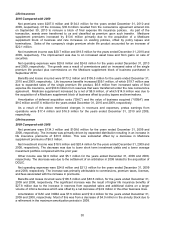

Subsequent Events

On April 15, 2011 the Company provided notice of the call for redemption of all 6,100,000 shares of its

issued and outstanding Series A Preferred stock at a redemption price of $25 per share plus accrued

dividends through the date of redemption which was June 1, 2011. The total amount paid pursuant to the

redemption was $155.7 million consisting of $152.5 million for the call price of $25 per share plus $3.2

million in accrued dividends.

The Company’s management has evaluated subsequent events occurring after March 31, 2011, the

date of our most recent balance sheet date, through the date our financial statements were issued. Other

than the redemption of the Series A Preferred stock, we do not believe any subsequent events have

occurred that would require further disclosure or adjustment to our financial statements.

Adoption of New Accounting Pronouncements

ASU 2009-16 formally incorporates into the FASB Codification amendments to Statements of Financial

Accounting Standards (“SFAS”) 140 made by SFAS 166 primarily to (1) eliminate the concept of a

qualifying special-purpose entity, (2) limit the circumstances under which a financial asset (or portion

thereof) should be derecognized when the entire financial asset has not been transferred to a non-

consolidated entity, (3) require additional information to be disclosed concerning a transferor's continuing

involvement with transferred financial assets, and (4) require that all servicing assets and servicing

liabilities be initially measured at fair value. The Company adopted the amendments to ASC 860-10 and

ASC 860-50 in the first quarter of fiscal 2011 and they did not have a material impact on our financial

statements.

ASU 2009-17 formally incorporates into the FASB Codification amendments to FIN 46(R) made by

SFAS 167 to require that a comprehensive qualitative analysis be performed to determine whether a

holder of variable interests in a variable interest entity also has a controlling financial interest in that entity.

In addition, the amendments require that the same type of analysis be applied to entities that were

previously designated as qualified special-purpose entities. The Company adopted the amendments to

ASC 810-10 in the first quarter of fiscal 2011 and it did not have a material impact on our financial

statements.

ASU 2010-06 formally incorporates into the FASB Codification amendments to SFAS 157. Entities will

be required to provide enhanced disclosures about transfers in and out of Level 1 and 2 fair value

classifications and separate disclosures about purchases, sales, issuances and settlements relating to

the Level 3 fair value classification. The new guidance also clarifies existing fair value disclosures

regarding the level of disaggregation of assets or liabilities and the valuation techniques and inputs used

to measure fair value. The Company adopted the amendments to ASC 820-10 for Level 1 and 2

disclosures and for Level 3 disclosures in the first quarter of fiscal 2011 and they did not have a material

impact on our financial statements.

Recent Accounting Pronouncements

ASU 2010-26 amends FASB ASC 944-30 to provide further guidance regarding the capitalization of

costs relating to the acquisition or renewal of insurance contracts. Specifically, only qualifying costs

associated with successful contract acquisitions are permitted to be deferred. The amended guidance is

effective for fiscal years beginning after December 15, 2011 (and for interim periods within such years),

with early adoption permitted as of the beginning of the entity's annual reporting period. The amended

guidance should be applied prospectively, but retrospective application for all prior periods is allowed.

The Company does not believe that the adoption of this statement will have a material impact on our

financial statements.

From time to time, new accounting pronouncements are issued by the FASB or the SEC that are

adopted by the Company as of the specified effective date. Unless otherwise discussed, these ASU’s

entail technical corrections to existing guidance or affect guidance related to specialized industries or

entities and therefore will have minimal, if any, impact on our financial position or results of operations

upon adoption.