Starwood 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

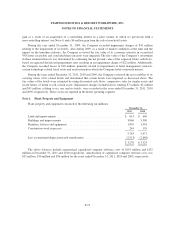

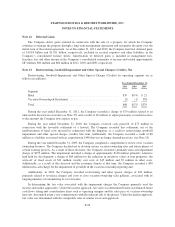

In June 2009, the Company securitized approximately $181 million of VOI notes receivable (the “2009-A

Securitization”) resulting in cash proceeds of approximately $125 million. The Company retained $44 million of

interests in the QSPE, which included $43 million of notes the Company effectively owned after the transfer and

$1 million related to the interest only strip. The related loss on the 2009-A Securitization of $2 million was

included in vacation ownership and residential sales and services in the Company’s consolidated statements of

income.

In December 2009, the Company securitized approximately $200 million of VOI notes receivable (the

“2009-B Securitization”) resulting in cash proceeds of approximately $166 million. The Company retained

$31 million of interests in the QSPE, which included $22 million of notes the Company effectively owned after

the transfer and $9 million related to the interest only strip. The related gain on the 2009-B Securitization of

$19 million is included in vacation ownership and residential sales and services in the Company’s consolidated

statements of income.

In December 2009, the Company entered into an amendment with the third-party beneficial interest owner

regarding the notes issued in the 2009-A Securitization (the 2009-A Amendment). The amendment to the terms

included a reduction of the coupon rate and an increase in the effective advance rate. As the increase in the advance

rate produced additional cash proceeds of $9 million, this resulted effectively in additional loans sold to the QSPE

from the original over collateralization. The related gain on the 2009-A Amendment of $4 million was included in

vacation ownership and residential sales and services in the Company’s consolidated statements of income.

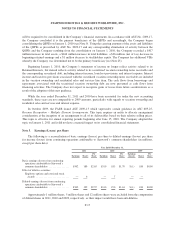

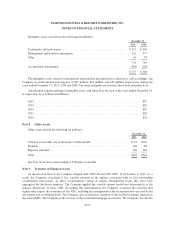

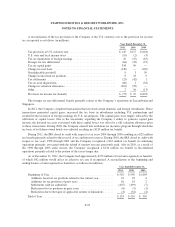

Note 10. Notes Receivable

Notes receivable (net of reserves) related to the Company’s vacation ownership loans consist of the

following (in millions):

December 31,

2011 2010

Vacation ownership loans-securitized ....................................... $510 $467

Vacation ownership loans-unsecuritized ..................................... 113 152

623 619

Less: current portion

Vacation ownership loans-securitized ..................................... (64) (59)

Vacation ownership loans-unsecuritized ................................... (20) (20)

$539 $540

The current and long-term maturities of unsecuritized VOI notes receivable are included in accounts

receivable and other assets, respectively, in the Company’s consolidated balance sheets.

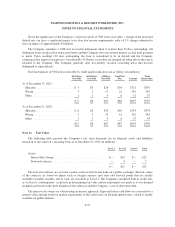

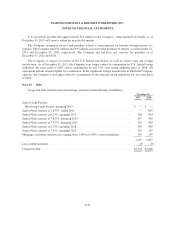

The Company records interest income associated with VOI notes in its vacation ownership and residential

sale and services line item in its consolidated statements of income. Interest income related to the Company’s

VOI notes receivable was as follows (in millions):

Year Ended

December 31,

2011 2010 2009

Vacation ownership loans-securitized .................................. $64 $66 $—

Vacation ownership loans-unsecuritized ................................ 21 21 48

$85 $87 $48

F-23