Starwood 2011 Annual Report Download - page 45

Download and view the complete annual report

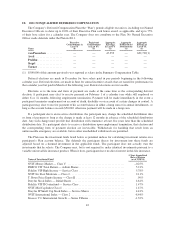

Please find page 45 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• direct total compensation consisting of salary, target and actual annual incentive awards, and the value of

option and restricted stock/restricted stock unit awards; and

• retirement benefits.

When establishing target compensation levels for 2011, the Compensation Committee reviewed peer group

data on payments to named executive officers as reported in proxy statements available as of February 2011 as

provided by Meridian.

2. Tax Considerations

Section 162(m) generally disallows a federal income tax deduction to public companies for incentive

compensation in excess of $1,000,000 paid to the chief executive officer and to each of the three other most

highly compensated executive officers (other than the chief financial officer). Qualified performance-based

compensation is not subject to the deduction limit if certain requirements are met. The Company believes that

compensation paid under the Executive Plan for 2011 meets these requirements and is generally fully deductible

for federal income tax purposes. In addition, for federal income tax purposes, compensation earned under option

grants is also fully deductible for federal tax purposes.

In designing the Company’s compensation programs, the Compensation Committee carefully considers the

effect of this provision together with other factors relevant to its business needs. In certain circumstances the

Company may approve compensation that does not meet these requirements in order to advance the long-term

interests of its stockholders. In February 2010, the Compensation Committee approved an increase in

Mr. van Paasschen’s base salary from $1,000,000 to $1,250,000. For the 2011 and 2012 fiscal years, the

Compensation Committee determined that Mr. van Paasschen’s base salary should remain $1,250,000. The

Company has historically taken, and intends to continue taking, reasonably practicable steps to minimize the

impact of the loss of deductibility under Section 162(m).

3. Share Ownership Guidelines

The Company has adopted share ownership guidelines for our executive officers, including the Named

Executive Officers. Pursuant to the guidelines, the Named Executive Officers, including the Chief Executive

Officer, are required to hold that number of shares having a market value equal to or greater than a multiple of

each executive’s base salary. For the Chief Executive Officer, the multiple was increased from five times base

salary to six times base salary in 2011 to be more in line with market practice, and for the other Named Executive

Officers, the multiple is four times base salary. A retention requirement of 35% is applied to restricted shares

upon vesting (net shares after tax withholding) and shares obtained from option exercises until the executive

meets the target, or if an executive falls out of compliance shares owned, stock equivalents (vested/unvested

restricted stock units), and unvested restricted stock (pre-tax) count towards meeting ownership targets.

However, stock options do not count towards meeting the target. Officers have five years from the date of hire or,

if later, the date they first become subject to the policy, to meet the ownership requirements. All Named

Executive Officers are in compliance with share ownership guidelines.

4. Equity Grant Practices

Determination of Option Exercise Prices. The Compensation Committee grants stock options with an

exercise price equal to the fair market value of a share on the grant date. Under the LTIP, the fair market value of

our common stock on a particular date is determined as the average of the high and low trading prices of a share

on the NYSE on that date.

35