Starwood 2011 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

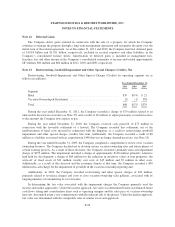

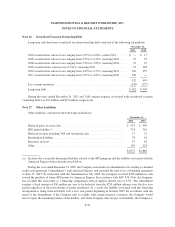

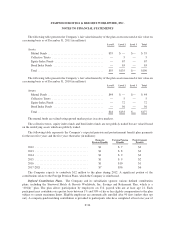

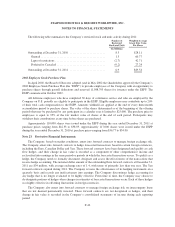

The following table presents the Company’s fair value hierarchy of the plan assets measured at fair value on

a recurring basis as of December 31, 2011 (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Mutual Funds ....................................... $55 $ — $— $ 55

Collective Trusts .................................... — 5 — 5

Equity Index Funds .................................. — 67 — 67

Bond Index Funds ................................... — 63 — 63

Total .............................................. $55 $135 $— $190

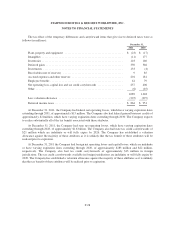

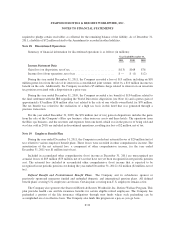

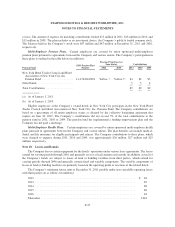

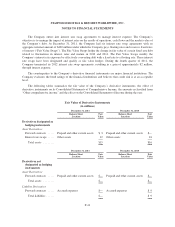

The following table presents the Company’s fair value hierarchy of the plan assets measured at fair value on

a recurring basis as of December 31, 2010 (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Mutual Funds ....................................... $44 $ — $— $ 44

Collective Trusts .................................... — 5 — 5

Equity Index Funds .................................. — 72 — 72

Bond Index Funds ................................... — 56 — 56

Total .............................................. $44 $133 $— $177

The mutual funds are valued using quoted market prices in active markets.

The collective trusts, equity index funds and bond index funds are not publicly traded but are valued based

on the underlying assets which are publicly traded.

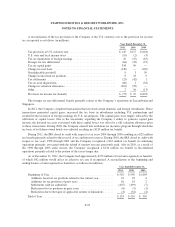

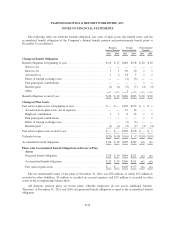

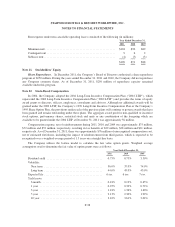

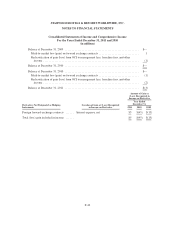

The following table represents the Company’s expected pension and postretirement benefit plan payments

for the next five years and the five years thereafter (in millions):

Domestic

Pension Benefits

Foreign Pension

Benefits

Postretirement

Benefits

2012 ..................................... $1 $ 7 $2

2013 ..................................... $1 $ 8 $2

2014 ..................................... $1 $ 9 $2

2015 ..................................... $1 $ 9 $2

2016 ..................................... $1 $10 $1

2017-2021 ................................. $7 $56 $6

The Company expects to contribute $12 million to the plans during 2012. A significant portion of the

contributions relate to the Foreign Pension Plans, which the Company is reimbursed.

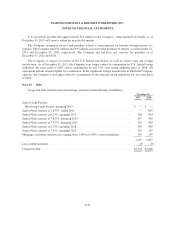

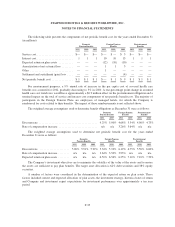

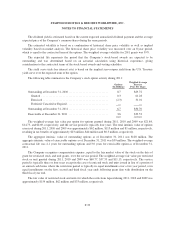

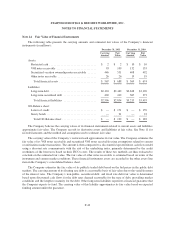

Defined Contribution Plans. The Company and its subsidiaries sponsor various defined contribution

plans, including the Starwood Hotels & Resorts Worldwide, Inc. Savings and Retirement Plan, which is a

“401(k)” plan. The plan allows participation by employees on U.S. payroll who are at least age 21. Each

participant may contribute on a pretax basis between 1% and 50% of his or her eligible compensation to the plan

subject to certain maximum limits. Eligible employees are automatically enrolled after 90 days (unless they opt

out). A company-paid matching contribution is provided to participants who have completed at least one year of

F-36