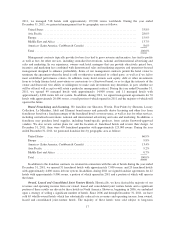

Starwood 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CRITICAL ACCOUNTING POLICIES

We believe the following to be our critical accounting policies:

Revenue Recognition. Our revenues are primarily derived from the following sources: (1) hotel and resort

revenues at our owned, leased and consolidated joint venture properties; (2) vacation ownership interests and

residential unit revenues; (3) management and franchise revenues; (4) revenues from managed and franchised

properties; and (5) other revenues which are ancillary to our operations. Generally, revenues are recognized when

the services have been rendered. The following is a description of the composition of our revenues:

• Owned, Leased and Consolidated Joint Ventures — Represents revenue primarily derived from hotel

operations, including the rental of rooms and food and beverage sales from owned, leased or consolidated

joint venture hotels and resorts. Revenue is recognized when rooms are occupied and services have been

rendered. These revenues are impacted by global economic conditions affecting the travel and hospitality

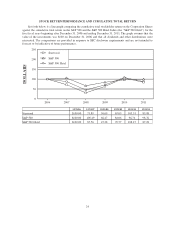

industry as well as relative market share of the local competitive set of hotels. REVPAR is a leading

indicator of revenue trends at owned, leased and consolidated joint venture hotels as it measures the

period-over-period growth in rooms revenue for comparable properties.

• Vacation Ownership Interests and Residential Units — We recognize revenue from VOI sales and

financings and the sales of residential units which are typically a component of mixed use projects that

include a hotel. Such revenues are impacted by the state of the global economy and, in particular, the U.S.

economy, as well as interest rates and other economic conditions affecting the lending market. Revenue is

generally recognized upon the buyer demonstrating a sufficient level of initial and continuing investment,

the period of cancellation with refund has expired and receivables are deemed collectible. We determine

the portion of revenues to recognize for sales accounted for under the percentage of completion method

based on judgments and estimates including total project costs to complete. Additionally, we record

reserves against these revenues based on expected default levels. Changes in costs could lead to

adjustments to the percentage of completion status of a project, which may result in differences in the

timing and amount of revenues recognized from the projects. We have also entered into licensing

agreements with third-party developers to offer consumers branded condominiums or residences. Our fees

from these agreements are generally based on the gross sales revenue of units sold. Residential fee

revenue is recorded in the period that a purchase and sales agreement exists, delivery of services and

obligations has occurred, the fee to the owner is deemed fixed and determinable and collectability of the

fees is reasonably assured. Residential revenue on whole ownership units is generally recorded using the

completed contract method, whereby revenue is recognized only when a sales contract is completed or

substantially completed. During the performance period, costs and deposits are recorded on the balance

sheet.

• Management and Franchise Fees — Represents fees earned on hotels and resorts managed worldwide,

usually under long-term contracts, franchise fees received in connection with the franchise of our

Sheraton, Westin, Four Points by Sheraton, Le Méridien and Luxury Collection brand names, termination

fees and the amortization of deferred gains related to sold properties for which we have significant

continuing involvement. Management fees are comprised of a base fee, which is generally based on a

percentage of gross revenues, and an incentive fee, which is generally based on the property’s

profitability. For any time during the year, when the provisions of our management contracts allow

receipt of incentive fees upon termination, incentive fees are recognized for the fees due and earned as if

the contract was terminated at that date, exclusive of any termination fees due or payable. Therefore,

during periods prior to year-end, the incentive fees recorded may not be indicative of the eventual

incentive fees that will be recognized at year-end as conditions and incentive hurdle calculations may not

be final. Franchise fees are generally based on a percentage of hotel room revenues. As with hotel

revenues discussed above, these revenue sources are affected by conditions impacting the travel and

hospitality industry as well as competition from other hotel management and franchise companies.

• Other Revenues from Managed and Franchised Properties – These revenues represent reimbursements of

costs incurred on behalf of managed hotel properties and franchisees. These costs relate primarily to

payroll costs at managed properties where we are the employer. Since the reimbursements are made based

26