Starwood 2011 Annual Report Download - page 35

Download and view the complete annual report

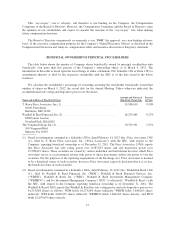

Please find page 35 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Total compensation for Named Executive Officers is evaluated against the peer group identified in this

proxy statement. Evaluated on this basis, the Compensation Committee believes the actual cash and equity

compensation delivered for the 2011 performance year was appropriate in light of the Company’s overall

performance and the performance of the particular executives.

We describe each of the compensation elements below and explain why we pay each element and how we

determine the amount of each element.

Base Salary. The Company believes it is essential to provide our Named Executive Officers with

competitive base salaries that will enable the Company to continue to attract and retain critical senior executives

from within and outside the hospitality industry. In the case of Named Executive Officers other than the Chief

Executive Officer, base salary typically accounts for approximately 20% of total compensation at target (in other

words, total compensation assuming performance goals are satisfied at targeted levels, but excluding benefits and

perquisites). In the case of Mr. van Paasschen, base salary for 2011 was $1,250,000. As a result, base salary

accounted for approximately 14% of total compensation at target for Mr. van Paasschen. Base salary serves as a

minimum level of compensation to Named Executive Officers in circumstances when achieving Company

financial and strategic/operational objectives becomes challenging and the level of incentive compensation is

impacted. Salaries for Named Executive Officers are generally based on the responsibilities of each position,

Company and individual performance, unique market demands and experience level. Salaries are reviewed

annually against similar positions among a group of peer companies developed by the Company and approved by

the Compensation Committee after consultation with Meridian, consisting of similarly-sized hotel and property

management companies as well as other companies representative of markets in which the Company competes

for key executive talent. See the section entitled Background Information on the Executive Compensation

Program — Use of Peer Data section beginning on page 34 of this proxy statement for a list of the peer

companies used in this analysis. Similar to other companies, the Company generally seeks to position base

salaries of our Named Executive Officers at or near the median base salary of the Company’s peer group for

similar positions but also reviews the range of values around the median, including the 25th and 75th percentile for

reference purposes. See additional detail regarding base salaries in the section entitled Narrative Disclosure to

Summary Compensation Table and Grants of Plan-Based Awards beginning on page 39 of this proxy

statement.

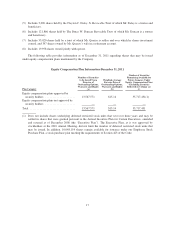

Incentive Compensation. Incentive compensation includes annual cash bonus awards under the

Company’s Executive Plan and long-term incentive compensation in the form of equity awards under the

Company’s LTIP. Incentive compensation typically accounts for approximately 80% of total compensation at

target (86% for Mr. van Paasschen in 2011), with annual cash bonus compensation and long-term incentive

compensation accounting for 19% and 61%, respectively (29% and 57% for Mr. van Paasschen, respectively, in

2011). The Company believes that this structure allows it to provide each Named Executive Officer with

substantial incentive compensation opportunities if performance objectives are met. The Company believes that

the allocation between base salary and incentive compensation is appropriate and beneficial because:

• it promotes the Company’s competitive position by allowing it to provide Named Executive Officers with

above-median total competitive compensation if targets are met;

• it targets and attracts highly motivated and talented executives within and outside the hospitality industry;

• it aligns senior management’s interests with those of stockholders;

• it promotes achievement of business and individual performance objectives; and

• it provides long-term incentives for Named Executive Officers to remain in the Company’s employ.

Annual Incentive Compensation. Annual cash bonuses are a key part of the Company’s executive

compensation program. The bonuses directly link the achievement of Company financial and strategic/

operational performance objectives to executive pay. Annual bonuses also provide a complementary balance to

25