Starwood 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Starwood posted another great year in 2011. We

grew REVPAR index and room count faster than

the industry. We played offense in the marketplace.

But we played it safe with our finances, as we enter

2012 with our strongest ever balance sheet. This

has been Starwood’s game plan since the crisis has

receded, and it is paying off as we further distance

ourselves from the competition and accelerate our

growth trajectory.

We delivered strong financial results despite a

turbulent global economy. As the most global

company in our industry, we witness firsthand world

events like the Arab Spring, the disaster in Japan or the

euro-zone drama. Behind those headlines, though,

we see encouraging trend lines. Our REVPAR gains

were fueled by rapid economic growth in emerging

markets and tight supply in the developed world.

The global economic recovery continued through

2011, bringing occupancies close to pre-crisis

levels. With many hotels full on weeknights and

during peak periods, we saw rates increase. For the

full year, higher rates accounted for over half of our

REVPAR gains. We are encouraged to see robust

demand for business travel, which drives 75% of our

total revenue. Corporate profits and cash on hand

are at record levels, and companies are scouring

the globe in search of growth opportunities.

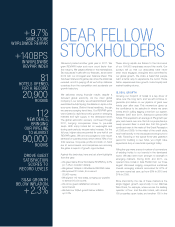

Against this backdrop, here are just a few highlights

from the year:

» We grew Same Store Worldwide REVPAR by 9.7%

(or 7.4% in constant dollars)

» We gained 140bps in Worldwide REVPAR index

» We opened 81 hotels, for a record

20,900 rooms

» We signed 112 new deals, bringing our pipeline

to almost 90,000 rooms

» We drove guest satisfaction scores to

record levels

» We held our SG&A growth below inflation,

up 2.3%

These strong results are thanks to the hard work

of our 154,000 employees around the world. Our

surveys tell us that our associates have never

been more engaged, energized and committed to

our global growth. We share a belief that people

want a better way to experience the world. Those

better experiences drive growth, brand loyalty and

market-leading returns.

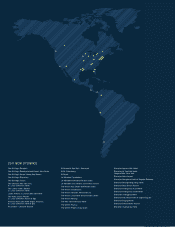

GLOBAL GROWTH

Growing our footprint of hotels is a key driver of

value over the long term, and we will continue to

generate and deliver on our pipeline of great new

hotels year after year. This momentum gives us

the confidence to be selective in where we open

hotels and in culling lagging ones from our system.

Between 2007 and 2011, Starwood opened 389

hotels. This equates to an average of 8% growth per

year, and means over one-third of our properties are

newly opened. Bear in mind also that this growth

continued even in the wake of the Great Recession

of 2008 and 2009. In the midst of the credit crisis,

new hotel activity in the developed world ground to

a halt. Factoring in the typical three-year gestation

period for building a new hotel, you might have

expected a drop in new hotel openings today.

Filling the gap were a record number of conversions

of existing hotels to our brands in the developed

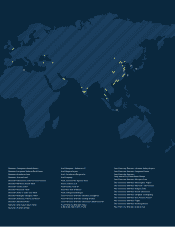

world. We also went from strength to strength in

emerging markets. During 2010 and 2011, we

opened more hotels in Asia Pacific than our three

largest US-based lodging competitors combined.

Overall, emerging markets accounted for 61% of

our new rooms last year, up from 50% in 2010 and

31% in 2009.

More importantly, the rise of these markets is the

single biggest growth opportunity in our lifetimes.

Take China, for example, where we are the leading

operator of four- and five-star hotels, with almost

100 properties open today and another 100 in the

DEAR FELLOW

STOCKHOLDERS

+

9.7%

SAME STORE

WORLDWIDE REVPAR

+

140BPS

IN WORLDWIDE

REVPAR INDEX

81

HOTELS OPENED,

FOR A RECORD

20,900

ROOMS

112

NEW DEALS,

BRINGING

OUR PIPELINE

TO ALMOST

90,000

ROOMS

DROVE GUEST

SATISFACTION

SCORES TO

RECORD LEVELS

SG&A GROWTH

BELOW INFLATION,

+

2.3%