Starwood 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

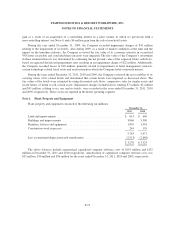

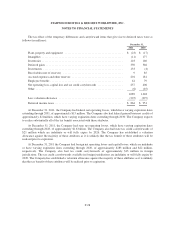

Note 7. Goodwill and Intangible Assets

The changes in the carrying amount of goodwill for the years ended December 31, 2011 and 2010 is as

follows (in millions):

Hotel

Segment

Vacation

Ownership

Segment Total

Balance at January 1, 2010 ................................. $1,332 $151 $1,483

Acquisitions ............................................. 26 — 26

Cumulative translation adjustment ........................... (8) — (8)

Asset dispositions ........................................ (10) — (10)

Other .................................................. 8 — 8

Balance at December 31, 2010 .............................. $1,348 $151 $1,499

Balance at January 1, 2011 ................................. $1,348 $151 $1,499

Acquisitions ............................................. 26 — 26

Cumulative translation adjustment ........................... (11) — (11)

Asset dispositions ........................................ (33) — (33)

Other .................................................. (1) — (1)

Balance at December 31, 2011 .............................. $1,329 $151 $1,480

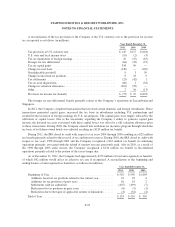

In 2011, the Company early adopted ASU 2011-08 (the “Topic”) to consider impairment for its two

reporting units, hotel and vacation ownership. The Topic allows companies to perform a qualitative assessment

of goodwill, to determine if the two-step goodwill impairment test is necessary. The determination depends on

whether it is more likely than not that the fair value of a reporting unit is greater than the carrying amount. The

Company concluded that the two-step goodwill impairment test is not required for either the hotel or vacation

ownership reporting unit. The vacation ownership reporting unit results reflected a 30%, or $237 million, excess

of fair value over book value in step 1 of the 2010 impairment test. The Company considered the fact that the

2011 results for the vacation ownership business exceeded expectations and evaluated other factors, such as

discount rates and market rates of return for the business, all of which indicate an excess of fair value over book

value. Based on this evaluation of internal and external qualitative factors, the Company concluded the two-step

goodwill impairment test is not required for the vacation ownership reporting unit.

The Company considered similar factors for the hotel business. In the hotel reporting unit, results reflected a

135%, or $8.6 billion, excess of fair value over book value in step one of the 2010 impairment test. The internal

and external factors affecting this business indicate that the fair value of the hotel reporting unit continues to

significantly exceed its carrying value and therefore, the Company concluded the two-step goodwill impairment

test is not required for the hotel reporting unit.

Prior to the adoption of the Topic in 2011, the Company performed its annual goodwill impairment test as of

October 31, 2010 for its hotel and vacation ownership reporting units and determined that there was no

impairment of its goodwill. The fair value was calculated using a discounted cash flow model, in which the

underlying cash flows were derived from management’s current financial projections. The two key assumptions

used in the fair value calculation are the discount rate and the capitalization rate in the terminal period, which

were 10% and 2%, respectively.

F-20