Starwood 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other governmental authority is in agreement with our views. The imposition of additional taxes or requirements

to change the way we conduct our business could cause us to have to pay taxes that we currently do not collect or

pay or increase the costs of our services or increase our costs of operations.

Our current business practice with our internet reservation channels is that the intermediary collects hotel

occupancy tax from its customer based on the price that the intermediary paid us for the hotel room. We then

remit these taxes to the various tax authorities. Several jurisdictions have stated that they may take the position

that the tax is also applicable to the intermediaries’ gross profit on these hotel transactions. If jurisdictions take

this position, they should seek the additional tax payments from the intermediary; however, it is possible that

they may seek to collect the additional tax payment from us and we would not be able to collect these taxes from

the customers. To the extent that any tax authority succeeds in asserting that the hotel occupancy tax applies to

the gross revenue on these transactions, we believe that any additional tax would be the responsibility of the

intermediary. However, it is possible that we might have additional tax exposure. In such event, such actions

could have a material adverse effect on our business, results of operations and financial condition.

Risks Relating to Ownership of Our Shares

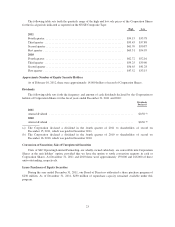

Our Board of Directors May Issue Preferred Stock and Establish the Preferences and Rights of Such

Preferred Stock. Our charter provides that the total number of shares of stock of all classes which the

Corporation has authority to issue is 1,200,000,000, consisting of one billion shares of common stock and

200 million shares of preferred stock. Our Board of Directors has the authority, without a vote of stockholders, to

establish the preferences and rights of any preferred shares to be issued and to issue such shares. The issuance of

preferred shares having special preferences or rights could delay or prevent a change in control even if a change

in control would be in the interests of our stockholders. Since our Board of Directors has the power to establish

the preferences and rights of preferred shares without a stockholder vote, our Board of Directors may give the

holders preferences, powers and rights, including voting rights, senior to the rights of holders of our shares.

Our Board of Directors May Implement Anti-Takeover Devices and Our Charter and Bylaws Contain

Provisions which May Prevent Takeovers. Certain provisions of Maryland law permit our Board of Directors,

without stockholder approval, to implement possible takeover defenses that are not currently in place, such as a

classified board. In addition, our charter contains provisions relating to restrictions on transferability of our

common stock, which provisions may be amended only by the affirmative vote of our stockholders holding

two-thirds of the votes entitled to be cast on the matter. As permitted under the Maryland General Corporation

Law, our Bylaws provide that directors have the exclusive right to amend our Bylaws.

We Cannot Provide Assurance That We Will Continue to Pay Dividends. There can be no assurance that

we will continue to pay dividends. Our Board of Directors may suspend the payment of dividends if the Board

deems such action to be in the best interests of the Company or stockholders. If we do not pay dividends, the

price of our common stock must appreciate for you to realize a gain on your investment in the Company. This

appreciation may not occur and our stock may, in fact, depreciate in value.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

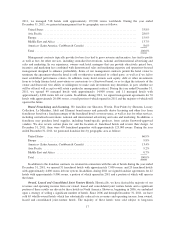

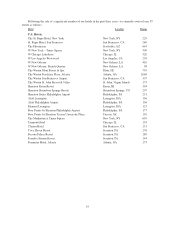

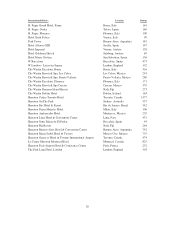

We are one of the largest hotel and leisure companies in the world, with operations in approximately 100

countries. We consider our hotels and resorts, including vacation ownership resorts (together “Resorts”),

generally to be premier establishments with respect to desirability of location, size, facilities, physical condition,

quality and variety of services offered in the markets in which they are located. Although obsolescence

attributable to age, condition of facilities, and style can adversely affect our Resorts, Starwood and third-party

15