Starwood 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

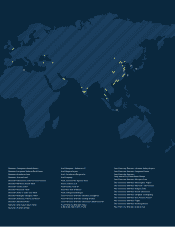

pipeline. Domestic travel volume there is already

roughly equal to the US and likely to double in the

next five years. China could one day be our largest

market, eclipsing the 480 hotels we have today in

the United States.

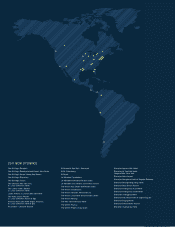

Two-thirds of the 112 hotel deals we signed in

2011 were in emerging markets. This means we

are positioned to lengthen our lead and strengthen

our brands with great new hotels. Globalization

is adding to the ranks of elite travelers like never

before, and our brands have captured more than

our fair share of that demand. Our luxury room

count doubled during the last five years, which

underscores the value of our investments in brands

and in loyalty.

A BETTER WAY TO EXPERIENCE THE WORLD

As we sell real estate, we are making a shift from

owning hotels to owning guest relationships.

Compelling brands, great service and best-in-class

properties are three key ingredients to fostering these

relationships. Starwood Preferred Guest® (SPG) is

what binds our brands and properties together.

To great fanfare, we recently announced changes to

our SPG program that will deepen our connection

to global mega-travelers. Here is how these

changes came to life, what it does for our guests

and how it creates value for our hotel owners.

In any branded business, the best marketing

investments are geared to recruiting and retaining

new brand-loyal customers and getting even more

business from existing ones. The more targeted

and the more focused on their needs, the better.

Over the last five years, we’ve doubled our number

of elite members, and spending per elite member is

up 60%. Today, the top 2% of our guests account for

30% of hotel profits. Our Platinum SPG members

give us nearly 50 times the business of our average

guest. Our first-mover advantage has enabled us

to benefit from the rising wealth around the world.

Today, 40% of our elite members live outside the

US, and these mega-travelers are more diverse,

more informed and more sophisticated than ever.

We engaged in a dialog with these travelers, and

what we learned made a lot of sense. High-end

travelers want more than just a good deal. They

want that personal touch, and to be treated in a

special way. Their comments helped us to recast

SPG. They told us that not all trips are equal and not

all benefits matter. They asked for more milestones,

more reasons to stay after they reached a certain

level and more choices. All of these are part of our

program. They also wanted to know whether their

loyalty with us over time counted for something, so

we introduced lifetime status. Our guests asked for

a more flexible definition of a stay. So we tested

our ability to meet that need, and today we are

offering 24-hour check-in for our most elite guests.

Even in this digital age, they appreciated a one-

on-one contact, which we have made a part of our

program for our most loyal guests.

We believe that the changes to SPG will not only

set the program apart, but will take loyalty to a

whole new level. A great benefit for guests means

more business at our hotels. For every dollar, euro

or yuan that we spend on the transformation, our

experience tells us that we should expect to see

over four times that amount in top-line growth. In

other words, happy guests mean better returns for

our owners, and stronger brands.

DELIVER MARKET-LEADING RETURNS

We are focused on delivering market-leading

returns for all of our stakeholders, and we have four

financial levers at our disposal. It starts with driving

REVPAR premiums, growing our footprint, holding

down costs and unlocking the value of our balance

sheet. As we have noted, 2011 was a strong year

along each of these measures. We made progress

in getting cash from the sale of our real estate

assets. We sold two hotels and a joint venture

in 2011 for net proceeds of $281 million. Other

sources of cash include over $200 million from time-

share and $74 million from residential units at The

St. Regis Bal Harbour Resort.

We expect 2012 to build on our momentum. We

will generate cash as we work toward our target of

being at least 80% fee-driven. From Bal Harbour

and from our timeshare business, we expect to

generate $375 million in cash. When it comes to

selling our owned hotels, we will continue to be

patient and disciplined sellers, searching for the

right prices, partners and management contracts.

We also expect to continue to gain share. Our

margins will grow, as REVPAR is driven by rising

rates. Our corporate customers expect to keep

hitting the road in 2012. Corporate negotiated

rates are set to be up mid- to high-single digits,

and our group meetings are being booked at higher

rates as well.

At Starwood, we are sticking to a cautiously

confident worldview. Our caution is reflected in

our conservative balance sheet and cost base.

After all, the world remains an uncertain place.

Our confidence is rooted in the long-term growth

prospects for high-end travel and for our portfolio

of brands. To lengthen our lead in 2012, we will

stay on offense, targeting additional REVPAR index

gains, opening more rooms than ever, signing the

most hotel deals since the beginning of the crisis

and further deepening our ties to elite guests.

Thank you for your interest in Starwood. And, of

course, we look forward to welcoming you as a

Starwood guest in 2012.

FRITS VAN PAASSCHEN

Chief Executive Officer