Starwood 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

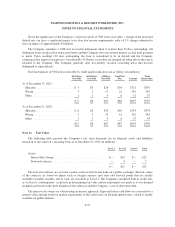

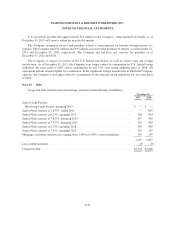

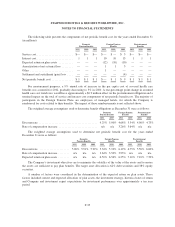

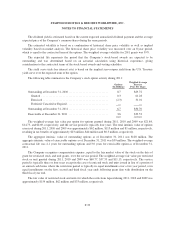

Note 16. Securitized Vacation Ownership Debt

Long-term and short-term securitized vacation ownership debt consisted of the following (in millions):

December 31,

2011 2010

2003 securitization, interest rates ranging from 3.95% to 6.96%, settled 2011 ...... $ — $ 17

2005 securitization, interest rates ranging from 5.25% to 6.29%, maturing 2018 .... 37 55

2006 securitization, interest rates ranging from 5.28% to 5.85%, maturing 2018 .... 27 39

2009 securitizations, interest rate at 5.81%, maturing 2016 .................... 92 128

2010 securitization, interest rates ranging from 3.65% to 4.75%, maturing 2021 .... 190 255

2011 securitization, interest rates ranging from 3.67% to 4.82%, maturing 2026 .... 186 —

532 494

Less current maturities ................................................. (130) (127)

Long-term debt ....................................................... $402 $367

During the years ended December 31, 2011 and 2010, interest expense associated with securitized vacation

ownership debt was $22 million and $27 million, respectively.

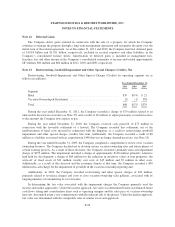

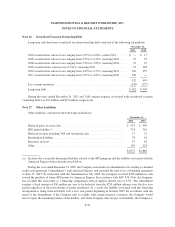

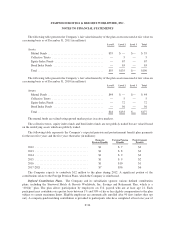

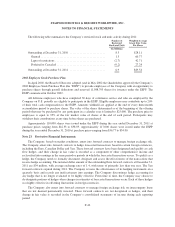

Note 17. Other Liabilities

Other liabilities consisted of the following (in millions):

December 31,

2011 2010

Deferred gains on asset sales ........................................... $ 933 $ 930

SPG point liability (a) ................................................. 724 702

Deferred revenue including VOI and residential sales ....................... 17 23

Benefit plan liabilities ................................................ 74 61

Insurance reserves ................................................... 47 46

Other ............................................................. 176 124

$1,971 $1,886

(a) Includes the actuarially determined liability related to the SPG program and the liability associated with the

American Express transaction discussed below.

During the year ended December 31, 2009, the Company entered into an amendment to its existing co-branded

credit card agreement (“Amendment”) with American Express and extended the term of its co-branding agreement

to June 15, 2015. In connection with the Amendment in July 2009, the Company received $250 million in cash

toward the purchase of future SPG points by American Express. In accordance with ASC 470, Debt,theCompany

has recorded this transaction as a financing arrangement with an implicit interest rate of 4.5%. The Amendment

requires a fixed amount of $50 million per year to be deducted from the $250 million advance over the five year

period regardless of the total amount of points purchased. As a result, the liability associated with this financing

arrangement is being reduced ratably over a five year period beginning in October 2009. In accordance with the

terms of the Amendment, if the Company fails to comply with certain financial covenants, the Company would

have to repay the remaining balance of the liability, and, if the Company does not pay such liability, the Company is

F-32