Starwood 2011 Annual Report Download - page 90

Download and view the complete annual report

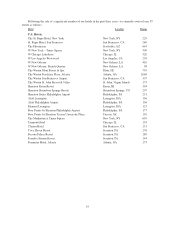

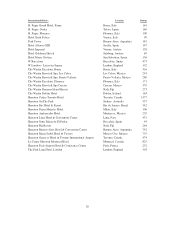

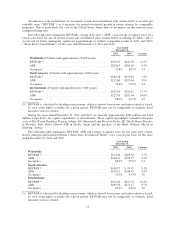

Please find page 90 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Vacation Ownership and Residential Business

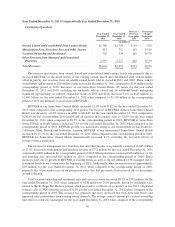

We develop, own and operate vacation ownership resorts, market and sell the VOIs in the resorts and, in

many cases, provide financing to customers who purchase such ownership interests. Owners of VOIs can trade

their interval for intervals at other Starwood vacation ownership resorts, intervals at certain vacation ownership

resorts not otherwise sponsored by Starwood through an exchange company, or for hotel stays at Starwood

properties. From time to time, we securitize or sell the receivables generated from our sale of VOIs.

We have also entered into arrangements with several owners for mixed use hotel projects that will include a

residential component. We have entered into licensing agreements for the use of certain of our brands to allow

the owners to offer branded condominiums to prospective purchasers. In consideration, we typically receive a

licensing fee equal to a percentage of the gross sales revenue of the units sold. The licensing arrangement

generally terminates upon the earlier of sell-out of the units or a specified length of time. We recently completed

the development of a residential project in Bal Harbour, Florida and are in the process of selling residential units.

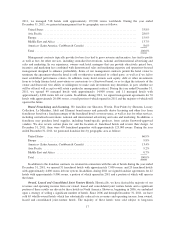

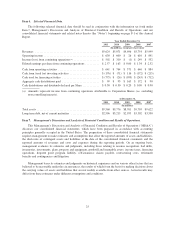

At December 31, 2011, we had 22 residential and vacation ownership resorts and sites in our portfolio with

17 actively selling VOIs and residences including one unconsolidated joint venture. During 2011 and 2010 we

invested approximately $70 million and $151 million, respectively, for vacation ownership capital expenditures,

including VOI construction at the Westin Desert Willow Villas in Palm Desert, CA, the Westin Lagunamar

Ocean Resort in Cancun, as well as construction costs at The St. Regis Bal Harbour Resort in Miami Beach, FL

(“St. Regis Bal Harbour”) .

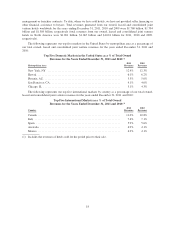

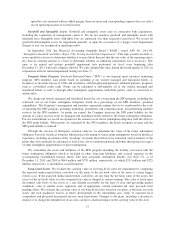

Due to the global economic crisis and its impact on the long-term outlook for the timeshare industry, during

the fourth quarter of 2009, we completed a comprehensive review of our vacation ownership projects. We

decided at that time that no new projects were to be initiated, and that we would not develop three vacation

ownership sites and future phases of certain existing projects. As a result, inventories, fixed assets and land

values at certain projects were determined to be impaired and were written down to their fair value, resulting in a

primarily non-cash pre-tax impairment charge in 2009 of $255 million. Additionally, in connection with this

review of the business, we made a decision to reduce the pricing of certain inventory at existing projects,

resulting in a pre-tax charge of $17 million. As a result of these decisions and future plans for the vacation

ownership business, we also recorded a $90 million non-cash charge for the impairment of goodwill associated

with the vacation ownership reporting unit. As a result of the economic recovery, in 2011, we decided to

construct additional timeshare inventory in a small portion of one of the projects where we had ceased

development.

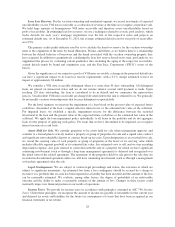

Item 3. Legal Proceedings.

Information regarding Legal Proceedings is incorporated by reference from the “Litigation” section in Note

25, Commitments and Contingencies, of our consolidated financial statements set forth in Item 8. Financial

Statements and Supplementary Data of this Annual Report, which is incorporated herein by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

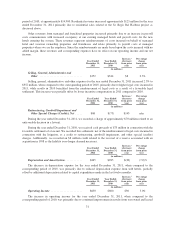

Market Information

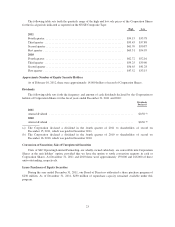

Our common stock, par value $0.01 per share (“Corporation Shares”), is traded on the New York Stock

Exchange (the “NYSE”) under the symbol “HOT”.

22