Starwood 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

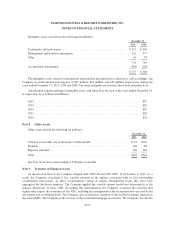

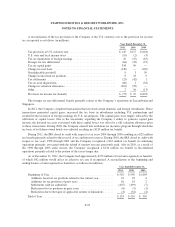

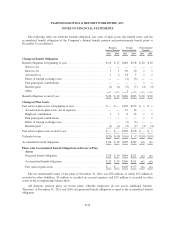

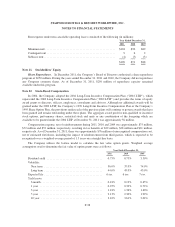

Aggregate debt maturities for each of the years ended December 31 are as follows (in millions):

2012 ............................................................................... $ 3

2013 ............................................................................... 505

2014 ............................................................................... 502

2015 ............................................................................... 455

2016 ............................................................................... 39

Thereafter ........................................................................... 693

$2,197

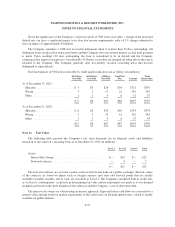

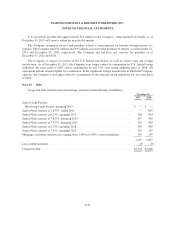

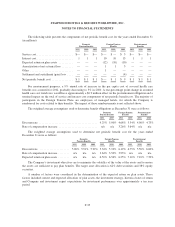

The Company maintains lines of credit under which bank loans and other short-term debt are drawn. In

addition, smaller credit lines are maintained by the Company’s foreign subsidiaries. The Company had

approximately $1.5 billion of available borrowing capacity under its domestic and foreign lines of credit as of

December 31, 2011. The short-term borrowings under these lines of credit at December 31, 2011 and 2010 were

de minimus.

The Company is subject to certain restrictive debt covenants under its short-term borrowing and long-term

debt obligations including defined financial covenants, limitations on incurring additional debt, ability to pay

dividends, escrow account funding requirements for debt service, capital expenditures, tax payments and

insurance premiums, among other restrictions. The Company was in compliance with all of the short-term and

long-term debt covenants at December 31, 2011.

During the year ended December 31, 2011, the Company entered into a credit agreement which provided a

loan of approximately $38 million, which is due in 2016, and is secured by one of its owned hotels. Proceeds

from this loan were used to pay off an existing credit agreement that was due in 2012.

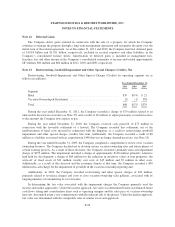

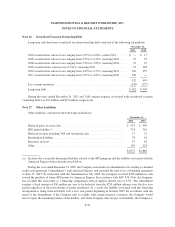

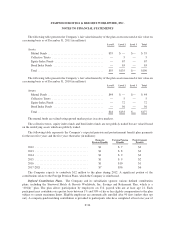

During the year ended December 31, 2011, the Company redeemed all of the outstanding 7.875% Senior

Notes due 2012, which had a principal amount of approximately $605 million. In connection with this

transaction, the Company terminated two interest rate swaps related to the 7.875% Senior Notes, which had

notional amounts totaling $200 million (see Note 23). As a result of the early redemption of the 7.875% Senior

Notes, the Company recorded a net charge of approximately $16 million in interest expense, net of interest

income line item in its statement of income, representing the tender premiums, swap settlements and other related

redemption costs.

During the year ended December 31, 2011, the Company sold its interest in a consolidated joint venture

which resulted in the buyer assuming approximately $57 million of the Company’s mortgage debt.

During the year ended December 31, 2011, the Company entered into two interest rate swaps with a total

notional amount of $100 million, whereby the Company pays floating and receives fixed interest rates (see Note

23).

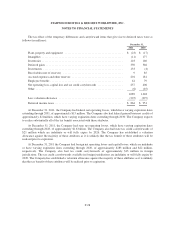

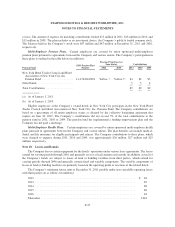

On April 20, 2010, the Company entered into a $1.5 billion senior credit facility. The facility matures on

November 15, 2013 and replaces the previous $1.875 billion revolving credit agreement, which would have

matured on February 11, 2011. The new facility includes an accordion feature under which the Company may

increase the revolving loan commitment by up to $375 million subject to certain conditions and bank

commitments. The multi-currency facility enhances the Company’s financial flexibility and is expected to be

used for general corporate purposes. The Company had no borrowings under the senior credit facility and $171

million of letters of credit outstanding as of December 31, 2011.

F-31