Starwood 2011 Annual Report Download - page 63

Download and view the complete annual report

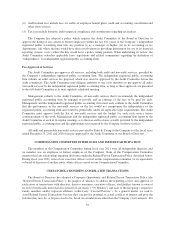

Please find page 63 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.purposes of the policy, a “Related Person Transaction” means any transaction involving the Company in which a

Covered Person has a direct or indirect material interest. A transaction involving entities controlled by the

Company shall be deemed a transaction in which the Company participates. However, we recognize that in some

circumstances transactions between us and related persons may be incidental to the normal course of business or

provide an opportunity that is in the best interests of the Company, or that is not inconsistent with the best

interests of the Company, or is more efficient to pursue than an alternative transaction. The Board has charged

the Governance Committee with establishing and periodically reviewing our Related Person Transaction Policy.

A copy of the policy is posted on our website at www.starwoodhotels.com/corporate/investor_relations.html.

The Related Person Transaction Policy also governs certain corporate opportunities to ensure that Corporate

Opportunities are not pursued by Covered Persons unless and until the Company has determined that it is not

interested in pursuing said opportunity. For purposes of the policy, a “Corporate Opportunity” means any

opportunity (i) that is within the Company’s existing line of business or is one in which the Company either has

an existing interest or a reasonable expectancy of an interest; and (ii) the Company is reasonably capable of

pursuing.

Under the Related Person Transaction Policy, except as otherwise provided, each director, executive officer,

and 5% Holder is required to submit any such Related Person Transaction or Corporate Opportunity to the

Governance Committee for review. In its review, the Governance Committee is to consider all relevant facts and

circumstances to determine whether it should (i) reject the proposed transaction; (ii) conclude that the proposed

transaction is appropriate and suggest that the Company pursue it on the terms presented or on different terms,

and in the case of a Corporate Opportunity, suggest that the Company pursue the Corporate Opportunity on its

own, with the party who brought the proposed transaction to the Company’s attention or with another third party;

or (iii) ask the Board of Directors to consider the proposed transaction so that the Board of Directors may then

take either of the actions described in (i) or (ii) above, and, at the Governance Committee’s option, in connection

with (iii), make a recommendation to the Board of Directors.

Any person bringing a proposed transaction to the Governance Committee is obligated to provide any and

all information requested by the Governance Committee and, in the case of a director, such director must recuse

himself or herself from any vote or other deliberation on the matter.

The policy may be changed at any time by the Board of Directors.

OTHER MATTERS

The Board of Directors is not aware of any matters not referred to in this proxy statement that may properly

be presented for action at the Annual Meeting. The deadline for stockholders to submit matters for consideration

at the Annual Meeting and have it included in these proxy materials was November 22, 2011, and the deadline

for stockholders to submit matters for consideration at the Annual Meeting without having the proposal included

in these proxy materials expired on February 20, 2012. However, if any other matter properly comes before the

Annual Meeting, it is the intention of the persons named in the enclosed proxy to vote the shares represented

thereby in accordance with their discretion.

SOLICITATION COSTS

The Company will pay the cost of soliciting proxies for the Annual Meeting, including the cost of mailing.

The solicitation is being made by mail and over the Internet and may also be made by telephone or in person

using the services of a number of regular employees of the Company at nominal cost. The Company will

reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for expenses incurred in

sending proxy materials to beneficial owners of shares. The Company has engaged D.F. King & Co., Inc. to

solicit proxies and to assist with the distribution of proxy materials for a fee of $19,500 plus reasonable

out-of-pocket expenses.

53