U-Haul 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

Table of contents

-

Page 1

-

Page 2

...2011, we added more than 820,000 square feet of rental space, bringing our total portfolio of owned and managed self-storage space to just over 36,300,000 square feet. Our presence in the portable-storage market continues to grow with our U-Box product offering. We now offer this product and service...

-

Page 3

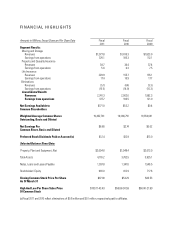

... and Diluted Preferred Stock Dividends Paid or Accrued (a)

Selected Balance Sheet Data:

Property, Plant and Equipment, Net Total Assets Notes, Loans and Leases Payable Stockholders' Equity Closing Common Stock Price Per Share As Of March 31 High And Low Per Share Sales Price Of Common Stock $2,094...

-

Page 4

...March 31, 2011 or

Â...

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from _____ to _____

Commission File Number

Registrant, State of Incorporation Address and Telephone Number

I.R.S. Employer Identification No.

1-11255

AMERCO...

-

Page 5

... aggregate market value of AMERCO common stock held by non-affiliates on September 30, 2010 was $588,807,710. The aggregate market value was computed using the closing price for the common stock trading on NASDAQ on such date. Shares held by executive officers, directors and persons owning directly...

-

Page 6

... Market Risk ...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security...

-

Page 7

... orange and white U-Haul trucks and trailers as well as offer self-storage rooms through a network of over 1,400 Company operated retail moving centers and approximately 15,000 independent U-Haul dealers. We also sell U-Haul brand boxes, tape and other moving and self-storage products and services...

-

Page 8

...000 trucks, 82,000 trailers and 33,000 towing devices. This equipment and our U-Haul brand of self-moving products and services are available through our network of managed retail moving centers and independent U-Haul dealers. Independent U-Haul dealers receive rental equipment from the Company, act...

-

Page 9

... dealer network to provide added convenience for our customers. U-Haul maximizes vehicle utilization by effective distribution of the truck and trailer fleets among the over 1,400 Company operated centers and approximately 15,000 independent dealers. Utilizing its proprietary reservations management...

-

Page 10

...management of our rental equipment to provide our retail centers with the right type of rental equipment, at the right time and at the most convenient location for our customers, effective marketing of our broad line of self-moving related products and services, maintaining longer hours of operation...

-

Page 11

..., security and price. Our largest competitors in the self-storage market are Public Storage Inc., Extra Space Storage, Inc., and Sovran Self-Storage Inc. Insurance Operating Segments The insurance industry is highly competitive. In addition, the marketplace includes financial services firms...

-

Page 12

... and the Consolidated Financial Statements and related notes. These risk factors may be important in understanding this Annual Report on Form 10-K or elsewhere. We operate in a highly competitive industry. The truck rental industry is highly competitive and includes a number of significant national...

-

Page 13

.... Should credit markets in the United States tighten or if interest rates increase significantly we may not be able to refinance existing debt or find additional financing on favorable terms, or at all. If one or more of the financial institutions that support our existing credit facilities fails...

-

Page 14

... customers, U-Haul maintains a large fleet of rental equipment. Our rental truck fleet rotation program is funded internally through operations and externally from debt and lease financing. Our ability to fund our routine fleet program could be adversely affected if financial market conditions limit...

-

Page 15

...operations. We operate in a highly regulated industry and changes in existing regulations or violations of existing or future regulations could have a material adverse effect on our operations and profitability. Our truck and trailer rental business is subject to regulation by various federal, state...

-

Page 16

...400 U-Haul retail centers of which 479 are managed for other owners, and operates 12 manufacturing and assembly facilities. We also operate 175 fixed-site repair facilities located throughout the United States and Canada. These facilities are used primarily for the benefit of our Moving and Storage...

-

Page 17

... case. The complaint alleges breach of fiduciary duty, self-dealing, usurpation of corporate opportunities, wrongful interference with prospective economic advantage and unjust enrichment and seeks the unwinding of sales of self-storage properties by subsidiaries of AMERCO to SAC prior to the filing...

-

Page 18

... derived the number of our stockholders using internal stock ledgers and utilizing Mellon Investor Services Stockholder listings. AMERCO's common stock is listed on the NASDAQ Global Select Market under the trading symbol "UHAL". The following table sets forth the high and the low sales price of the...

-

Page 19

... us, using management's discretion, to buy back shares from former employees who were participants in our Employee Stock Ownership Plan ("ESOP"). To be eligible for consideration, the employee's ESOP account balance(s) must be valued at more than $1,000 at the then-prevailing market prices but have...

-

Page 20

From January 1, 2009 through March 31, 2011, our insurance subsidiaries purchased 308,300 shares of Series A Preferred on the open market for $7.2 million. Pursuant to Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 260 - Earnings Per Share ("ASC 260"), for ...

-

Page 21

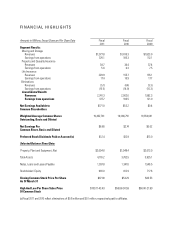

... financial data for AMERCO and consolidated entities for each of the last five years ended March 31:

Years Ended March 31, 2011 Summary of Operations: Self-moving equipment rentals Self-storage revenues Self-moving and self-storage products and service sales Property management fees Life insurance...

-

Page 22

... self-storage rental facilities and related moving and self-storage products and services. We are able to expand our distribution and improve customer service by increasing the amount of moving equipment and storage rooms available for rent, expanding the number of independent dealers in our network...

-

Page 23

... to Consolidated Financial Statements included in this Form 10-K. Moving and Storage Operating Segment Our Moving and Storage operating segment consists of the rental of trucks, trailers, portable storage boxes, specialty rental items and self-storage spaces primarily to the household mover as well...

-

Page 24

... ability to fund its own operations and execute its business plan without any future subordinated financial support; therefore, the Company was no longer the primary beneficiary of SAC Holding II as of the date of Blackwater's contribution. Accordingly, at the date AMERCO ceased to be considered the...

-

Page 25

... but not limited to, the general state of the used vehicle market, the age and condition of the vehicle at the time of its disposal and the depreciation rates with respect to the vehicle. We typically sell our used vehicles at our sales centers throughout North America, on our web site at uhaul.com...

-

Page 26

... of time to maturity. Fair values of short term investments, investments available-for-sale, long term investments, mortgage loans and notes on real estate, and interest rate swap contracts are based on quoted market prices, dealer quotes or discounted cash flows. Fair values of trade receivables...

-

Page 27

... million in accrued dividends. The Company's management has evaluated subsequent events occurring after March 31, 2011, the date of our most recent balance sheet date, through the date our financial statements were issued. Other than the redemption of the Series A Preferred stock, we do not believe...

-

Page 28

...rentals Self-storage revenues Self-moving and self-storage products and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Consolidated revenue

$

$

Self-moving equipment rental revenues increased...

-

Page 29

...whole life business. Total costs at the life insurance segment increased $73.6 million for fiscal 2011, compared with fiscal 2010. Operating expenses for Moving and Storage decreased $2.5 million primarily from reduced liability costs associated with the rental equipment fleet offset by increases in...

-

Page 30

...021 39,534 40,180 2,002,005 $ 1,992,266

Self-moving equipment rentals Self-storage revenues Self-moving and self-storage products and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Consolidated...

-

Page 31

... to the balance sheet in fiscal 2010 along with an $18.6 million improvement in the gain on the disposal of rental equipment. Cost of sales decreased $10.3 million largely from lower propane costs combined with a positive LIFO inventory adjustment. Total costs and expenses at the insurance companies...

-

Page 32

... Storage operating segment for the fiscal 2011 and fiscal 2010: Year Ended March 31, 2011 2010 (In thousands) Self-moving equipment rentals $ 1,549,058 $ 1,421,331 Self-storage revenues 120,698 110,369 Self-moving and self-storage products and service sales 205,570 198,785 Property management fees...

-

Page 33

...reduced investment yields on invested short-term balances. The Company owns and manages self-storage facilities. Self-storage revenues reported in the consolidated financial statements represent Company-owned locations only. Self-storage data for our owned storage locations follows:

Year Ended March...

-

Page 34

... balance sheet in fiscal 2010 along with an $18.6 million improvement in the gain on the disposal of rental equipment. Cost of sales decreased $10.3 million largely from lower propane costs combined with a positive LIFO inventory adjustment. Equity in the earnings of AMERCO's insurance subsidiaries...

-

Page 35

... due to the acquisition of a Medicare supplement block of business and rate increases on existing policies, offset by policy lapses and terminations. Sales of the company's single premium whole life product accounted for an increase of $22.1 million. Net investment income was $20.7 million and $18...

-

Page 36

... generally unavailable to fulfill the obligations of non-insurance operations (AMERCO, U-Haul and Real Estate). As of March 31, 2011 (or as otherwise indicated), cash and cash equivalents, other financial assets (receivables, short-term investments, other investments, fixed maturities, and related...

-

Page 37

... our internally generated funds will be used to service the existing debt and fund operations. U-Haul estimates that during fiscal 2012 the Company will reinvest in its truck and trailer rental fleet approximately $220 million, net of equipment sales and excluding any lease buyouts. For fiscal 2011...

-

Page 38

... in self-moving equipment rental revenues, storage revenues and product and service sales was primarily responsible for the improved operating cash flows. Also, in the third quarter of fiscal 2011 the Company received a $37.4 million refund related to the federal income tax loss carrybacks filed in...

-

Page 39

... of the Notes to Consolidated Financial Statements. The available-for-sale securities held by the Company are recorded at fair value. These values are determined primarily from actively traded markets where prices are based either on direct market quotes or observed transactions. Liquidity is...

-

Page 40

... significant shareholder and director of AMERCO, has an interest in Mercury. The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.5 million...

-

Page 41

...improving pricing, product and utilization for self-moving equipment rentals. Maintaining an adequate level of new investment in our truck fleet is an important component of our plan to meet our operational goals. Revenue in the U-Move program could be adversely impacted should we fail to execute in...

-

Page 42

... unaudited financial statements for the eight quarters beginning April 1, 2009 and ending March 31, 2011. The Company believes that all necessary adjustments have been included in the amounts stated below to present fairly, and in accordance with GAAP, such results. Moving and Storage operations are...

-

Page 43

...not considered material. Item 8. Financial Statements and Supplementary Data The Report of Independent Registered Public Accounting Firm and Consolidated Financial Statements of AMERCO and its consolidated subsidiaries including the notes to such statements and the related schedules are set forth on...

-

Page 44

... Form 10-K, our Disclosure Controls were effective related to the above stated design purposes. Inherent Limitations on Effectiveness of Controls The Company's management, including the CEO and CAO, does not expect that our Disclosure Controls or our internal control over financial reporting will...

-

Page 45

... reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. Management assessed our internal control over financial reporting as of March 31, 2011, the end of our...

-

Page 46

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of the Company as of March 31, 2011 and 2010, and the related consolidated statements of operations, changes in stockholders' equity, comprehensive income (loss), and...

-

Page 47

... of the 2011 fiscal year. The Company has adopted a Code of Ethics that applies to all directors, officers and employees of the Company, including the Company's principal executive officer and principal accounting officer. A copy of our Code of Ethics is posted on AMERCO's web site at amerco.com...

-

Page 48

... 15. Exhibits and Financial Statement Schedules The following documents are filed as part of this Report:

Page Financial Statements: Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets - March 31, 2011 and 2010 Consolidated Statements of Operations - Years Ended March...

-

Page 49

... Agreement, dated as of March 15, 2004 among SAC Holding Corporation, SAC Holding II Corporation, AMERCO, U-Haul International, Inc., and Law Debenture Trust Company of New York U-Haul Dealership Contract

Page or Method of Filing Incorporated by reference to AMERCO's Current Report on Form...

-

Page 50

... to AMERCO's Form S-4 Registration Statement filed on March 30, 2004, no. 333-114042 Incorporated by reference to AMERCO's Annual Report on Form 10-K for the year ended March 31, 2004, file no. 1-11255

10.12

Management Agreement between Nineteen SAC SelfStorage Limited Partnership and U-Haul

10...

-

Page 51

... June 8, 2005 by Amerco Real Estate Company, Amerco Real Estate Company of Texas, Inc., Amerco Real Estate Company of Alabama, Inc., U-Haul Co. of Florida, Inc. and U-Haul International, Inc. Form of Mortgage, Security Agreement, Assignment of Rents and Fixture Filing, dated June 8, 2005 in favor...

-

Page 52

... to Security Agreement (New Truck Term Loan Facility) executed June 7, 2006, among UHaul Leasing and Sales Co., U-Haul Co. of Arizona, and U-Haul International, Inc., in favor of Merrill Lynch Commercial Finance Corp. Credit Agreement dated June 6, 2006, among U-Haul Leasing and Sales Co., U-Haul Co...

-

Page 53

... and Security Agreement, dated as of August 18, 2006, to the Amended and Restated Credit Agreement, dated as of June 8, 2005, among Amerco Real Estate Company of Texas, Inc., Amerco Real Estate Company of Alabama, Inc., U-Haul Co. of Florida, Inc., U-Haul International, Inc. and the Marketing...

-

Page 54

... Number 10.63

Description Amended and restated Property Management Agreement among Six-B SAC Self-Storage Corporation and subsidiaries of U-Haul International, Inc. Amended and restated Property Management Agreement among Six-C SAC Self-Storage Corporation and subsidiaries of U-Haul International...

-

Page 55

.... Amended and Restated AMERCO Employee Stock Ownership Plan Credit Agreement, dated April 29, 2011, among Amerco Real Estate Company and U-Haul Company of Florida and J.P. Morgan Chase Bank, N.A. Code of Ethics Subsidiaries of AMERCO Consent of BDO USA, LLP Power of Attorney Rule 13a-14(a)/15d-14...

-

Page 56

...Sarbanes-Oxley Act of 2002 Certificate of Jason A. Berg, Principal Financial Officer and Chief Accounting Officer of AMERCO pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

Page or Method of Filing Furnished herewith

32.2

Furnished herewith

* Indicates compensatory plan arrangement.

51

-

Page 57

... Registered Public Accounting Firm Board of Directors and Stockholders AMERCO Reno, Nevada We have audited the accompanying consolidated balance sheets of AMERCO and consolidated subsidiaries (the "Company") as of March 31, 2011 and 2010 and the related consolidated statements of operations, changes...

-

Page 58

... Rental trailers and other rental equipment Rental trucks Less: Accumulated depreciation Total property, plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Accounts payable and accrued expenses Notes, loans and leases payable Policy benefits and losses, claims...

-

Page 59

...Self-moving equipment rentals Self-storage revenues Self-moving and self-storage products and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses...

-

Page 60

..., net of tax Fair market value of cash flow hedges, net of tax Adjustment to post retirement benefit obligation Net earnings Preferred stock dividends: Series A ($2.13 per share for fiscal 2009) Treasury stock Net activity Balance as of March 31, 2009 Increase in market value of released ESOP...

-

Page 61

... STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

Fiscal Year Ended March 31, 2011 Comprehensive income (loss): Net earnings Other comprehensive income (loss): Foreign currency translation Unrealized gain on investments Change in fair value of cash flow hedges Postretirement benefit obligation gain Total...

-

Page 62

... Proceeds from sales of: Property, plant and equipment Short term investments Fixed maturity investments Equity securities Preferred stock Real estate Mortgage loans Net cash used by investing activities Cash flow from financing activities: Borrowings from credit facilities Principal repayments...

-

Page 63

... conform to calendar year reporting as required by state insurance departments. Management believes that consolidating their calendar year into our fiscal year financial statements does not materially affect the financial position or results of operations. The Company discloses any material events...

-

Page 64

... reportable segments. They are Moving and Storage, Property and Casualty Insurance and Life Insurance. Moving and Storage operations include AMERCO, U-Haul, and Real Estate and the wholly-owned subsidiaries of U-Haul and Real Estate. Operations consist of the rental of trucks and trailers, sales...

-

Page 65

... of time to maturity. Fair values of short-term investments, investments available-for-sale, long-term investments, mortgage loans and notes on real estate, and interest rate swap contracts are based on quoted market prices, dealer quotes or discounted cash flows. Fair values of trade receivables...

-

Page 66

... primarily of truck and trailer parts and accessories used to manufacture and repair rental equipment as well as products and accessories available for retail sale. Inventory is held at Company owned locations; our independent dealers do not hold any of the Company's inventory. Inventory cost is...

-

Page 67

... surplus real estate, which is lower than market value at the balance sheet date, was $9.7 million and $9.8 million for fiscal 2011 and 2010, respectively, and is included in Investments, other. Receivables Accounts receivable include trade accounts from moving and self-storage customers and dealers...

-

Page 68

... are recorded in Accounts payable and accrued expenses on the consolidated balance sheets. Revenue Recognition Self-moving rentals are recognized for the period that trucks and moving equipment are rented. Self-storage revenues, based upon the number of paid storage contract days, are recognized...

-

Page 69

... estimated useful lives of the properties. These costs improve the safety or efficiency of the property or are incurred in preparing the property for sale. Income Taxes AMERCO files a consolidated tax return with all of its legal subsidiaries, except for Dallas General Life Insurance Company ("DGLIC...

-

Page 70

... are net earnings less preferred stock dividends, adjusted for the price paid by our insurance companies for purchasing AMERCO Preferred stock less its carrying value on our balance sheet. Preferred stock dividends include accrued dividends of AMERCO. Preferred stock dividends paid to or accrued...

-

Page 71

... of time that individual securities have been in a continuous unrealized loss position. The Company sold available-for-sale securities with a fair value of $134.7 million, $168.6 million and $234.2 million in fiscal 2011, 2010 and 2009, respectively. The gross realized gains on these sales totaled...

-

Page 72

...-temporary impairments is based on security-specific analysis as of the balance sheet date and considers various factors including the length of time to maturity, the extent to which the fair value has been less than the cost, the financial condition and the near-term prospects of the issuer, and...

-

Page 73

... FINANCIAL STATEMENTS -- (CONTINUED)

Investments, other The carrying value of other investments was as follows:

March 31, 2011 2010 (In thousands) 77,745 $ 127,385 79,635 72,438 18,777 17,621 4,404 4,190 21,307 5,852 201,868 $ 227,486

Short-term investments Mortgage loans, net Real estate Policy...

-

Page 74

... and the Company had the full $198.8 million available to be drawn on the revolving credit facility. U-Haul International, Inc. is a guarantor of this loan. The amortizing term portion of the Real Estate Loan requires monthly principal and interest payments, with the unpaid loan balance and accrued...

-

Page 75

... with the balances due upon maturity. The default provisions of the loans include non-payment of principal or interest and other standard reporting and change-in-control covenants. There are limited restrictions regarding our use of the funds.

Working Capital Loans

Amerco Real Estate Company is...

-

Page 76

...2011, the outstanding balance was $120.2 million. The note is secured by the box trucks that were purchased and the corresponding operating cash flows associated with their operation. The 2007 Box Truck Note has the benefit of a financial guaranty insurance policy which guarantees the timely payment...

-

Page 77

AMERCO AND CONSOLIDATED SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED) Other Obligations

The Company entered into capital leases for new equipment between April 2008 and February 2011, with terms of the leases between 3 and 7 years. At March 31, 2011, the balance of these ...

-

Page 78

... Facility fees

$ $ $

Note 11: Derivatives The Company manages exposure to changes in market interest rates. The Company's use of derivative instruments is limited to highly effective interest rate swaps to hedge the risk of changes in cash flows (future interest payments) attributable to changes...

-

Page 79

...twelve months. Please see Note 3, Accounting Policies in the Notes to Consolidated Financial Statements. Note 12: Stockholders' Equity The Serial common stock may be issued in such series and on such terms as the AMERCO Board of Directors (the "Board") shall determine. The Serial preferred stock may...

-

Page 80

...Provision for Taxes Earnings before taxes and the provision for taxes consisted of the following:

Years Ended March 31, 2011 2010 2009 (In thousands) Pretax earnings: U.S. Non-U.S. Total pretax earnings Current provision (benefit) Federal State Non-U.S. Deferred provision (benefit) Federal State Non...

-

Page 81

...:

2011 Statutory federal income tax rate Increase (reduction) in rate resulting from: State taxes, net of federal benefit Foreign rate differential Federal tax credits Interest on deferred tax Dividend received deduction Change in valuation allowance Other Actual tax expense of operations Years...

-

Page 82

... and allocated to active employees, based on the proportion of debt service paid in the year. When shares are scheduled to be released from collateral, prorated over the year, the Company reports compensation expense equal to the current market price of the shares scheduled to be released, and...

-

Page 83

...-time service upon retirement from the Company are entitled to group term life insurance benefits. The life insurance benefit is $2,000 plus $100 for each year of employment over ten years. The plan is not funded and claims are paid as they are incurred. The Company uses a March 31 measurement date...

-

Page 84

...decline annually to an ultimate rate of 4.5% in fiscal 2029. If the estimated health care cost trend rate assumptions were increased by one percent, the accumulated post retirement benefit obligation as of fiscal year-end would increase by approximately $112,212 and the total of the service cost and...

-

Page 85

... of time to maturity. Fair values of short term investments, investments available-for-sale, long term investments, mortgage loans and notes on real estate, and interest rate swap contracts are based on quoted market prices, dealer quotes or discounted cash flows. Fair values of trade receivables...

-

Page 86

... the fair value measurement. The following table represents the financial assets and liabilities on the condensed consolidated balance sheet at March 31, 2011, that are subject to ASC 820 and the valuation approach applied to each of these items.

Significant Quoted Prices in Active Other Markets for...

-

Page 87

AMERCO AND CONSOLIDATED SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Other Obligations (In thousands) 174 174

Balance at March 31, 2010 Issuance of U-Haul Investors Club Securities Balance at March 31, 2011

$

$

Note 17: Reinsurance and Policy Benefits and Losses, Claims...

-

Page 88

... Commitments The Company leases a portion of its rental equipment and certain of its facilities under operating leases with terms that expire at various dates substantially through 2017, with the exception of one land lease expiring in 2034. As of March 31, 2011, AMERCO has guaranteed $167.6 million...

-

Page 89

... case. The complaint alleges breach of fiduciary duty, self-dealing, usurpation of corporate opportunities, wrongful interference with prospective economic advantage and unjust enrichment and seeks the unwinding of sales of self-storage properties by subsidiaries of AMERCO to SAC prior to the filing...

-

Page 90

.... Real Estate regularly makes capital and operating expenditures to stay in compliance with environmental laws and has put in place a remedial plan at each site where it believes such a plan is necessary. Since 1988, Real Estate has managed a testing and removal program for underground storage tanks...

-

Page 91

... a unique structure for the Company to earn moving equipment rental revenues and property management fee revenues from the SAC Holdings self-storage properties that the Company manages. Related Party Revenues

2011 U-Haul interest income revenue from SAC Holdings U-Haul interest income revenue from...

-

Page 92

... space for marketing company offices, vehicle repair shops and hitch installation centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. The terms of the leases are similar to the terms of leases for other properties owned by unrelated parties that are leased to the Company. At March 31, 2011...

-

Page 93

AMERCO AND CONSOLIDATED SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

The Company does not have the power to direct the activities that most significantly impact the economic performance of the individual operating entities which have management agreements with U-Haul. ...

-

Page 94

... STATEMENTS -- (CONTINUED)

Note 21: Statutory Financial Information of Insurance Subsidiaries Applicable laws and regulations of the State of Arizona require Property and Casualty Insurance and Life Insurance to maintain minimum capital and surplus determined in accordance with statutory accounting...

-

Page 95

AMERCO AND CONSOLIDATED SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Note 22: Financial Information by Geographic Area

United States Canada Consolidated (All amounts are in thousands U.S. $'s) Fiscal Year Ended March 31, 2011 Total revenues Depreciation and amortization, ...

-

Page 96

... CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Note 22A: Consolidating Financial Information by Industry Segment AMERCO's three reportable segments are Moving and Storage, comprised of AMERCO, U-Haul, and Real Estate and the subsidiaries of U-Haul and Real Estate, Property and Casualty Insurance...

-

Page 97

...)

Note 22A: Financial Information by Consolidating Industry Segment:

Consolidating balance sheets by industry segment as of March 31, 2011 are as follows:

Moving & Storage AMERCO Legal Group

AMERCO

U-Haul

Real Estate

Eliminations

Property & Moving & Casualty Storage Insurance (a) Consolidated...

-

Page 98

... TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Consolidating balance sheets by industry segment as of March 31, 2011 are as follows:

Moving & Storage

AMERCO

U-Haul

Real Estate

Eliminations

AMERCO Legal Group Property & Moving & Casualty Life Storage Consolidated Insurance (a) Insurance...

-

Page 99

... TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Consolidating balance sheets by industry segment as of March 31, 2010 are as follows:

Moving & Storage AMERCO Legal Group

AMERCO

U-Haul

Real Estate

Eliminations

Property & Moving & Casualty Life Storage Consolidated Insurance (a) Insurance...

-

Page 100

... FINANCIAL STATEMENTS -- (CONTINUED)

Consolidating balance sheets by industry segment as of March 31, 2010 are as follows:

Moving & Storage AMERCO Consolidated

AMERCO

U-Haul

Real Estate

Eliminations

AMERCO Legal Group Property & Moving & Casualty Life Storage Insurance (a) Insurance...

-

Page 101

... FINANCIAL STATEMENTS -- (CONTINUED)

Consolidating statements of operations by industry segment for period ending March 31, 2011 are as follows:

Moving & Storage

AMERCO

U-Haul

Real Estate

Eliminations

AMERCO Legal Group Property & Moving & Casualty Life Storage Consolidated Insurance...

-

Page 102

...822) (d) $

AMERCO Consolidated

Revenues: Self-moving equipment rentals Self-storage revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues...

-

Page 103

... FINANCIAL STATEMENTS -- (CONTINUED)

Consolidating statements of operations by industry segment for period ending March 31, 2009 are as follows:

Moving & Storage AMERCO Consolidated

AMERCO

U-Haul

Real Estate

Eliminations

AMERCO Legal Group Property & Moving & Casualty Life Storage Insurance...

-

Page 104

...FINANCIAL STATEMENTS -- (CONTINUED)

Consolidating cash flow statements by industry segment for the year ended March 31, 2011, are as follows:

Moving & Storage

AMERCO

U-Haul

Real Estate

Elimination

AMERCO Legal Group Property & Moving & Casualty Life Storage Consolidated Insurance (a) Insurance...

-

Page 105

... FINANCIAL STATEMENTS -- (CONTINUED)

Continuation of consolidating cash flow statements by industry segment for the year ended March 31, 2011, are as follows:

Moving & Storage

AMERCO

U-Haul

Real Estate

Elimination

AMERCO Legal Group Moving & Property & Storage Casualty Life Consolidated...

-

Page 106

...provided (used) by operating activities

Cash flows from investing activities: Purchases of: Property, plant and equipment Short term investments Fixed maturities investments Equity securities Preferred stock Real estate Mortgage loans Proceeds from sales of: Property, plant and equipment Short term...

-

Page 107

... & Storage Casualty Life Consolidated Insurance (a) Insurance (a) Elimination (In thousands) 107 107 -

AMERCO Consolidated

Cash flows from financing activities: Borrowings from credit facilities Principal repayments on credit facilities Debt issuance costs Capital lease payments Leveraged Employee...

-

Page 108

... (used) by operating activities 13,410 41,557 $ (64,180) $ 6,371 $ 57,809 (57,809)

Cash flows from investing activities: Purchases of: Property, plant and equipment Short term investments Fixed maturities investments Equity securities Preferred stock Real estate Mortgage loans Proceeds from sales...

-

Page 109

... FINANCIAL STATEMENTS -- (CONTINUED)

Continuation of consolidating cash flow statements by industry segment for the year ended March 31, 2009 are as follows:

Moving & Storage

AMERCO

U-Haul

Real Estate Elimination

AMERCO Legal Group Property & Moving & Casualty Life Storage Consolidated...

-

Page 110

... STATEMENTS -- (CONTINUED) Note 23: Subsequent Events

Preferred Stock On April 15, 2011 the Company provided notice of the call for redemption of all 6,100,000 shares of its issued and outstanding Series A Preferred Stock at a redemption price of $25 per share plus accrued dividends through the date...

-

Page 111

SCHEDULE I CONDENSED FINANCIAL INFORMATION OF AMERCO BALANCE SHEETS

March 31, 2011 2010 (In thousands) ASSETS Cash and cash equivalents Investment in subsidiaries Related party assets Other assets Total assets $ 250,104 $ (138,714) 1,146,296 41,802 1,299,488 $ 100,460 (279,582) 1,176,096 56,079 1,...

-

Page 112

CONDENSED FINANCIAL INFORMATION OF AMERCO STATEMENTS OF OPERATIONS

Years Ended March 31, 2011 2010 2009 (In thousands, except share and per share data) Revenues: Net interest income from subsidiaries Expenses: Operating expenses Other expenses Total expenses Equity in earnings of subsidiaries ...

-

Page 113

... FINANCIAL INFORMATION OF AMERCO STATEMENTS OF CASH FLOW

Years Ended March 31, 2011 2010 2009 (In thousands) Cash flows from operating activities: Net earnings Change in investments in subsidiaries Adjustments to reconcile net earnings to cash provided by operations: Depreciation Net gain on sale...

-

Page 114

...Significant Accounting Policies AMERCO, a Nevada corporation, was incorporated in April, 1969, and is the holding Company for U-Haul International, Inc., Amerco Real Estate Company, Repwest Insurance Company and Oxford Life Insurance Company. The financial statements of the Registrant should be read...

-

Page 115

SCHEDULE II AMERCO AND CONSOLIDATED SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS Years Ended March 31, 2011, 2010 and 2009

Balance at Beginning of Year Year ended March 31, 2011 Allowance for doubtful accounts (deducted from trade receivable) Allowance for doubtful accounts (deducted from notes ...

-

Page 116

... (FOR PROPERTY-CASUALTY INSURANCE OPERATIONS) Years Ended December 31, 2010, 2009 AND 2008

Fiscal Year

Affiliation with Registrant

Deferred Policy Acquisition Cost Unearned Premiums Net Earned Premiums (1) (In thousands) Net Investment Income (2)

Reserves for Unpaid Claims Discount if and...

-

Page 117

... report to be signed on its behalf by the undersigned, thereunto duly authorized. AMERCO

By:

/s/ Edward J. Shoen Edward J. Shoen President and Chairman of the Board

Dated: June 8, 2011

AMERCO

By:

/s/ Jason A. Berg Jason A. Berg Principal Financial Officer and Chief Accounting Officer

Dated...

-

Page 118

..., to sign any and all amendments to this Form 10-K Annual Report, and to file the same, with all exhibits thereto and other documents in connection therewith with the Securities and Exchange Commission, granting unto said attorneyin-fact and agent, full power and authority to do and perform each and...

-

Page 119

... (the "Company") of our reports dated June 8, 2011, relating to the consolidated financial statements and financial statement schedules, and the effectiveness of the Company's internal control over financial reporting, which appear in this Form 10-K. /s/ BDO USA, LLP Phoenix, Arizona June 8, 2011

-

Page 120

...Rule 13a-14(a)/15d-14(a) Certification

I, Edward J. Shoen, certify that: 1. I have reviewed this annual report on Form 10-K of AMERCO (the "Registrant"); 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make...

-

Page 121

...; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting.

(b)

/s/ Jason A. Berg Jason A. Berg Principal Financial Officer and Chief Accounting Officer of AMERCO Date: June 8, 2011

-

Page 122

... the Securities Exchange Act of 1934; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. AMERCO, a Nevada corporation /s/ Edward J. Shoen Edward J. Shoen President and Chairman of the Board Date...

-

Page 123

... of the Securities Exchange Act of 1934; and

(2)

The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. AMERCO, a Nevada corporation /s/ Jason A. Berg Jason A. Berg Principal Financial Officer and Chief...

-

Page 124

... AMERCO, Director of U-Haul, Amerco Real Estate Company and Repwest Insurance Company Director of AMERCO Director of AMERCO Director of AMERCO, U-Haul and Amerco Real Estate Company Director of AMERCO Director of AMERCO Director of AMERCO, U-Haul, Amerco Real Estate Company and Oxford Life Insurance...

-

Page 125

... in the short-term rental of trucks, trailers and related equipment to the do-it-yourself mover. The Company also sells related moving products and services, and rents self-storage facilities and general rental items. In addition, the Company's insurance subsidiaries engage in the life and property...

-

Page 126