Starwood 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

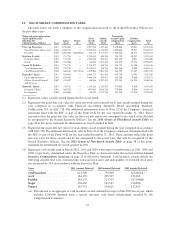

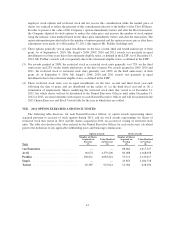

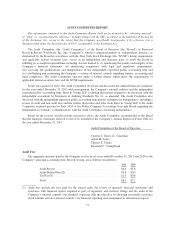

IX. 2011 NONQUALIFIED DEFERRED COMPENSATION

The Company’s Deferred Compensation Plan (the “Plan”) permits eligible executives, including our Named

Executive Officers, to defer up to 100% of their Executive Plan cash bonus award, as applicable, and up to 75%

of their base salary for a calendar year. The Company does not contribute to the Plan. No Named Executive

Officer made deferrals under the Plan in 2011.

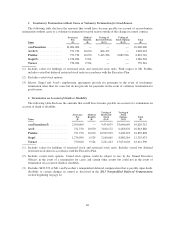

Name

Executive

Contributions in

Last FY

($)

Registrant

Contributions

in Last FY

($)

Aggregate

Earnings

in Last FY

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance at

Last FYE

($)

van Paasschen ........... — — 47,353 — 632,729(1)

Avril ................... — — — — —

Prabhu ................. — — — — —

Siegel .................. — — — — —

Turner ................. — — — — —

(1) $500,000 of this amount previously was reported as salary in the Summary Compensation Table.

Deferral elections are made in December for base salary paid in pay periods beginning in the following

calendar year. Deferral elections are made in June for annual incentive awards that are earned for performance in

that calendar year but paid in March of the following year. Deferral elections are irrevocable.

Elections as to the time and form of payment are made at the same time as the corresponding deferral

election. A participant may elect to receive payment on February 1 of a calendar year while still employed or

either 6 or 12 months following employment termination. Payment will be made immediately in the event a

participant terminates employment on account of death, disability or on account of certain changes in control. A

participant may elect to receive payment of his account balance in either a lump sum or in annual installments, so

long as the account balance exceeds $50,000; otherwise payment will be made in a lump sum.

If a participant elects an in-service distribution, the participant may change the scheduled distribution date

or form of payment so long as the change is made at least 12 months in advance of the scheduled distribution

date. Any such change must provide that distribution will commence at least five years later than the scheduled

distribution date. If a participant elects to receive a distribution upon employment termination, that election and

the corresponding form of payment election are irrevocable. Withdrawals for hardship that result from an

unforeseeable emergency are available, but no other unscheduled withdrawals are permitted.

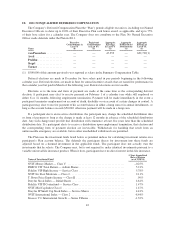

The Plan uses the investment funds listed below as potential indices for calculating investment returns on a

participant’s Plan account balance. The deferrals the participant directs for investment into these funds are

adjusted based on a deemed investment in the applicable funds. The participant does not actually own the

investments that he selects. The Company may, but is not required to, make identical investments pursuant to a

variable universal life insurance product. When it does, participants have no direct interest in this life insurance.

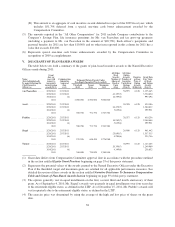

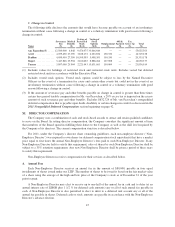

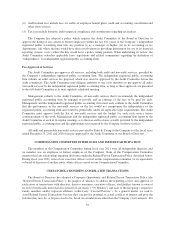

Name of Investment Fund

1-Year Annualized

Rate of Return

(as of 2/28/11)

NVIT Money Market — Class V ........................................ –0.25%

PIMCO VIT Total Return — Admin Shares ................................ 5.21%

Fidelity VIP High Income — Service Class ................................ 5.78%

NVIT Inv Dest Moderate — Class 2 ...................................... 2.11%

T. Rowe Price Equity Income — Class II .................................. .99%

Dreyfus Stock Index — Initial Shares ..................................... 4.61%

Fidelity VIP II Contrafund — Service Class ................................ 1.47%

NVIT Mid Cap Index Class I ........................................... 1.47%

Dreyfus IP Small Cap Stock Index — Service Shares ........................ 4.41%

NVIT International Index — Class 2 ..................................... -8.44%

Invesco V.I. International Growth — Series I Shares ......................... -1.32%

42