Starwood 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

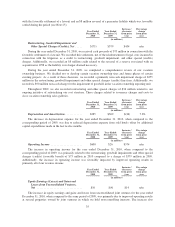

Cash Used for Financing Activities

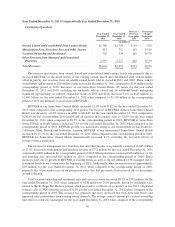

The following is a summary of our debt portfolio (including capital leases) as of December 31, 2011:

Amount

Outstanding at

December 31,

2011 (a)

Weighted

Average

Interest Rate at

December 31,

2011

Weighted

Average

Maturity

(Dollars in millions) (In years)

Floating Rate Debt

Revolving Credit Facility ......................... $ — — 1.9

Mortgages and Other ............................ 40 5.02% 5.0

Interest Rate Swaps .............................. 400 4.69%

Total/Average .................................. $ 440 4.72% 5.0

Fixed Rate Debt

Senior Notes ................................... $2,093 7.08% 3.9

Mortgages and Other ............................ 64 7.46% 11.5

Interest Rate Swaps .............................. (400) 6.86%

Total/Average .................................. $1,757 7.14% 4.1

Total Debt

Total Debt and Average Terms ..................... $2,197 6.66% 4.2

(a) Excludes approximately $432 million of our share of unconsolidated joint venture debt and securitized

vacation ownership debt of $532 million, all of which is non-recourse.

For specifics related to our financing transactions, issuances, and terms entered into for the years ended

December 31, 2011 and 2010, see Note 15 of the consolidated financial statements. We have evaluated the

commitments of each of the lenders in our Revolving Credit Facility (the “Facility”) which matures on

November 15, 2013. In addition, we have reviewed our debt covenants and do not anticipate any issues regarding

the availability of funds under the Facility.

On December 15, 2011, we redeemed all $605 million of our 7.875% Senior Notes, which would have

matured in May 2012. We paid $628 million in connection with this early redemption, including $16 million for

the call premium and other associated costs (see Note 15).

Due to the adoption of ASU Nos. 2009-16 and 2009-17, as discussed in Notes 2, 9, and 10, our 2011 cash

flows from financing activities include the borrowings and repayments of securitized vacation ownership debt.

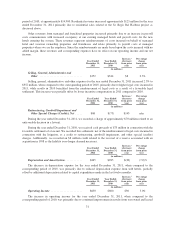

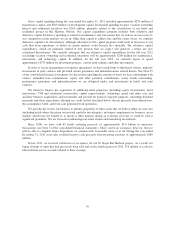

December 31,

2011

December 31,

2010

(in millions)

Gross Unsecuritized Debt ...................................... $2,197 $2,857

less: cash (including restricted cash of $212 million in 2011 and $44

million in 2010) ........................................... (666) (797)

Net Unsecuritized Debt ........................................ $1,531 $2,060

Gross Securitized Debt (non-recourse) ........................... $ 532 $ 494

less: cash restricted for securitized debt repayments (not included

above) .................................................. (22) (19)

Net Securitized Debt .......................................... $ 510 $ 475

Total Net Debt ............................................... $2,041 $2,535

40