Starwood 2011 Annual Report Download - page 43

Download and view the complete annual report

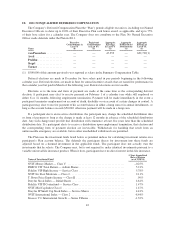

Please find page 43 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.These change in control arrangements are described in more detail in the Potential Payments Upon

Termination or Change in Control section beginning on page 43 of this proxy statement. The change in control

severance agreements are intended to promote stability and continuity of senior management. The Company

believes that the provision of severance pay to these Named Executive Officers upon a change in control aligns

their interests with those of stockholders. By making severance pay available, the Company is able to mitigate

executive concern over employment termination in the event of a change in control that benefits stockholders. In

addition, the acceleration of equity compensation vesting in connection with a change in control provides these

Named Executive Officers with protection against equity forfeiture due to termination and ample incentive to

achieve Company goals, including facilitating a sale of the Company at the highest possible price per share,

which would benefit both stockholders and executives. In addition, the Company acknowledges that seeking a

new senior position is a long and time-consuming process. Lastly, each severance agreement permits the

executive to maintain certain benefits for a period of two years following termination and to receive

outplacement services. The aggregate effect of our change in control provisions is intended to focus executives

on maximizing value to stockholders. In addition, should a change in control occur, benefits will be paid only

after a “double trigger” event as described in the Potential Payments Upon Termination or Change in Control

section beginning on page 43 of this proxy statement. The Company believes benefit levels have been set to be

competitive with peer group practices.

3. Additional Severance Arrangements

In 2007, the Company entered into a letter agreement with Mr. Prabhu clarifying that, pursuant to his

employment agreement dated November 13, 2003, his severance included the acceleration of 50% of unvested

stock options in the event that his employment was terminated without cause by us or by him for good reason.

The clarification formally documented Mr. Prabhu’s existing severance arrangements as part of his employment

with the Company.

This additional severance arrangement is described in more detail beginning on page 43 of this proxy

statement under the heading Potential Payments Upon Termination or Change in Control.

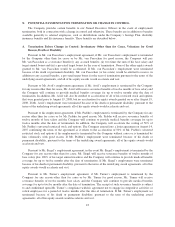

4. Potential Impact on Compensation for Executive Misconduct

If the Board of Directors determines that an executive officer has engaged in misconduct, the Board of

Directors may take a range of actions to remedy the misconduct. In 2011 the Compensation Committee adopted

an incentive recoupment policy that allows the Company to recover any annual incentive payment or long-term

incentive award to any individual executive at the senior vice president level or above, including our Named

Executive Officers, if the Board of Directors determines that (i) the Company is required to prepare an

accounting financial restatement due to the material non-compliance of the Company with any financial reporting

requirement under applicable securities laws and the compensation payment previously made was based on

erroneous data; or (ii) the Board of Directors determines that the executive engaged in intentional misconduct

that caused or substantially caused the need for a financial restatement and a lower payment would have been

made to the executive based upon the restated financial results. In such circumstances the Company will, to the

extent practicable, seek to recover from the individual executive the amount by which the individual executive’s

payments for the relevant period exceeded the lower payment that would have been made based on the restated

financial results. In addition, the Company’s LTIP provides that the Compensation Committee may cancel,

suspend, withhold or otherwise restrict or limit any long-term incentive award to any participant under the LTIP,

including executive officers, if the Compensation Committee determines that such participant engaged in

misconduct.

33