Starwood 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

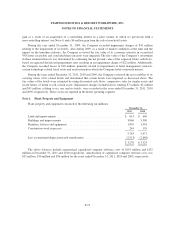

Note 12. Deferred Gains

The Company defers gains realized in connection with the sale of a property for which the Company

continues to manage the property through a long-term management agreement and recognizes the gains over the

initial term of the related agreement. As of December 31, 2011 and 2010, the Company had total deferred gains

of $1.018 billion and $1.011 billion, respectively, included in accrued expenses and other liabilities in the

Company’s consolidated balance sheets. Amortization of deferred gains is included in management fees,

franchise fees and other income in the Company’s consolidated statements of income and totaled approximately

$87 million, $81 million and $82 million in 2011, 2010 and 2009, respectively.

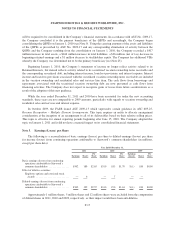

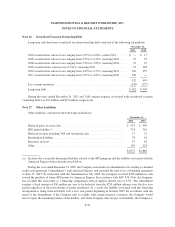

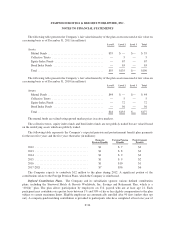

Note 13. Restructuring, Goodwill Impairment and Other Special Charges (Credits), Net

Restructuring, Goodwill Impairment and Other Special Charges (Credits) by operating segment are as

follows (in millions):

Year Ended December 31,

2011 2010 2009

Segment

Hotel .......................................................... $70 $(74) $ 21

Vacation Ownership & Residential .................................. (2) (1) 358

Total .......................................................... $68 $(75) $379

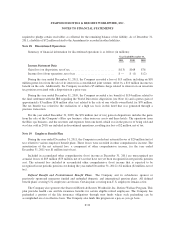

During the year ended December 31, 2011, the Company recorded a charge of $70 million related to an

unfavorable decision in a lawsuit (see Note 25) and a credit of $2 million to adjust previously recorded reserves

to the amounts the Company now expects to pay.

During the year ended December 31, 2010, the Company received cash proceeds of $75 million in

connection with the favorable settlement of a lawsuit. The Company recorded this settlement, net of the

reimbursement of legal costs incurred in connection with the litigation, as a credit to restructuring, goodwill

impairment, and other special charges (credits) line item. Additionally, the Company recorded a credit of $8

million as a liability associated with an acquisition in 1998 that was no longer deemed necessary (see Note 25).

During the year ended December 31, 2009, the Company completed a comprehensive review of its vacation

ownership business. The Company decided not to develop certain vacation ownership sites and future phases of

certain existing projects. As a result of these decisions, the Company recorded a primarily non-cash impairment

charge of $255 million. The impairment included a charge of approximately $148 million primarily related to

land held for development; a charge of $64 million for the reduction in inventory values at four properties; the

write-off of fixed assets of $21 million; facility exit costs of $15 million and $7 million in other costs.

Additionally, as a result of this decision and the economic climate at that time, the Company recorded a $90

million non-cash charge for the impairment of goodwill in the vacation ownership reporting unit.

Additionally, in 2009, the Company recorded restructuring and other special charges of $34 million,

primarily related to severance charges and costs to close vacation ownership sales galleries, associated with its

ongoing initiative of rationalizing its cost structure.

In determining the fair value associated with the impairment charges the Company primarily used the

income and market approaches. Under the income approach, fair value was determined based on estimated future

cash flows taking into consideration items such as operating margins and the sales pace of vacation ownership

intervals, discounted using a rate commensurate with the inherent risk of the project. Under the market approach,

fair value was determined with the comparable sales of similar assets and appraisals.

F-26