Starwood 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

period of 2010, at approximately $14,900. Residential revenue increased approximately $125 million for the year

ended December 31, 2011 primarily due to residential sales related to the St. Regis Bal Harbour project as

discussed above.

Other revenues from managed and franchised properties increased primarily due to an increase in payroll

costs commensurate with increased occupancy at our existing managed hotels and payroll costs for the new

hotels entering the system. These revenues represent reimbursements of costs incurred on behalf of managed

hotel and vacation ownership properties and franchisees and relate primarily to payroll costs at managed

properties where we are the employer. Since the reimbursements are made based upon the costs incurred with no

added margin, these revenues and corresponding expenses have no effect on our operating income and our net

income.

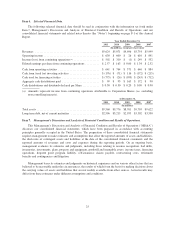

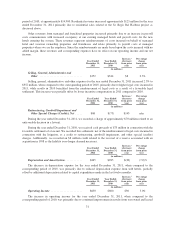

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Selling, General, Administrative and

Other .............................. $352 $344 $8 2.3%

Selling, general, administrative and other expenses for the year ended December 31, 2011 increased 2.3% to

$352 million, when compared to the corresponding period of 2010, primarily due to higher legal costs incurred in

2011, while results in 2010 benefitted from the reimbursement of legal costs as a result of a favorable legal

settlement. This increase was partially offset by lower incentive compensation in 2011 compared to 2010.

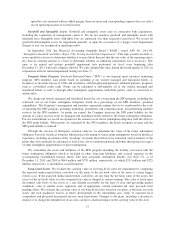

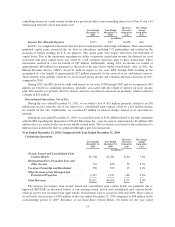

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Restructuring, Goodwill Impairment and

Other Special Charges (Credits), Net ..... $68 $(75) $143 n/m

During the year ended December 31, 2011, we recorded a charge of approximately $70 million related to an

unfavorable decision in a lawsuit.

During the year ended December 31, 2010, we received cash proceeds of $75 million in connection with the

favorable settlement of a lawsuit. We recorded this settlement, net of the reimbursement of legal costs incurred in

connection with the litigation, as a credit to restructuring, goodwill impairment, and other special (credits)

charges. Additionally, we recorded an $8 million credit related to the reversal of a reserve associated with an

acquisition in 1998 as the liability is no longer deemed necessary.

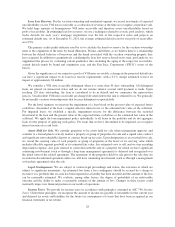

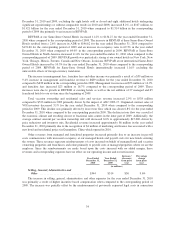

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Depreciation and Amortization ............ $265 $285 $(20) (7.0)%

The decrease in depreciation expense for the year ended December 31, 2011, when compared to the

corresponding period of 2010, was primarily due to reduced depreciation expense from sold hotels, partially

offset by additional depreciation related to capital expenditures made in the last twelve months.

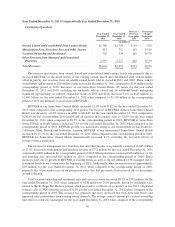

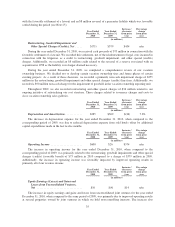

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Operating Income ...................... $630 $600 $30 5.0%

The increase in operating income for the year ended December 31, 2011, when compared to the

corresponding period of 2010, was primarily due to continued improvement in results from our owned and leased

31