Starwood 2011 Annual Report Download - page 62

Download and view the complete annual report

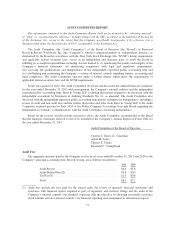

Please find page 62 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Audit-related fees include fees for audits of employee benefit plans, audit and accounting consultation and

other attest services.

(3) Tax fees include domestic and foreign tax compliance and consultations regarding tax matters.

The Company has adopted a policy which requires the Audit Committee of the Board of Directors to

approve the hiring of any current or former employee (within the last five years) of the Company’s independent

registered public accounting firm into any position (i) as a manager or higher, (ii) in its accounting or tax

departments, (iii) where the hire would have direct involvement in providing information for use in its financial

reporting systems, or (iv) where the hire would be in a policy setting position. When undertaking its review, the

Audit Committee considers applicable laws, regulations and related commentary regarding the definition of

“independence” for independent registered public accounting firms.

Pre-Approval of Services

The Audit Committee pre-approves all services, including both audit and non-audit services, provided by

the Company’s independent registered public accounting firm. The independent registered public accounting

firm submits an audit services fee proposal, which also must be approved by the Audit Committee before the

audit commences. The Audit Committee may delegate authority to one of its members to pre-approve all audit/

non-audit services by the independent registered public accounting firm, as long as these approvals are presented

to the full Audit Committee at its next regularly scheduled meeting.

Management submits to the Audit Committee all non-audit services that it recommends the independent

registered public accounting firm be engaged to provide and an estimate of the fees to be paid for each.

Management and the independent registered public accounting firm must each confirm to the Audit Committee

that the performance of the non-audit services on the list would not compromise the independence of the

registered public accounting firm and would be permissible under all applicable legal requirements. The Audit

Committee must approve both the list of non-audit services and the budget for each such service before

commencement of the work. Management and the independent registered public accounting firm report to the

Audit Committee at each of its regular meetings as to the non-audit services actually provided by the independent

registered public accounting firm and the approximate fees incurred by the Company for those services.

All audit and permissible non-audit services provided by Ernst & Young to the Company for the fiscal years

ended December 31, 2011 and 2010 were pre-approved by the Audit Committee or our Board of Directors.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee during fiscal year 2011 were all independent directors, and

no member was an employee or former employee of the Company. None of the Compensation Committee

members had any relationship requiring disclosure under the Related Person Transaction Policy described below.

During fiscal year 2011, none of our executive officers served on the compensation committee (or its equivalent)

or board of directors of another entity whose officer served on our Compensation Committee.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Board of Directors has adopted a Corporate Opportunity and Related Person Transaction Policy (the

“Related Person Transaction Policy”), the purpose of which is to address the reporting, review and approval or

ratification of transactions with directors, director nominees, executive officers, stockholders known to own of

record or beneficially more than five percent of our shares (“5% Holders”) and each of the foregoing’s respective

family members and/or corporate affiliates (collectively “Covered Persons”). As a general matter, we seek to

avoid Related Person Transactions because they can involve potential or actual conflicts of interest and pose the

risk that they may be, or be perceived to be, based on considerations other than the Company’s best interests. For

52