Starwood 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

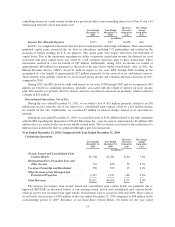

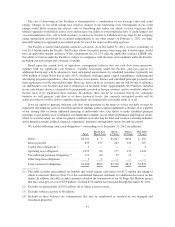

hotels and the increase in management and franchise fees attributable to the increase in REVPAR as well as the

net addition of 49 managed and franchised hotels to our system since the beginning of 2011. Additionally,

residential sales at the St. Regis Bal Harbour favorably impacted 2011 operating income by $27 million.

Operating income for the year ended December 31, 2011, as compared to 2010, was negatively impacted by a

$70 million charge associated with an unfavorable legal decision in 2011, while 2010 benefited from a favorable

settlement of a lawsuit of $75 million. Results were also negatively impacted by political unrest in the Middle

East and North Africa, as well as the earthquake and tsunami in Japan.

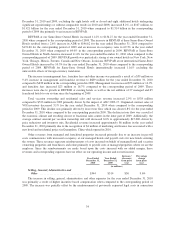

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

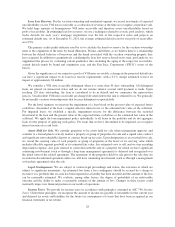

Equity Earnings (Losses) and Gains and

Losses from Unconsolidated Ventures,

Net ................................ $11 $10 $1 10.0%

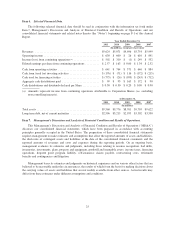

The increase in equity earnings and gains and losses from unconsolidated joint ventures for the year ended

December 31, 2011, when compared to the corresponding period of 2010 was primarily due to improved

operating results at several properties owned by joint ventures in which we hold non-controlling interests,

partially offset by unfavorable mark-to-market adjustments on US dollar denominated loans at several properties

in Latin America.

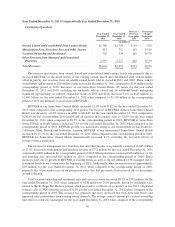

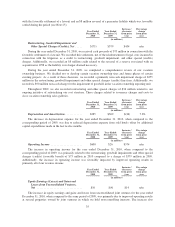

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Net Interest Expense .................... $216 $236 $(20) (8.5)%

The decrease in net interest expense for the year ended December 31, 2011, when compared to the

corresponding period of 2010, was primarily due to a lower average debt balance and an increase in capitalized

interest related to construction projects, primarily relating to the St. Regis Bal Harbour, partially offset by a $16

million charge for redemption premiums and other costs associated with the early payoff of all of our $605

million Senior Notes, which were originally issued in April 1, 2002 and due in May 2012. Our weighted average

interest rate was 6.66% at December 31, 2011 as compared to 6.86% at December 31, 2010.

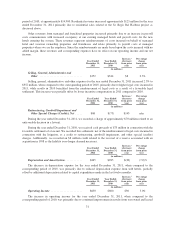

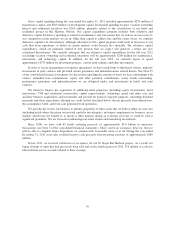

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Loss on Asset Dispositions and Impairments,

Net ................................ $— $(39) $(39) 100.0%

During the year ended December 31, 2011, we recorded an impairment charge of $31 million to write-off

our noncontrolling interest in a joint venture that owns a hotel in Tokyo, Japan, a $9 million loss due to

significant renovations and related asset retirements at two properties, $7 million in losses relating to the

impairment of six hotels whose carrying value exceeded their book value and a $2 million loss on an investment

in a management contract that was terminated during the period. These amounts were offset by a $50 million

gain as a result of the write-up to fair value of our previously held noncontrolling interest in two hotels in which

we obtained a controlling interest (see Note 4).

During the year ended December 31, 2010, we recorded a net loss on dispositions of approximately $39

million, primarily related to a $53 million loss on the sale of one wholly-owned hotel (see Note 5) as well as a $4

million impairment of fixed assets that are being retired in connection with a significant renovation of a wholly-

owned hotel, and a $2 million impairment on one hotel whose carrying value exceeded its fair value. These

charges were partially offset by a gain of $14 million from insurance proceeds received for a claim at a wholly-

owned hotel that suffered damage from a storm in 2008, a $5 million gain as a result of an acquisition of a

32