Starwood 2011 Annual Report Download - page 22

Download and view the complete annual report

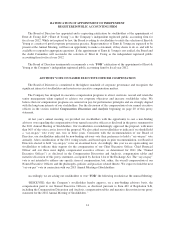

Please find page 22 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.comprised of Messrs. Daley (chairperson), Aron, Clarke and Youngblood, all of whom are “independent”

directors, as determined by the Board in accordance with the NYSE listing requirements and applicable federal

securities laws. The Board of Directors has determined that each of Messrs. Daley and Aron is an “audit

committee financial expert” under federal securities laws. The Board of Directors has adopted a written charter

for the Audit Committee which states that the Audit Committee provides oversight regarding accounting,

auditing and financial reporting practices of the Company. The Audit Committee selects and engages the

Company’s independent registered public accounting firm to audit the Company’s annual consolidated financial

statements and discusses with it the scope and results of the audit. The Audit Committee also discusses with the

independent registered public accounting firm, and with management, financial accounting and reporting

principles, policies and practices and the adequacy of the Company’s accounting, financial, operating and

disclosure controls. The Audit Committee met nine times during 2011.

Capital Committee. The Capital Committee is currently comprised of Mr. Quazzo (chairperson),

Ms. Galbreath and Messrs. Hippeau and Ryder, all of whom are “independent” directors, as determined by the

Board in accordance with the NYSE listing requirements and applicable federal securities laws. The Capital

Committee was established in November 2005 to exercise some of the power of the Board relating to, among

other things, capital plans and needs, mergers and acquisitions, divestitures and other significant corporate

opportunities between meetings of the Board. The Capital Committee met six times during 2011.

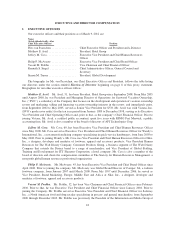

Compensation and Option Committee. Under the terms of its charter, the Compensation and Option

Committee (the “Compensation Committee”) is required to consist of three or more members of the Board who

meet the independence requirements of the NYSE, are “non-employee directors” pursuant to Exchange Act

Rule 16b-3, and are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as

amended (the “Code”). The Compensation Committee is currently comprised of Messrs. Aron (chairperson),

Clarke, Daley, Ryder and Youngblood, all of whom are “independent” directors, as determined by the Board in

accordance with the NYSE listing requirements and applicable federal securities laws. The Compensation

Committee makes recommendations to the Board with respect to the salaries and other compensation to be paid

to the Company’s executive officers and other members of senior management, and administers the Company’s

employee benefits plans, including the Company’s 2004 Long-Term Incentive Compensation Plan. The

Compensation Committee met six times during 2011.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating

Committee (the “Governance Committee”) is currently comprised of Ambassador Barshefsky (chairperson),

Ms. Galbreath, and Messrs. Duncan and Hippeau, all of whom are “independent” directors, as determined by the

Board in accordance with the NYSE listing requirements and applicable federal securities laws. The Governance

Committee, operating pursuant to a written charter, was established in May 2004 and combines the functions of

the Corporate Governance Committee and the Nominating Committee. The Governance Committee establishes,

or assists in the establishment of, the Company’s governance policies (including policies that govern potential

conflicts of interest) and monitors and advises the Company as to compliance with those policies. The

Governance Committee reviews, analyzes, advises and makes recommendations to the Board with respect to

situations, opportunities, relationships and transactions that are governed by such policies, such as opportunities

in which a director or executive officer or their affiliates has a personal interest. In addition, the Governance

Committee is responsible for making recommendations for candidates to the Board (taking into account

suggestions made by officers, directors, employees and stockholders), recommending directors for service on

Board committees, developing and reviewing background information for candidates, and making

recommendations to the Board of Directors for changes to the Guidelines related to the nomination or

qualifications of directors or the size or composition of the Board of Directors. The Governance Committee met

five times during 2011.

There are no firm prerequisites to qualify as a candidate for the Board, although the Board of Directors

seeks a diverse group of candidates who possess the background, skills and expertise relevant to the business of

the Company, or candidates that possess a particular geographical or international perspective. The Board of

12