Starwood 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

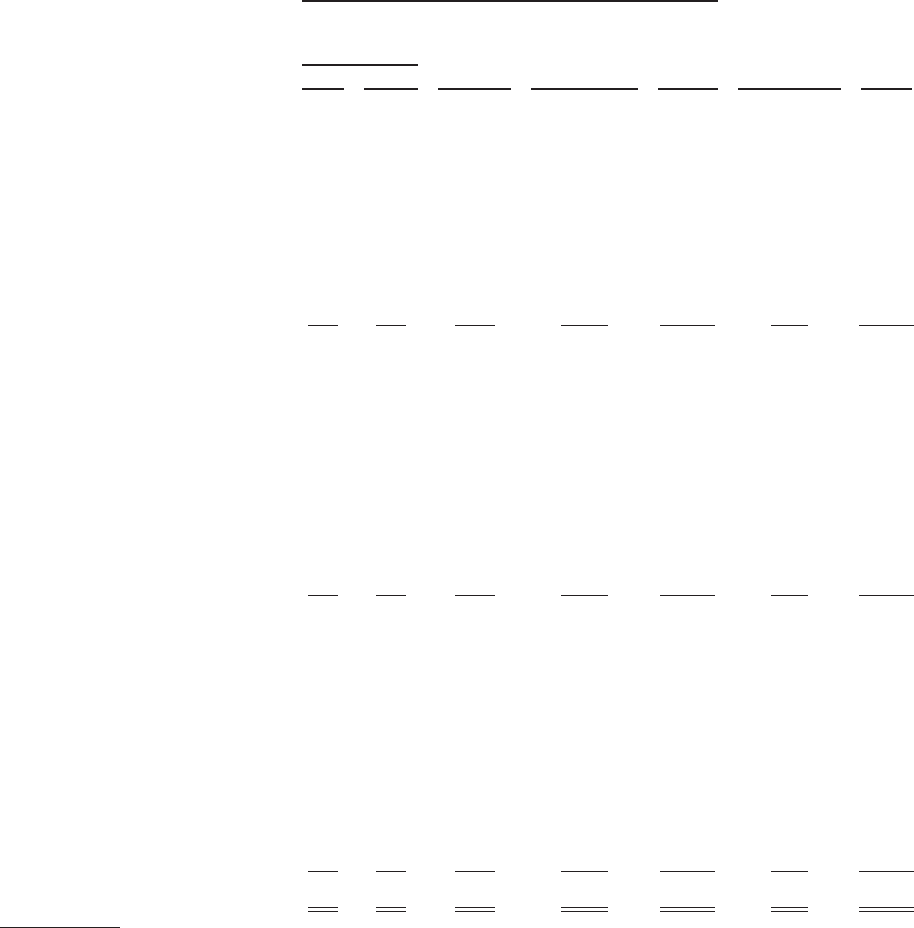

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

CONSOLIDATED STATEMENTS OF EQUITY

Equity Attributable to Starwood Stockholders

Shares Additional

Paid-in

Capital (1)

Accumulated

Other

Comprehensive

(Loss)

Income (2)

Retained

Earnings

Equity

Attributable to

Noncontrolling

Interests TotalShares Amount

(in millions)

Balance at December 31, 2008 . . . 183 $ 2 $493 $(391) $1,517 $ 23 $1,644

Net income (loss) ............. — — — — 73 (2) 71

Stock option and restricted stock

award transactions, net ....... 4 — 54 — — — 54

ESPP stock issuances .......... — — 5 — — — 5

Other comprehensive income

(loss) ..................... — — — 108 — 1 109

Dividends declared ............ — — — — (37) (1) (38)

Balance at December 31, 2009 . . . 187 2 552 (283) 1,553 21 1,845

Net income (loss) ............. — — — — 477 (2) 475

Stock option and restricted stock

award transactions, net ....... 6 — 248 — — — 248

ESPP stock issuances .......... — — 5 — — — 5

Impact of adoption of ASU

No. 2009-17 ................ — — — — (26) — (26)

Other comprehensive income

(loss) ..................... — — — — — (1) (1)

Dividends declared ............ — — — — (57) (3) (60)

Balance at December 31, 2010 . . . 193 2 805 (283) 1,947 15 2,486

Net income (loss) ............. — — — — 489 (2) 487

Stock option and restricted stock

award transactions, net ....... 3 — 154 — — — 154

ESPP stock issuances .......... — — 5 — — — 5

Other comprehensive income

(loss) ..................... — — — (65) — 1 (64)

Dividends declared ............ — — — — (99) (1) (100)

Sale of controlling interest ...... — — — — — (13) (13)

Other ....................... — — (1) — — 1 —

Balance at December 31, 2011 . . . 196 $ 2 $963 $(348) $2,337 $ 1 $2,955

(1) Stock option and restricted stock award transactions are net of a tax (expense) benefit of $26 million, $28 million and $(18) million in

2011, 2010, and 2009 respectively.

(2) As of December 31, 2011, this balance is comprised of $276 million of cumulative translation adjustments and $75 million of net

unrecognized actuarial losses, partially offset by $3 million of unrecognized gains on forward contracts.

The accompanying notes to financial statements are an integral part of the above statements.

F-8