Starwood 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

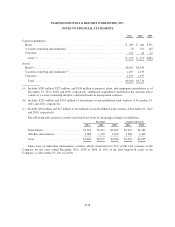

outstanding under this program totaled $13 million at December 31, 2011. The Company evaluates these loans

for impairment, and at December 31, 2011, believes these loans are collectible. Unfunded loan commitments

aggregating $19 million were outstanding at December 31, 2011, none of which is expected to be funded in the

future. These loans typically are secured by pledges of project ownership interests and/or mortgages on the

projects. The Company also has $94 million of equity and other potential contributions associated with managed

or joint venture properties, $48 million of which is expected to be funded in 2012.

Surety bonds issued on behalf of the Company at December 31, 2011 totaled $21 million, the majority of

which were required by state or local governments relating to the Company’s vacation ownership operations and

by its insurers to secure large deductible insurance programs.

To secure management contracts, the Company may provide performance guarantees to third-party owners.

Most of these performance guarantees allow the Company to terminate the contract rather than fund shortfalls if

certain performance levels are not met. In limited cases, the Company is obligated to fund shortfalls in

performance levels through the issuance of loans. Many of the performance tests are multi-year tests, are tied to

the results of a competitive set of hotels, and have exclusions for force majeure and acts of war and terrorism.

The Company does not anticipate any significant funding under performance guarantees or losing a significant

number of management or franchise contracts in 2012.

In connection with the acquisition of the Le Méridien brand in November 2005, the Company assumed the

obligation to guarantee certain performance levels at one Le Méridien managed hotel for the periods 2007

through 2014. During the year ended December 31, 2010, the Company reached an agreement with the owner of

this property to fully release the Company of its performance guarantee obligation in return for a payment of

approximately $1 million to the owner. Additionally, in connection with this settlement, the term of the

management contract was extended by five years. As a result of this settlement, the Company recorded a credit to

selling, general, administrative and other expenses of approximately $8 million for the difference between the

carrying amount of the guarantee liability and the cash payment of $1 million.

In connection with the purchase of the Le Méridien brand in November 2005, the Company was

indemnified for certain of Le Méridien’s historical liabilities by the entity that bought Le Méridien’s owned and

leased hotel portfolio. The indemnity is limited to the financial resources of that entity. However, at this time, the

Company believes that it is unlikely that it will have to fund any of these liabilities.

In connection with the sale of 33 hotels in 2006, the Company agreed to indemnify the buyer for certain

liabilities, including operations and tax liabilities. At this time, the Company believes that it will not have to

make any material payments under such indemnities.

Litigation. The Company is involved in various legal matters that have arisen in the normal course of

business, some of which include claims for substantial sums. Accruals have been recorded when the outcome is

probable and can be reasonably estimated. While the ultimate results of claims and litigation cannot be

determined, the Company does not expect that the resolution of all legal matters will have a material adverse

effect on its consolidated results of operations, financial position or cash flow. However, depending on the

amount and the timing, an unfavorable resolution of some or all of these matters could materially affect the

Company’s future results of operations or cash flows in a particular period.

In August 2009, Sheraton Operating Corporation (“Sheraton”) filed a lawsuit as plaintiff in the Supreme

Court of the State of New York (the “Court”) against Castillo Grand LLC (“Castillo”) asserting claims arising

out of a dispute over a hotel development contract. Two earlier lawsuits arising out of the same hotel

development contract filed by Castillo against Sheraton in federal court had been dismissed for lack of subject

matter jurisdiction. Castillo filed counterclaims in the state court action alleging, among other things, that

Sheraton’s breach of contract resulted in design changes and construction delays. The matter was tried to the

Court and, on November 18, 2011, the Court issued its Post Trial Decision ruling in favor of Castillo on some

F-45