Starwood 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Committee retains the ability to consider whether an adjustment of the financial goals for any year is necessitated

by exceptional circumstances, for example, an unanticipated and material downturn in the business cycle that

triggers, in response, an increased focus by the Compensation Committee on the Company’s performance

relative to the industry. This ability is intended to be narrowly and infrequently used and, if applicable, the basis

for its use would be detailed in the Company’s proxy statement.

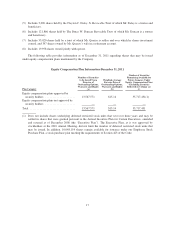

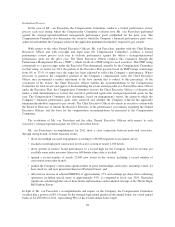

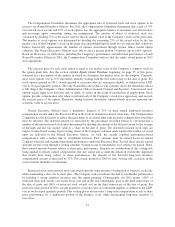

Performance against the financial goals determined 75% of Named Executive Officers’ total target annual

bonus opportunity. Subject to achieving the EP Threshold, actual bonuses paid to Named Executive Officers for

financial performance may range from 0% to 200% of the pre-determined target bonus for this category of

performance, as determined by the Compensation Committee. For Named Executive Officers, the Company

financial performance portion is based 50% on earnings per share and 50% on EBITDA of the Company.

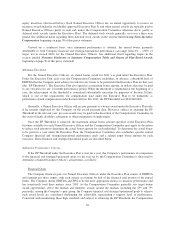

As noted above, once the EP Threshold is achieved, the minimum and maximum annual bonus amount

specified in the Executive Plan becomes available for award. The maximum bonus payout for the applicable

Company financial performance metric is limited to 200% of target (“Maximum”) and the Compensation

Committee may apply its discretion to reduce such amount to the actual bonus amount for each Named Executive

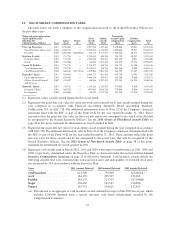

Officer. The table below sets forth for each metric the performance levels for 2011 which would have resulted in

100% bonus payout (“Target”), the minimum performance level (“Minimum”) that would have resulted in a 40%

bonus pool payout and the Maximum that would have resulted in a 200% target of bonus pool payout. In

addition, the table sets forth the approximate mid-points of payout between the Minimum to Target and Target to

Maximum and indicates the related required performance level:

Minimum

(40%)

Mid-point

(70%)

Target

(100%)

Mid-point

(150%)

Maximum

(200%)

Earnings per share ...... $ 0.99 $ 1.39 $ 1.80 $ 2.47 $ 3.15

Company EBITDA ...... $820,000,000 $923,000,000 $1,025,000,000 $1,196,000,000 $1,367,000,000

For the 2011 performance period, “adjusted” EBITDA (which exceeded the EP Threshold) for purposes of

determining annual bonuses was $1,021,000,000. EBITDA was adjusted to exclude the impact of asset sales and

changes in foreign exchange rates versus budgeted. Earnings per share from continuing operations for 2011 for

bonus purposes was $1.76 which excludes tax benefits related to non-core items partially offset by restructuring,

goodwill impairment and other special charges and debt extinguishment charges. Using the metrics described

above resulted in a payout eligibility of 98% of target for the Company financial portion of the annual bonus for

the 2011 fiscal year for the Named Executive Officers.

Strategic/Operational Goals

The strategic/operational performance goals for Named Executive Officers under the Executive Plan

consists of “Big 5” and leadership competency objectives that link individual contributions to execution of our

business strategy and major financial and operating goals. “Big 5” refers to each executive’s specific deliverables

within the Company’s critical performance categories — win with talent, execute brilliantly, build great brands,

deliver global growth, and drive outstanding results. As part of a structured process that cascades down

throughout the Company, these objectives are developed at the beginning of the year, and they integrate and align

an executive with the Company’s strategic and operational plan. Achievement of “Big 5” objectives typically

accounts for 80% of the strategic/operational performance evaluation, and achievement of leadership competency

objectives typically accounts for 20% of such evaluation. The portion of annual bonus awards attributable to

strategic/operational management performance represents 25% of Named Executive Officers’ total target. Actual

bonuses paid to Named Executive Officers for strategic/operational performance may range from 0% to 175% of

the pre-determined target amount for this category of performance, as determined by the Compensation

Committee. The strategic/operational performance goals are generally established at levels that are reasonably

difficult to achieve relative to historical trends and future expectations, and that will generally require significant

effort on the part of our Named Executive Officers to achieve.

27