Starwood 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management or franchise contracts. To date, where we have sold hotels, we have not provided seller financing or

other financial assistance to buyers. Total revenues generated from our owned, leased and consolidated joint

venture hotels worldwide for the years ending December 31, 2011, 2010 and 2009 were $1.768 billion, $1.704

billion and $1.584 billion, respectively (total revenues from our owned, leased and consolidated joint venture

hotels in North America were $1.001 billion, $1.067 billion and $1.024 billion for 2011, 2010 and 2009,

respectively).

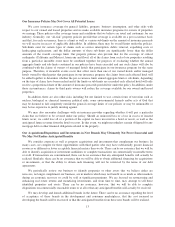

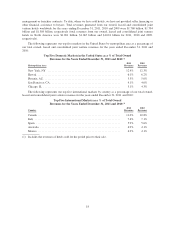

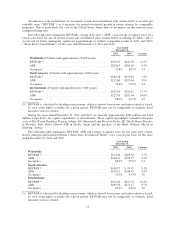

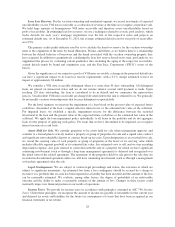

The following represents our top five markets in the United States by metropolitan area as a percentage of

our total owned, leased and consolidated joint venture revenues for the years ended December 31, 2011 and

2010:

Top Five Domestic Markets in the United States as a % of Total Owned

Revenues for the Years Ended December 31, 2011 and 2010 (1)

2011 2010

Metropolitan Area Revenues Revenues

New York, NY ................................................... 12.4% 12.3%

Hawaii .......................................................... 6.1% 6.2%

Phoenix, AZ ...................................................... 5.3% 5.0%

San Francisco, CA ................................................. 4.1% 4.0%

Chicago, IL ...................................................... 3.1% 4.3%

The following represents our top five international markets by country as a percentage of our total owned,

leased and consolidated joint venture revenues for the years ended December 31, 2011 and 2010:

Top Five International Markets as a % of Total Owned

Revenues for the Years Ended December 31, 2011 and 2010 (1)

2011 2010

Country Revenues Revenues

Canada .......................................................... 11.0% 10.8%

Italy ............................................................ 7.4% 7.1%

Spain ........................................................... 5.9% 5.6%

Australia ........................................................ 4.9% 4.1%

Mexico .......................................................... 4.2% 4.1%

(1) Includes the revenues of hotels sold for the period prior to their sale.

18