Starwood 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

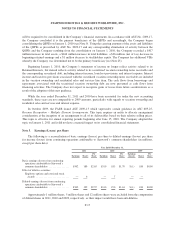

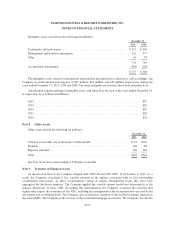

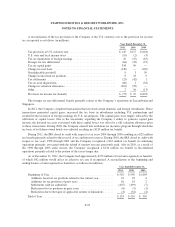

Intangible assets consisted of the following (in millions):

December 31,

2011 2010

Trademarks and trade names ............................................ $313 $309

Management and franchise agreements .................................... 412 377

Other ............................................................... 16 78

741 764

Accumulated amortization .............................................. (164) (196)

$ 577 $ 568

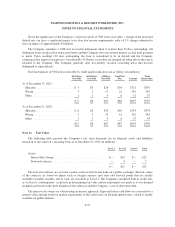

The intangible assets related to management and franchise agreements have finite lives, and accordingly, the

Company recorded amortization expense of $29 million, $33 million, and $35 million, respectively, during the

years ended December 31, 2011, 2010 and 2009. The other intangible assets noted above have indefinite lives.

Amortization expense relating to intangible assets with finite lives for each of the years ended December 31,

is expected to be as follows (in millions):

2012 ......................................................................... $29

2013 ......................................................................... $29

2014 ......................................................................... $29

2015 ......................................................................... $28

2016 ......................................................................... $28

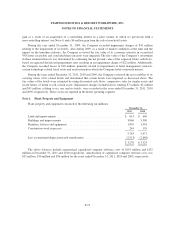

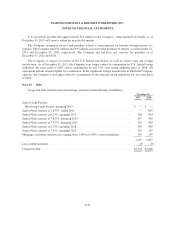

Note 8. Other Assets

Other assets include the following (in millions):

December 31,

2011 2010

VOI notes receivable, net of allowance of $46 and $69 ......................... $ 93 $132

Prepaids .............................................................. 104 88

Deposits and other ...................................................... 158 161

Total ................................................................ $355 $381

See Note 10 for discussion relating to VOI notes receivable.

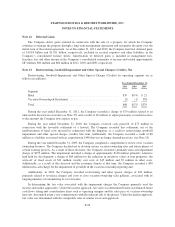

Note 9. Transfers of Financial Assets

As discussed in Note 2, the Company adopted ASU 2009-16 and ASU 2009 -17 on January 1, 2010. As a

result, the Company concluded it has variable interests in the entities associated with its five outstanding

securitization transactions. As these securitizations consist of similar, homogenous loans, they have been

aggregated for disclosure purposes. The Company applied the variable interest model and determined it is the

primary beneficiary of these VIEs. In making this determination, the Company evaluated the activities that

significantly impact the economics of the VIEs, including the management of the securitized notes receivable and

any related non-performing loans. The Company also evaluated its retention of the residual economic interests in

the related VIEs. The Company is the servicer of the securitized mortgage receivables. The Company also has the

F-21